What are Proof of Work, Proof of Stake blockchain consensus systems in crypto? Here’s all you need to know

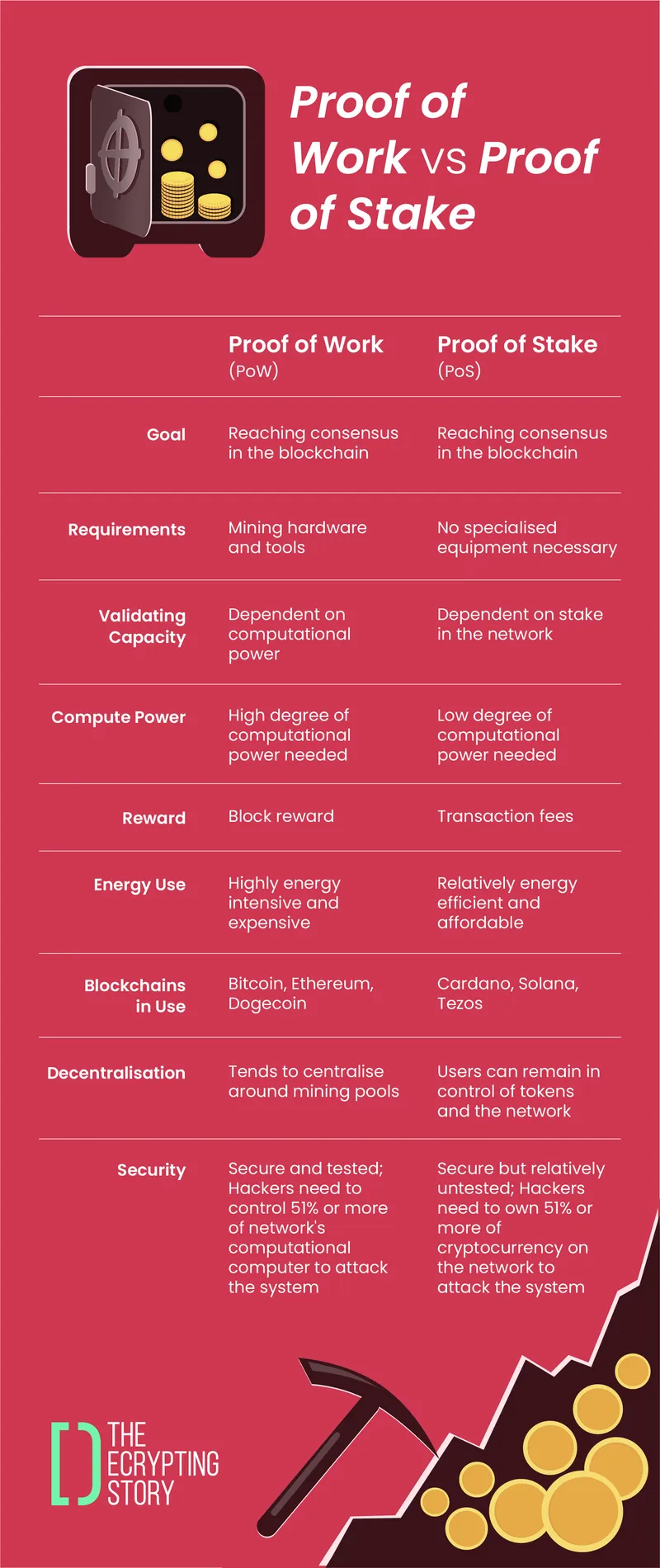

Proof of Work and Proof of Stake are consensus mechanisms that help blockchain networks reach an agreement on validating and recording transactions on blockchains. While they both share the goal of reaching a consensus, the process of reaching the goal is different.

(It may help to read our explainer article on Blockchain first to develop a better understanding of some of the concepts explained in this article.)

In recent years, blockchain technology’s use has expanded from enabling cryptocurrency transactions and building digital asset marketplaces to facilitating cross-border payments and enabling supply chain management, etc.

Blockchain transactions are recorded on multiple computers or devices across the world (also referred to as nodes). Further, they are managed by peer-to-peer (P2P) networks of nodes or users.

In a P2P network, there is no central server or administrator. When a user wants to exchange information with a peer, they can send it directly to the recipient, without having to go through a centralised system or database.

In such decentralised networks, any user can participate and transact on the blockchain. Thus, mechanisms must exist to ensure the transactions are accurate and address any vulnerabilities that may arise from this design.

This is where consensus mechanisms, or algorithms, come into play.

A consensus mechanism can be broadly defined as a fault-tolerant mechanism that helps the network reach agreement on single or multiple data points that represent transactions on the blockchain.

Proof of Work (PoW) and Proof of Stake (PoS) are the two primary consensus mechanisms used in blockchains.

Here’s all you need to know:

Proof of Work (PoW) explained

Proof of Work was the earliest consensus algorithm to crop up in the blockchain world when it was mentioned by Bitcoin founder Satoshi Nakamoto in the 2008 Bitcoin whitepaper.

Satoshi, whose identity is unknown, argued a purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution, and that digital signatures provided only part of the solution.

“But the main benefits are lost if a trusted third party is still required to prevent double-spending. We propose a solution to the double-spending problem using a peer-to-peer network,” Satoshi wrote.

Double-spending occurs when a user spends the same funds more than once. For instance, you cannot use the same Rs 100 note to pay for a coffee worth Rs 100 followed by a sandwich worth Rs 100.

But in the context of digital money, cryptocurrency included, users have to be prevented from duplicating and spending the same electronic version of the Rs 100 bill multiple times.

PoW allows anyone, or any node, to validate the creation of new blocks pertaining to new transactions and update the blockchain according to the rules of the system.

Thus, the PoW system prevents double-spending as transactions are recorded publicly, and “the network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work.”

Essentially, PoW means the longest chain serves as proof of the sequence of events (or transactions) witnessed, and also as proof that it came from the largest pool of CPU power.

Owing to Bitcoin’s decentralised design, this means as long as nodes that are not attacking the network control a majority of the CPU power, they would generate the longest chain of transactions and prevent attackers from compromising the network.

How PoW functions:

If you want to buy a coffee and a sandwich worth Rs 200 in total, you can send crypto (like Bitcoin) worth that amount to the cafe, provided crypto is accepted as legal tender in your country and the vendor accepts it.

In the case of Bitcoin, which uses a PoW consensus algorithm, here’s how the transaction would work:

There is no singular entity, such as a bank, responsible for your payment. Instead, all the nodes on the Bitcoin blockchain will have to be involved in the transaction.

For you to send a fraction of a Bitcoin to the cafe, you must first know the cafe’s public key (which is a public address for the cafe’s crypto wallet) and then broadcast a message in the Bitcoin network so that other nodes can see it.

The nodes, or the users, then set out to solve a puzzle set out by the protocol, which requires them to hash transactions and other information in the block.

This is referred to as mining, and those performing this task are called miners. The miners must keep hashing data (slightly modified each time) until a valid solution is found to the puzzle and the Bitcoin worth Rs 200 can be sent to the cafe.

Finding a valid solution for the successful transfer of Bitcoin creates a new block, and generates a block reward for the miner responsible.

Once the transaction is added to the Bitcoin blockchain, all other nodes can see and validate it, and update their copies of the ledger.

Disadvantages of PoW

Besides Bitcoin, some of the most popular crypto, such as Ethereum, Dogecoin, and Litecoin, use the PoW consensus system. Ethereum is currently in the process of moving towards Proof of Stake.

While PoW systems accord safety and security to blockchains, they also have some disadvantages.

The computational capabilities needed to solve the puzzles and validate block creation is significant. This is why nodes or users who want to participate in the network and mine Bitcoin must have a powerful computer with advanced hardware.

These powerful computers consume large amounts of energy, making PoW systems highly energy-intensive.

For example, the process of creating Bitcoin to hold, trade, or spend reportedly consumes 91 terawatts of electricity per year – which is more than what Finland, a nation of 5.5 million people, uses annually.

Proof of Stake (PoS) explained

Due to the disadvantages of PoW, many new blockchains start with a Proof of Stake system, which is fairly more energy-efficient and secure.

While both PoW and PoS share the goal of reaching consensus in a blockchain, the process of reaching the goal is different.

In PoS, users or nodes who want to participate in the network must lock a certain amount of the network’s native token, or cryptocurrency, as their stake. The size of the stake generally determines the chances for a particular node to be selected as the next validator to create the next block.

However, in order for the network not to favour only the nodes with the highest stakes, unique and randomised methods of an election are implemented. Some of these include ‘Coin Age Selection’ and ‘Randomised Block Selection.’

The Coin Age Selection method allows the network to pick nodes based on how long their tokens have been staked for. Coin Age is essentially the number of coins staked multiplied by the number of days they have been staked for.

When a node is selected to validate and create the next block, its Coin Age is reset to zero, and must wait before it can be elected to forge another block. This prevents wealthy and large nodes from dominating the blockchain.

The Randomised Block Selection method is a more pseudo-random approach that selects nodes based on low hash values and high stakes, allowing other nodes to predict which node is likely to be the next forger.

Advantages of PoS

In PoS, nodes usually receive transaction fees in the form of pre-mined crypto in exchange. This is unlike PoW, where miners receive block rewards in the form of freshly-minted crypto.

In PoS, the stake deters nodes from validating or creating fraudulent transactions. If the network detects a fraudulent transaction, the node responsible will lose part of its stake and its right to participate as a forger.

As long as the stake involved is higher than the potential reward, nodes stand to lose more than they gain if they attempt fraud.

PoS systems also do not require high amounts of computational power to solve puzzles, and they are more energy-efficient, affordable, and open to participation for a larger number of users. Further, as new crypto is not usually created to reward miners, the price of the coin may remain more stable.

Cardano, Solana, Tezos, Algorand, and Ethereum 2.0 (upcoming) are examples of blockchains that use PoS consensus algorithms.

YourStory’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Edited by Kanishk Singh

![[Funding alert] CoinSwitch Kuber turns unicorn; raises $260M from a16z, Coinbase Ventures, and existing investors](https://images.yourstory.com/cs/2/11718bd02d6d11e9aa979329348d4c3e/Kuber-1633505987743.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)