This Gurugram-based startup envisions democratising crypto information by making it simple, noiseless and easy

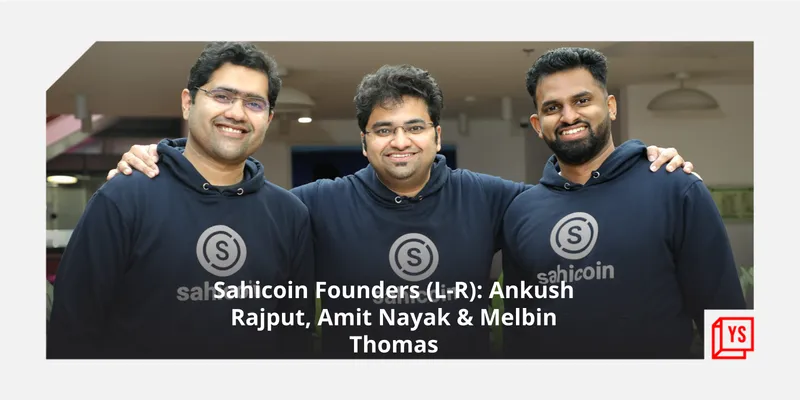

Founded in August 2021 by Amit Nayak, Ankush Rajput and Melbin Thomas, Sahicoin is a crypto native social platform that brings crypto experts and new investors together on a single platform to share crypto updates, trends, knowledge, and intelligence signals.

According to statistics, as of 2021, the global crypto market is worth $2.1 trillion, with over 300 million users, and is expected to surpass one billion users in the next 2-3 years. While it looks like a competitive space, the scope of user growth and widespread applications of the technology makes it a potential blue ocean.

“Being early movers and category creators in the consumer crypto space gives us the advantage to capture markets quickly and pivot efficiently when needed,” says Amit Nayak, CEO and Co-founder of Sahicoin, a Gurugram-based social investment platform where users can discover crypto with friends and experts.

Founded in August 2021 by Amit Nayak, Ankush Rajput, and Melbin Thomas, Sahicoin is an intelligent social platform for crypto users to exchange simplified knowledge and recommendations from experts.

Moreover, users get crypto exposure and can quickly test their investment strategies with zero investment and earn points and rewards for contributing to the platform.

The genesis

In 2017, Amit, Ankush, and Melbin entered the crypto world, and each of them found the journey painful in terms of understanding the market.

They had their thesis and kept discussing their investment strategies. They discovered that each of them had different ways of investing and started collaborating to make better investment decisions.

Realising that their generation was never mentored on better financial planning, early investing, and how to identify better investment opportunities, as well as the increasing hype around crypto post-2020, the founders decided to solve the core problems faced by crypto enthusiasts.

They established:

- Knowledge around crypto is complex, noisy, and scattered across multiple platforms. It is hard to keep a track of developments and new opportunities.

- Trustworthy advice was missing, and users were endlessly searching for more validation.

- The biggest challenge was the lack of time to research, identify more imminent trustworthy people, and develop their theories for investment.

”This is where we felt an urge to converge on the idea of a platform for early crypto investors that can simplify knowledge, drive collaboration, aggregate qualified signals, and establish trust in a faster way for a user to make investment decisions, and hence, started Sahicoin,” Amit says.

The team

Batchmates from IIT Kanpur, the co-founders are associated with each other for the last 15+ years. After their graduation, Amit Nayak moved to management consulting roles and worked with OkCredit and Travel Triangle.

Ankush Rajput has worked in product roles in multiple consumer internet startups, starting with Snapdeal. He was also with Shop101, GoMechanic, and Airmeet, before starting Sahicoin.

Melbin Thomas led product and strategy at Digital Green, headed and opened soccer schools at Bengaluru Football Club, and worked as a growth product consultant to Teller Finance – a US-based crypto lending platform.

“We are currently a team of 15+ professionals who have built startups from zero to one and led their growth stories. Since we were born in COVID-19 lockdown, we are very accustomed to operating and executing with a culture of remote working,” Amit tells YourStory.

The way ahead

In its early stage now, Sahicoin’s app is available on both Android and iOS platforms and is an invite-only app, with experts and users joining from more than 10 countries, including India, the US, Canada, United Kingdom, Singapore, UAE, and others.

“We are at a growth stage. We have potential revenue models to unfold in the course of our journey as we scale,” says Amit.

The bootstrapped venture is targeting GenZ and Millennials who find crypto interesting and exciting.

“Since crypto, by nature, can go beyond the boundaries, our expansion is not just limited to India. We’ll be expanding to other geographies. We will also be partnering with key exchanges, Defi, and NFT players, which will expedite their growth, and onboard the next billion users in the crypto ecosystem,” Amit says.

“Other social investment platforms like Public.com, Commonstock, and Robinhood have overlapping themes; mainly focused on US stocks,” he adds.