5 iconic Budgets that changed the Indian economy

With the current Finance Minister Arun Jaitley having presented the Union Budget for 2017 today, here is a look back at some iconic Union Budgets that changed the economy of India.

1951

The Budget in 1951 was made and presented on February 28, 1950, by John Mathai, who was then the finance minister of India. This Budget directly resulted in the creation of the Planning Commission for India. Minister John was instrumental in assessing the available resources and identifying the sectors and areas that needed concentration. This Budget reduced the maximum income rate from 30 percent to 2 percent. However, the maximum rate of personal taxation was around 78 percent. The reason behind formulating this Budget was a high amount of inflation, increase in capital cost, low savings, and low investments, as it was after Independence.

1968

This was presented on February 29, 1968, by Morarji Desai. Interestingly, twice, he presented the Budget on his birthday — in 1964 and in 1968 — the only finance minister to have done so. Morarji Desai presented 10 Union Budgets, the most by a finance minister. This particular Budget was widely proclaimed as a people-sensitive budget because of the withdrawal of spousal allowance. He stated in his Budget speech, "It would be improper for any outsider to decide as to who is dependent on whom… to eliminate this unintended strain on the relationship of marriage." This Budget reduced a lot of burden in administering the excise department, thereby halting the discretionary power with the field officers.

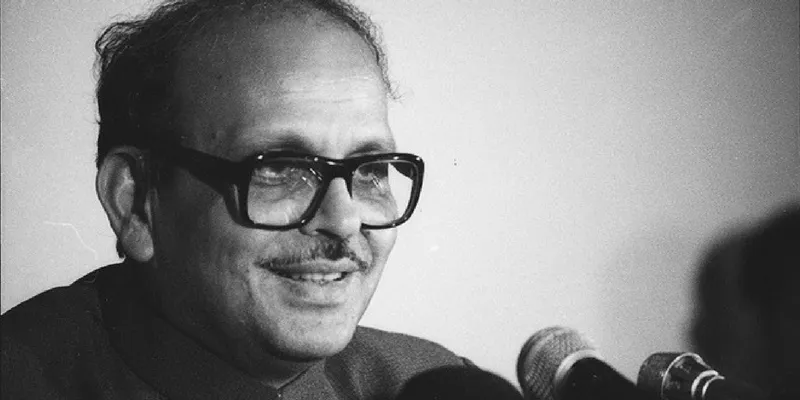

1986

The famous carrot and stick budget of 1986 was presented on February 28, 1986, by VP Singh. The Budget went on to be a humble inception for the major indirect tax reform that clearly ensured impressive development in the shift to the Goods & Services Tax regime. It included a development bank for small-scale industries, insurance schemes for accidents for municipal sweepers and rail porters, subsidised bank loans for autorickshaw drivers. VP Singh was responsible in curbing corruption by tax evaders by empowering the Enforcement Directorate of the Finance Ministry.

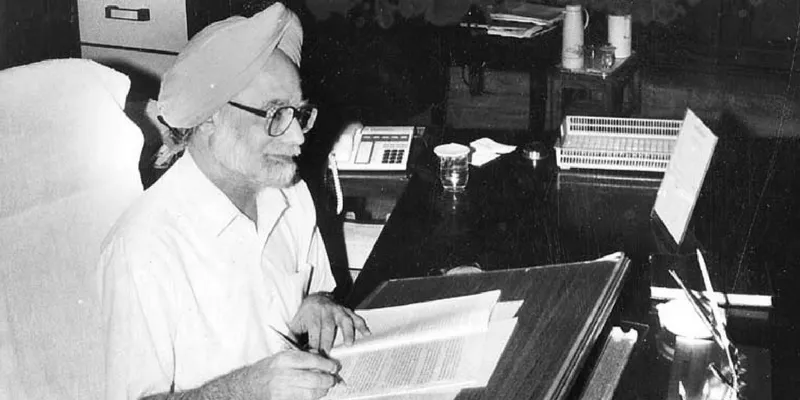

1991

It is well known that the ex-Prime Minister of India Dr Manmohan Singh is an expert in finance and economics. This Budget, which was called 'The Epochal Budget', was presented by him on July 24, 1991. This Budget immediately transformed the import-export policy. The reason behind the introduction of this Budget was to curb the balances of payments. It was highly precarious back then and further postponement would only have led to terrible consequences. Dr Manmohan Singh also introduced the service tax in the 1994 Budget to penetrate into the fastest growing sectors of the economy.

1997

Considered the dream Budget, this was presented by Palaniappan Chidambaram on February 28, 1997. This Budget resulted in the moderation of tax rates for the public and also businesses. The main reason for formulating this Budget was to amplify the tax base in the country. It was only a little above one percent of the population that paid taxes in India during that period. The moderation of rates resulted in a big improvement of overall compliance of the tax payers. People who used to hide their income to evade tax have started to pay up. After 1997-98, the personal income tax collections have gone up to Rs 1,00,100 crore from Rs 18,700 crore by 2010-11.

Do you have an interesting story to share? Please write to us at tci@yourstory.com. To stay updated with more positive news, please connect with us on Facebook and Twitter.