This CA plans to bring 10 lakh small farmers out of poverty by 2025

Sathya Raghu, who gave up a job at PwC to start Kheyti, is on a mission to see 1 million small farmers move out of the recurring cycle of poverty by 2025.

Despite being a successful chartered accountant and holding a steady job at PwC India, Sathya Raghu wasn’t happy. His mind kept returning to a stark childhood memory: while at play in the fields, Sathya once saw a farmer eating mud.

Intrigued, the young boy ran to the farmer and asked him what he was doing. “My stomach does not know that my pocket is empty,” the farmer said, a line that continues to haunt Satya.

I went to my grandfather and told him I wanted to fight farmer problems. In his wise way, he told me, ‘Solve them, don’t just fight them’, he recalls.

So after working at PwC for more than three years, the 31-year-old decided to let go of his consulting career. In 2009, he started working to understand how he could make a difference to the lives of small farmers.

On December 28, 2015, Sathya translated his vision into action and co-founded Kheyti with Kaushik Kappagantulu, Saumya and Ayush Sharma. He had devised a two-pronged solution to solve financial problems faced by farmers.

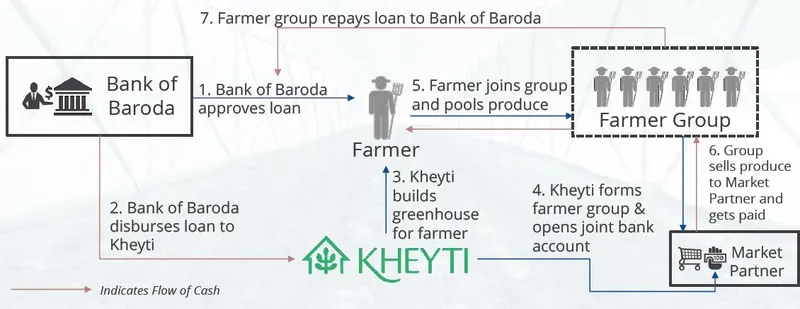

After knocking on the door of various financial institutions and banks, he signed a MOU with Bank of Baroda on 31 July, 2017, to lend to farmers at 8.6 percent as opposed to the norm of 22 percent. His organisation also introduced a tiny greenhouse for farmers, one that occupies a mere 2 percent land share. This helps battle climate change among other external factors while providing a steady income to farmers each month.

Greenhouse - a miniature magic box

Kheyti introduced Greenhouse-in-a-Box (GIB), a low-cost, modular greenhouse integrated with end-to-end support, to battle income variability.

This initiative by Kheyti, unlike other existing schemes by private and public organisations, offers small-size greenhouses. “The smallest size that our other competitors provide is around 1/4th of an acre. Our greenhouse is 1/16th of an acre, and it occupies just 2 percent of land. Technology alone can’t solve farmers’ problem. There is a need for an end-to-end approach,” Sathya explains.

To financially empower farmers, the organisation has partnered with firms such as Big Basket, Northwestern Institute for Sustainability and Energy, T-Hub, AgriPlast, AIPICRISAT- Agribusiness and Innovation Platform, and Acumen Funderscircle. Kheyti offers farmers financing, inputs, training, advisory and market services through this extended reach.

The GIB has the power to convert any small farmer into a climate-resilient smart farmer. Our vision is to see 1 million small farmers move out of the recurring cycle of poverty by 2025, Sathya says.

Also, since this asset occupies mere 1-2 percent of a small farmers’ land, other activities can continue undisrupted on the field.

Towards the end of the first cycle of production, Laxmaiah, one of the farmers who signed up for the pilot project, said, “Sathya Bhai, from my childhood, I have been hearing this rhetoric ‘Farmer is King’. I am able to feel that only after Kheyti entered our lives.”

It was a satisfying moment for Sathya.

Now, loans at 8.6 percent

The GIB kit costs Rs 1.8 lakh, of which farmers are required to make a down payment of Rs 30,000. The balance - Rs 1.5 lakh - is arranged through a loan. Although banks, when giving out a loan of Rs 1 lakh or less, are not required to base their loans on mortgage of land, Sathya explains that bankers insist.

If a cab driver buys a car, due consideration is given to future cash flows as it is recognised as a cash-generating asset. We wanted banks to view agricultural loans through a similar lens, he says.

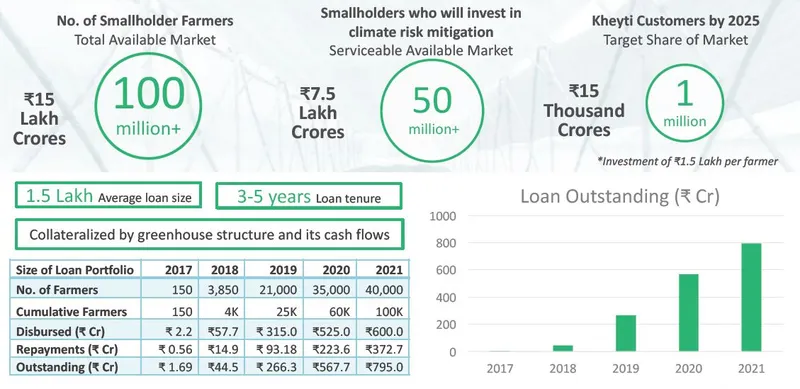

Close to 100 million small farmers in India lose money from farming as they are exposed to environmental risks at multiple levels. Greenhouse has the potential to generate future cash flows by reducing risks at various levels. Similarly if the banker trusts that future cash flows can come out of this asset, land mortgage will no longer be required for loans.

With this hypothesis, Sathya’s seven-membered team approached more than 20 financial institutions.

Initially, Samunnati Financial Intermediation Pvt Ltd agreed to disburse loans based on hypothecation of future cash flows and the greenhouse asset. However, since they are a Non-Banking Financial Company, the cost of capital remained high and the lowest interest rate offered by them was 22 percent per annum.

Later, Sathya approached Bank of Baroda and within 3 months signed a deal to lend to farmers at a standard rate of 8.6 percent for a tenure of 3-5 years.

Honestly, farmers have a greater probability to lose than gain. In today’s condition, they are not a great banking candidate. That is why we need to de-risk farming as a business by introducing an end-to-end approach, Sathya explains.

This plan aims to ensure that the farmers get out of poverty, permanently. As per the World Bank, a family of five in rural India needs Rs 4,800 per month to stay above the poverty line. This drop in interest rate means that farmers, who were getting approximately Rs 4,000 per month, will now receive Rs 6,000 per month as free cash flow after servicing their loan. Further, they stand to earn as much as Rs 8,000-Rs 10,000 after they pay the loan by the end of the third year.

As farmers are encouraged to grow vegetables, cash flows start quickly - typically within 60 days of sowing, unlike with field crops like paddy and wheat, which may take 4-6 months. Open field farming is subject to innumerable risks of climate change. But since the Kheyti Greenhouse provides indoor farming, farmers are more likely to receive a steady and dependable income.

A farmer, who was part of the pilot community, says, I now have hope for the future. Earlier, if I had any issues, my knowledge to resolve the problem was limited to what the pesticide shop owner tells me. But now, Kheyti gets production experts from different parts of the world to solve these problems.

Fostering community engagement

Kheyti spent the first six months on field in Telangana, and conducted detailed conversations with farmers to understand their life, needs, challenges and aspirations.

It was evident that small farmers are victims of climate change, even though they are not great contributors to it. Excess heat, increased pest problems, and reduced water due to erratic rains were some of the prominent issues. As a consequence, small farmers had income uncertainty and we decided we should solve this. The hard work of a small farmer should pay off, the way it does for you and me. That brought us to Kheyti, Sathya says.

The three pillars of Kheyti are “meritocracy, legal clarity and community”. The model has built a community of farmers where they are independent yet interdependent. Every farmer has a greenhouse in his /her land and the benefit is based on one’s own effort. However, input connections and market connections achieve economies of scale as they are planned for the entire community. Farmers already live in clusters in most parts of rural India, and Sathya explains that while production advisory is provided to every farmer separately, trainings are planned during weekly community meetings.

Read More:

How these agri-startups are helping farmers battle drought and poverty

3 reasons, 2 demands, and 1 proposed solution for the Madhya Pradesh farmers’ agitation

The journey ahead

Sathya’s team evaluated farmers in almost 95 villages before finalising the community for their pilot. After explaining the idea of Kheyti, farmers were assured that they could return the entire greenhouse asset in six months if they were not satisfied.

“Interestingly, of the first 15 farmers, 14 farmers applied for one more greenhouse,” Sathya says proudly.

Currently, Kheyti has raised funding of approximately $400,000 from competitions and foundations. The organisation is operational only in Telangana, as of now. It plans to reach 150 farmers by end of this year and gradually scale up to 40,000 farmers in five years. The team is also exploring options of collaborating with the government to extend their reach.

Sathya is hoping, along with the rest of us, that innovating at the grassroots will change the life of the marginalised farmer.

Enter the SocialStory Photography contest and show us how people are changing the world! Win prize money worth Rs 1 lakh and more. Click here for details!