After two unsuccessful attempts at video streaming, here’s how ZEE cracked the OTT puzzle with ZEE5

In an increasingly cluttered video-streaming market, ZEE, one of India’s oldest entertainment companies, is looking to delight users with premium digital content and cutting-edge technology.

ZEE was not only India’s first-ever satellite TV channel (launched in the early ’90s), but also the first broadcaster to venture into ‘online streaming’ at a time when it was an alien concept in the entertainment industry.

It was February 2012, and at a glittering press conference in Mumbai, ZEE MD and CEO Punit Goenka unveiled DittoTV - ZEE’s subscription video-on-demand (SVoD) service that would enable users to watch live TV, movies, and music videos on their PCs, phones, laptops, and BlackBerrys. (Those were the days when companies made special efforts to develop apps for BlackBerrys.)

Not many present at the event that evening would have grasped the concept of online video streaming. Surely, DittoTV was ahead of its time, at least in price-sensitive and low-bandwidth India, and it struggled to make a mark.

Four years on, in February 2016, ZEE made a second attempt to capture the video streaming market with OZEE - an advertising video-on-demand (AVoD) service that was a bit like YouTube and gave free content access to all its users.

By this time, online streaming was not entirely unheard of in India, given the success of ZEE rival STAR India’s Hotstar that had picked up considerable buzz during the 2015 Cricket World Cup. And, there was Netflix, of course, which launched in the country just a month ago (January 2016), marking a shift in the way entertainment would be produced and consumed going forward.

OZEE, despite clocking 145 million-odd views in a quarter, failed to make a significant impact, even though the video-streaming or OTT market in India was becoming more cluttered by the day. Amazon Prime Video, launched in December 2016, and a bunch of homegrown services from VOOT and ALTBalaji to SonyLIV and JioTV, etc. competed for viewership and wallet share.

Suddenly, everyone was creating for digital. A-listers lined up. Budgets shot up. Users increased. The number of OTT services in India ballooned to about 30.

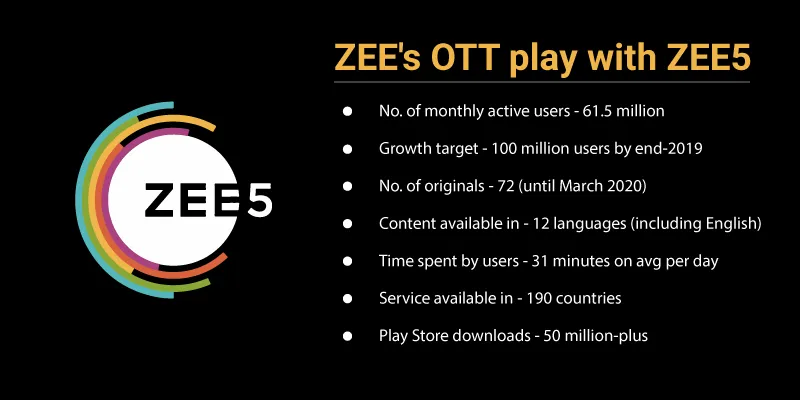

In February 2018, ZEE consolidated its DittoTV and OZEE platforms to roll out an all-new OTT service - ZEE5, which offered content in 12 languages across multiple formats from original films and web shows to short fiction content, book-to-screen adaptations, digital movie premiers, and more. There was regular TV content too, from ZEE’s vast broadcast network of 45 channels.

1560425648689.jpg?fm=png&auto=format)

Tarun Katial, CEO of ZEE5 India

In a year since launch, ZEE5 notched up 61.5 million users in English, Tamil, Hindi, Malayalam, Telugu, Kannada, Marathi, Bengali, Oriya, Bhojpuri, Gujarati, and Punjabi. These are on ZEE5’s own platform only, and do not include viewers coming in from its ecosystem partners, including telecom operators, device manufacturers, and ecommerce companies.

According to ZEE’s latest quarterly results, ZEE5 users spend an average of 31 minutes per day on the platform, and video views per user have almost doubled, leading to a “significant improvement” in app engagement. Further, ZEE5 has crossed 50 million downloads on Google Play Store, and has consistently ranked among the top five entertainment apps in India.

Tarun Katial, CEO of ZEE5 India, tells YourStory,

“We launched a few years later than most competition. It was always going to be unique and different. When you launch later than everyone else, you can learn from their mistakes and understand the gaps in the market. That is what gave us an advantage.”

In October 2018, ZEE5 went global, launching in 190 countries, both as an AVoD and SVoD service, through various partners. And, the company isn’t resting yet. It plans to reach 100 million users by the end of 2019.

For that, ZEE5 has outlined a business strategy that hinges on three pillars: original content, ecosystem partnerships, and cutting-edge technology.

Building volumes in Indian language originals

Irrespective of the medium, content is still the king. It is what fuels the OTT engine. And, ZEE5 knows it too well.

Tarun says,

“We want to build volumes in Indian original content. Earlier, OTT content was complementing TV content in terms of genres, characters, storylines. But, a lot of reverse learning has happened now. Our strategy is originals in regional languages because we realised that India consumes in languages. That is why we launched the platform in 12 languages.”

ZEE5 is so serious about its regional strategy that not only content but also app display is available in 12 languages. Now, the platform looks to rope in A-list writers, actors, and directors to “tell stories in a cinematic way”.

On its first anniversary in February 2019, ZEE5 announced 72 new originals that will start streaming by March 2020. These include shows across multiple genres and languages in Hindi, Tamil, Telugu, Marathi, Bengali and Malayalam. “We are looking at one-and-a-half show launches per week. Nobody comes even close to that,” Manish Aggarwal, Business Head of ZEE5 India, had said at the time.

Some of its most talked-about originals are Karenjit Kaur – An Untold Story (a biopic on Sunny Leone), Rangbaaz (a crime thriller from the badlands of UP), Abhay (a procedural cop drama), The Final Call (a thriller based on a novel), and Parchhayee – Ghost Stories by Ruskin Bond. Its regional offerings include Kallachirippu and What’s Up Velakkari in Tamil, Chitra Vichitram and B. Tech in Telugu, Date with Saie in Marathi, and Kaali and Sharate Aaj in Bengali.

In a first-of-its-kind initiative in the OTT industry, ZEE5 also launched regional subscription packs for Tamil, Telugu, and Kannada users. These tiered SVOD packs enable consumers to watch premium content in a language of their choice at half the price.

1560426404476.jpg?fm=png&auto=format)

Tarun says,

“We want to appeal to India’s diverse audience clusters. We do not want to make digital niche. That would be a dis-service to so many clusters. We want to make it mass, and with learnings from our network of 45 channels, we have the ability to do it.”

Growing through ecosystem partnerships

ZEE5 is now available on all major telecom networks in India as a bundled offering with the customer’s data plan. Its content can be accessed on Vodafone Play and Airtel TV apps for free. A customised-for-feature-phones app is also available on KaiOS for Reliance JioPhone users, thus establishing ZEE5’s intent of capturing the widest consumer segment possible.

ZEE5 claims it records 10 million monthly streams on JioPhones.

Telco partnerships give users an excellent opportunity to get a glimpse of the vast content catalogue on the platform, while also acting as a funnel for ZEE to upgrade them to ZEE5 Premium subscribers.

Tarun explains,

“Telcos are using content for both customer acquisition and retention. And, we gain access to a large audience sample."

1560426742946.jpg?fm=png&auto=format)

Besides telcos, it has also partnered with OEMs inlcuding Samsung, LG, Thomson, Kodak, CloudWalker, and Xiaomi, which pre-install the ZEE5 app on their devices.

Lastly, there are a plethora of tie-ups with popular consumer internet companies. These include music-streaming service Gaana (a bundled package offering consumers both subscriptions at the price of one), train ticketing platform RailYatri (allowing consumers to buy seven-day subscription packs along with their tickets), mobile wallets Paytm and Amazon Pay (to provide cashbacks to subscribers on monthly, half-yearly, and annual packs), and hospitality platforms MakeMyTrip and OYO (to offer exclusive benefits to both their customers).

Enabling a tech-led personalised user experience

One of the biggest challenges of digital entertainment is, what Tarun calls, “content delivery”. There are multiple issues from poor bandwidth to lower-end devices to deal with. More so in India, where the sheer size of the audience presents OTT operators with more than one end-user challenge.

To combat this, ZEE5 is making deep investments in technology to bring a rich, seamless, and personalised viewing experience to users.

It wants to ensure that when a viewer logs in to the app, content discovery is easy, recommendations are spot on, alerts and notifications are timely, and more. Essentially, the platform has to satisfy its subscribers as opposed to putting them off with features and functionalities that are irrelevant to them.

ZEE5 has partnered with close to 30 companies around the world, including 14 deep tech startups from Israel, to bring about customisations in the app and improve the overall UI/UX. Most of these companies, including Applicaster with which ZEE5 inked a deal, are specialists in the mobile entertainment space.

Rajneel Kumar, Business Head - Expansion Projects & Head of Products, ZEE5 India with Jonathan Laor, Co-Founder and CEO, Applicaster (one of the 14 Israel startups ZEE5 is working with).

These innovative tech solutions will help ZEE5 acquire new users faster, increase cross-screen engagement, improve personalised search, fine-tune outreach campaigns, capture the right time to engage with users through notifications/messages, and so on.

Rajneel Kumar, Business Head- Expansion Projects and Head of Products, ZEE5

India, tells YourStory,

“It is the agility and speed of innovation of these companies that attracted us to them. We have the audience and the scale, and they have the technology. It is a good fit. There are complex solutions we are trying to build for all specific areas of the ZEE5 platform - from sign-ins and subscriptions to video compression, search, and playback. By combining all the tech, we will be able to create a better consumer experience.”

The company did not divulge investment figures or revenue numbers. But, cash burn may not be a concern right now given it belongs to the Rs 32,900 crore ZEE Entertainment Enterprises Ltd, one of India’s few profitable media companies.

Standing out in a congested OTT market

India’s OTT market is estimated to be worth $5 billion by 2023, according to BCG. Gone are the days when digital entertainment was dismissed as “niche” or something not worthy of the mainstream. Today, there are over 30 OTT platforms - international and homegrown - in India, with more to come.

In a rapidly evolving sector as this, it is not easy to a) stand out and b) stay consistently relevant.

Not every platform can offer everything. For instance, ZEE5 is often asked about the absence of sports content - a huge growth driver of OTT consumption - on its platform. Or, the dearth of quality English language content, which can drive usage in the hundreds of millions, as it did for rival Hotstar.

But, CEO Tarun is confident that ZEE5’s three-pronged strategy, especially its focus on regional original content, will power it to a 100 million users and above.

He says,

“We are not in the sports business on the broadcast side too. So, we have limited ability to do sports OTT content. Our focus will remain on originals. We know that people enjoy content in their own language. The reception to our regional packs has been phenomenal.”

“And, we will continue to rope in consumers from across the country from different device and bandwidth ecosystems,” Tarun says.