Budget 2021: Reactions from India Inc and startups

On the heels of Budget 2021, presented by Finance Minister Nirmala Sitharaman, here's a look at what the stakeholders of the Indian startup ecosystem think.

As India recovers from the COVID-19 pandemic, India Inc and startups hopes from Budget 2021 were clear: resurgence and revival. As expected, this was a Budget like never before, fully focussed on complete economic reset.

Union Finance Minister Nirmala Sitharaman presented her third Budget in the Lok Sabha on Monday, February 1, replacing the Swadeshi 'bahi khata' with a tablet as she readied to present India’s first-ever paperless Union Budget.

In her speech, the Finance Minister laid emphasis on six key pillars which are:

- Health and wellbeing

- Infrastructure

- Inclusive development

- Development of human capital

- R&D

- Minimum government, maximum governance

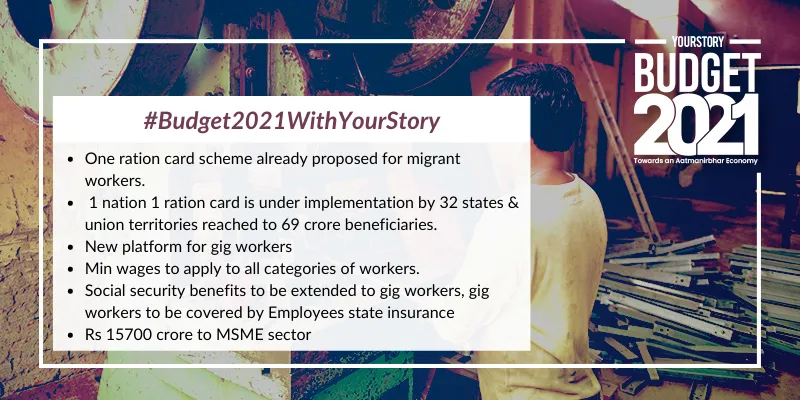

From announcing bad bank to extending social security benefits to the gig workers, and from boosting infrastructure to healthcare and renewable energy, the Budget initiated positive sentiments across all sectors.

The revision of definition for small companies under the Companies Act, Rs 15,700 crore boost for MSMEs, and Rs 50,000 crore boost to strengthen the R&D sector are some of the key takeaways from this Budget.

Here’s a look at what Indian entrepreneurs, startup founders, investors, and other stakeholders from the Indian startup ecosystem had to say about Budget 2021.

Anup Jain, Managing Partner, Orios Venture Partners

There is a strong focus on infra, which is key to driving India's overall development. Also, this means a revival in the construction industry, which will have a domino effect on employment and GDP per capita. This is extremely positive. Hiking the FDI to 74 percent is a revolutionary move that opens up the insurance sector and improves access to India's underinsured citizens.

The Incorporation of one-person companies (OPCs) without any restriction on paid-up limit is a welcome move for startups as two directors were NEC at a minimum and founders were forced to co-opt others under the Companies Act. The flexibility to convert a company to any form is another welcome step to ease doing business"

Padmaja Ruparel, Founding Partner of IAN Fund

Budget 2021 opens up opportunities for startups across health, hygiene, water, clean air, sanitation, etc. The vision of Aatmanirbhar Bharat with a focus on good governance and women empowerment will lead to a boost for the Indian Economy.

Indian startups have a great opportunity to innovate and help to sustain the economy. Non-conventional energy boosted with a focus on solar and Non-renewable sources.

Siddarth Pai, Founding Partner and CFO, , Co-Chair, Regulatory Affairs Committee, IVCA

Budget 2021 navigated the fiscal constraints faced by the government of India effectively without the need to introduce new taxes (save for the agriculture cess). The investments into healthcare, education and infrastructure will help sow the seeds for India to build a solid foundation for the coming decade. A noteworthy measure has been to introduce a "warehousing" mechanism for offshore funds who currently invest into India - a system that allows them to move their fund to GIFT IFSC without the transfer being subject to tax.

This is a huge boost to the Indian fund ecosystem as part of the "Onshore the Offshore" program that has been in vogue for the past few years. This will help ensure that the gateway to Indian equities will be in India and the need to have a foreign launchpad in order to invest into Indian equities is mitigated. Startups will benefit from the extension of the tax holiday by another year, but reforms in the IMB process will be necessary in order for it to live up to its full potential. Overall, Budget 2021 is a strong foundation for the next set of reforms that will be needed in order to become a $5 trillion economy by 2025.

Rajat Tandon, President, IVCA

Congratulations Hon’ble Finance Minister on several positive inclusions in the Finance Bill 2021, like, extending tax benefits to Startups, incentives on setting up of one-person companies, tax exemption to Global Funds on relocating to IFSC which echoes IVCA’s mission that is Onshoring the Offshore pool of funds, ease of compliance for REIT and InVIT, amongst others.

Based on the recent Regulatory Roundtables at Prarambh - Startup India International Summit, with domestic and global funds, chaired by Honourable Finance Minister and Commerce Minister, respectively, IVCA is hopeful that the Government of India will continue supporting the domestic and global alternative investment ecosystem, while the PE, VC asset class will continue to boost employment, grow Indian startups, scale-ups to growth companies and advance the economic growth of the country moving ahead of the pandemic.

Mihir Mehta, Senior Vice President, Ashika Capital

Allotment of a massive capital expenditure corpus in order to enhance and support national highway projects, roads, and other ancillary infrastructure shows the continued commitment of the government to strengthen connectivity across the country, which in turn will largely improve supply chain and logistics over the next few years.

Also, allotment of corpus to states and independent bodies will hopefully lead to better utilisation of funds across states and ensure that projects that require immediate attention from a financial capital perspective, are taken up on priority.

Alok Mittal, CEO and Founder, Indifi Technologies

Significant investments in the infrastructure sector is a welcome step and is likely to accelerate the revival of the economy in a sustainable fashion.

Setting up of a world-class fintech hub in GIFT City is a tremendous opportunity to provide seamless linkage for Indian fintech companies to global financial ecosystems. MSMEs have borne the brunt of COVID-linked disruptions, and more may have to be done outside of the Budget announcements to revive that key engine of India's economy.

Kumar Abhishek, Founder-CEO,

The support extended by the government to GIFT city is a crucial development for the Fintech ecosystem, especially startups. The availability of customised support and tools will not only expedite the processes and development but also create an environment conducive to ideas and innovations.

Also, the investment to promote digital payment will definitely uplift and establish infrastructure throughout the country, especially in Tier-II and Tier-III cities. Fintech companies will have better access to different locations and adequate incentives for growth.

Renuka Ramnath, Founder, and CEO, Multiples Asset Management Ltd & Chairperson

The Indian Private Equity & Venture Capital Association is very heartened to see a spending heavy Budget which augurs well for the economy. This Budget comes on the heels of a series of roundtables with key stakeholders in government, regulatory bodies, and the entire PE, VC, Startup ecosystem. The discussions were wide-ranging and very positive. Pleased with some of the announcements for IFSC for onshoring the offshore, startups, Infrastructure, Real-estate and the healthcare sector. We hope we can see some benefits for the AIF industry once we read the finer points.

There is consensus around doing what it takes to build a vibrant PE, VC sector. We also hope to see concrete policy changes and steps to enable this common vision. Today, India needs at least 2.5 percent of the GDP to come in the form of PE, VC investments for the country to reach its $5 Trillion target, i.e. (Around ₹8.75 Lakh Crore or $125 Bn). Only an internationally competitive tax and regulatory environment, as well as a level playing for domestic capital - unlisted shares, will catalyse investors to look towards India.

Vikas Garg, Chief Financial Officer,

Vikas Garg, Deputy CFO, Paytm

The Finance Minister has presented a balanced Budget that is aimed at maximum growth of all sectors in the coming year. The Rs 1,500 crore proposed scheme to incentivise digital payments is a welcome move that will accelerate the growth of cashless transactions in our country.

During the pandemic, digital payments emerged as one of the key enablers of empowerment at the grassroots and brought millions of people under the fold of the formal economy. Government's continued emphasis on increasing investment in Infrastructure, Insurance and digital payments will ensure financial inclusion of the masses.

Bhavish Aggarwal

Bhavish Aggarwal, Co-founder and CEO, Ola

welcomes a progressive and growth-oriented Budget. Measures under Aatmanirbhar Mission will create global champions in automobiles, financial services and technology and foster an environment where India becomes integral to global supply chains.

Increased investment in insurance and infrastructure will open new avenues of capital. We strongly support government's clean air focus with our EV plans that'll accelerate the world’s transition to sustainable mobility.

Ashley Menezes, Partner and COO, ChrysCapital Advisors, LLP & Chair, Regulatory Affairs Committee, IVCA

IVCA would like to thank the Government of India on boldy tackling the 2020 crisis and the welcoming Budget 2021. The Hon'ble Finance Minister mentioned in her speech that “Asia is poised to occupy a prominent position and India will have a leading role therein”. The PE/VC industry is relentlessly working together with the Government of India in realising its $5 trillion economy vision by supporting Indian startups and creating many more unicorns/decacorns.

Indian entrepreneurs have delivered numerous success stories, and they deserve an enabling capital environment. There has been a concerted effort on the part of the PE/VC industry to engage on critical regulatory issues with the Government stakeholders, to provide Indian entrepreneurs with the funds they need to build the companies they envision and to deliver value and create jobs. To achieve this objective, we believe that continued consultation is the need of the hour and we are hopeful of the Government’s support going forward.

Srini Sriniwasan, Managing Director, Kotak Investment Advisors Ltd & Chair, Credit and Special Situations Council, IVCA

The thrust on infra spend, monetisation of Infra assets and the proposed ARC route to sell NPAs to AIFs are game-changing opportunities for the AIF industry to scale up and seize the initiative! As always execution efficiently will be key and the AIF industry will be geared up to meet expectations.

Harshit Jain MD, CEO and Founder,

This year’s Budget by Finance Minister is pragmatic, positive, and committed to the healthcare sector which needed a deliberate boost post unprecedented virus outbreak last year.

- The announcement of a centrally funded scheme - Aatmanirbhar Health Yojana - with an outlay of Rs 64,180 crore over six years in addition to the National Health Mission is a welcome step towards strengthening primary, secondary and tertiary healthcare in the country.

- Setting up of 15 health emergency centres shows the government’s intent to be future-ready to address any healthcare crises. It is commendable that the government has put healthcare at the forefront, putting the focus on curative and preventive health and wellbeing.

- The allocation this year is likely to be around Rs 2,23,846 crore, which is a whopping over 130 percent rise from the Budget last year.

- The proposals would make quality healthcare accessible and affordable, besides standardising healthcare infrastructure across the country.

Harshvardhan Lunia, CEO and Co-founder,

The doubling of budget allocation for MSMEs in FY 22 to Rs 15,700 crore shows the confidence in India's thriving ecosystem of SMEs and MSMEs fueling the growth of the country and leveraging technology effectively. The reduction in margin money required for startups aimed at focusing on innovations and necessary support for them to continuously enhance their proposition. With this, we expect that in near future:

- OPC proposition on the relaxation of paid-up capital and residency requirements for NRIs will be paving the way for future investments to support financial inclusion.

- We hope efforts to witness PSU bank participation in extending capital access to NBFC, as the funds have been allocated for recapitalisation for banks' fundraising plans to clean up their books.

- Easing capital access to MSMEs through partnerships between retail-focused NBFCs and banks could be a game-changer.

Gurbaxish Singh Kohli, Vice President, Federation of Hotel and Restaurant Association of India (FHRAI)

The Union Budget 2021 has disappointed the Hospitality industry. Hospitality and Tourism roughly account for 10 percent of India’s GDP and employ nearly 9 per cent of India’s working population and yet, it failed to find space in the Union Budget. The Hospitality industry has been bleeding, and the FHRAI has brought it to the government's notice through several representations time and again. Our pre-Budget memorandum to the Finance Minister included some priority reforms to stabilise the industry such as

- Review of the Kamath Committee recommendations, Classifying Hospitality under the RBI Infrastructure lending norm criteria, granting industry status to hotels, restaurants, and resorts across the country,

- To include Hospitality and Tourism in the concurrent list

- MAT waiver for a period of three years,

- IGST billing to hotels for corporate and MICE bookings.

“The hospitality industry is disheartened and feels demotivated in its darkest hour. With zero foreign exchange earnings and less than 25 per cent of pre-pandemic revenues, the sector is facing an existential crisis, but we are surprised that the sector could not find even a mention in the FM's Budget.”

Shachindra Nath, Executive Chairman & Managing Director, U GRO Capital

One of the key highlights of the Budget is setting-up of the development finance institution (DFI) towards infrastructure financing and institutional framework to purchase a corporate bond, which would solve the issue of liquidity for the infrastructure sector and corporate bond market. Also, with the path-breaking initiative of instituting Asset Reconstruction Company (ARC) and asset management company (AMC) for NPA consolidation, banks have been allowed to streamline their focus on the much-needed growth. Other laudable initiatives are:

- The government has reduced the threshold for NBFCs to initiate recovery under the SARFAESI Act, 2002. This is an effective step towards ushering credit discipline and in the long-term will increase the penetration of credit to small businesses.

- The government has also doubled its allocation towards MSMEs, which would greatly support their revival and the eventual growth.

“Holistically, the Union Budget 2021 is an encouraging event, yet we optimistically look forward to a distinctive support for NBFCs, with a framework to provide them sufficient liquidity, while also furthering the credit guarantee scheme support to the MSMEs.”

Deepak MV, Co-founder & CEO, Etrio

From an overall Auto industry standpoint, the soft step towards the introduction of a voluntary scrappage policy is a welcome move. Further, the allocation of Rs 1.97 lacs crore towards PLI along with custom duty increase on components should spur investments in domestic manufacturing. The infrastructure investment focus would definitely drive demand for M&HCVs and construction equipments specifically along with boosting demand for mobility at large. However, for the EV industry, it's been a bit of disappointment with no direct mention of any EV focussed initiative or policy including FAME.

“There were a lot of expectations from the Budget, including ramping up of charging infrastructure, enablement of retail financing for EVs, and moderation of the inverted GST tax structure with lowering taxes on EV input components including battery."

Madhusudanan R, Cofounder, by M2P Solutions

The Budget proposal to allocate Rs 1,500 crore to boost digital payments is a welcome step, along with the Acceptance Development Fund set up by RBI should really push for higher adoption of digital payments in smaller towns.

The setting up of Fintech Hub in Gift City will pave way for new and innovative companies to set up shop and attract talent in a big way, we may have to wait and watch how this plays out as typically fintech hubs are in large cities globally, London, Singapore, Hongkong, etc, So Gift City is a surprise addition.

Vivek Gupta, Co-Founder,

Heartened to see development proposal for five major fishing hubs, including Chennai, Kochi and Paradip, as sustainable ecosystems for economic activity.

Like I said in the past, the fisheries segment earns the country a huge amount of FOREX- a focus on this sector will bear good returns, especially for the fishermen & farmers who are hit badly by the pandemic.

Dinesh Chhabra, CEO, Usha International

We welcome this Budget, India's first post-COVID-19 Budget, which is expansionary and focuses on the nation’s growth, bringing a positive sentiment to the overall economy. Strengthening the healthcare facility of the country, providing financial incentive to promote digital mode of payment will further boost the ‘Digital Revolution’ in India and is tailored to further accelerate growth rate are laudable initiatives.

- Furthermore, the exemption duty on steel and copper scrap, up to March 2022, will also help control the rise in price of consumer goods that will translate into healthy sales in the coming summer season.

- Giving a boost to agriculture and rural on the one hand and the MSME sector on the other will go a long way in strengthening the India we want to build.

- We are confident that the budget allocation for FY 2021-22 will provide the much needed thrust to the V-shaped growth trajectory of Indian economy.

“This Budget clearly indicates the Government’s intent on rebuilding a new India.”

Chet Jainn, Founder & CEO,

There is some good news for NRIs with the elimination of double taxation. Reducing residency requirements for incorporation of OPCs (including NRIs) will boost the startup ecosystem, and startups are getting tax breaks for one more year, is undoubtedly a good sign.

Another good news was to see an increase in the number of Indian taxpayers, definitely a good sign for businesses targeting tax-paying citizens.

Dhruv Agarwala, Group CEO, , Makaan.com and .com

Amid a sharp improvement in consumer sentiment with regard to property purchases post the start of the COVID-19 vaccine rollout, the government’s move in the Budget to extend the benefit of additional Rs 1.5 lakh tax deduction on home loan interest, until March 31, 2022, will act as a further impetus to the residential property sector.

This move will augur well, especially for the affordable housing segment, which will also benefit from the decision to offer a tax holiday for affordable housing projects for one more year, to boost supply.

- The support announced today by the Honourable Finance Minister for rental housing too will go a long way in boosting the real estate market and will ease a lot of pressure points in the rental home market.

- This will also help migrant workers to a great extent and will support them in remaining in metros and other big cities during times of financial hardships such as the one presented by the Covid-19 pandemic.

- The infusion of lakhs of crores into India’s infrastructure segment, with a focus on improving connectivity, will be particularly beneficial for India’s housing sector.

- The proposed debt financing for REITs and InvITs, and the setting up of the Development Financial Institution for augmenting funds for infra and the real estate sector is expected to provide a major fillip to the sector, and will attract more investments in the sector.

- The proposed extension of the tax holiday for start-ups by one more year, a tax exemption for relocating funds to IFSC, and a tax holiday for the aircraft leasing business in GIFT city, are some of the other measures that would also help India’s real estate sector as a whole.”

“However, the long-standing demand of the real estate industry to expand the definition of affordable housing so as to include homes priced more than Rs 45 lakhs in big metro cities, has sadly not been addressed.”

Rohit Manglik, CEO,

The impact of digitisation is evident from the presentation of the first-ever digital census, but also the fact that the Union Budget 2021 was presented digitally on a tablet. The announcement of strengthening 15,000 schools, setting up 1,000 Sainik Schools and 750+ Modern Eklavya Mission Schools for SC/ST students in tribal areas indicate the government's serious intent to bolster education.

The proposed National Translation Policy will facilitate access to education without any language barriers. The Budget could have done more in the direction of e-learning and skill development. Nevertheless, it is a significant step towards shaping the trajectory of the education sector in the post-pandemic scenario.

Bala Sarda, Founder,

1.97 trillion committed to the manufacturing sectors over five years starting this financial chain. It’ll help bring scale, job and growth. Manufacturing companies need to become an integral part of the supply chain and the government is gearing up to support the economy for sustainable growth. This is a much-needed stimulus to boost demand and consumer confidence.

“Most importantly, Rs 1,000 crore has been announced for tea workers of Assam and West Bengal. The details have not yet been shared but this is a positive step for the COVID impacted tea industry.”

Vamsi Krishna, CEO & Co-founder,

The National Education Policy has been a strategic move towards guiding the development of India’s education. To strengthen the policy further, this Union Budget is focusing on initiatives like National Digital Educational Architecture (NDEA) which will provide a diverse education eco-system for the development of digital infrastructure, educational planning, governance, and administrative activities.

The complete shift from using assessments to not only judge the cognitive levels of the learner but also using it as an opportunity to identify the unique strengths and the potential is a student-centric approach which will lead to the holistic development of a child and provide them with a greater edge, globally.

"Further, I would like to see more investments & budget allocation go into the education sector to enhance it with more trending technologies which will make education accessible to students in the farthest corners of the country.”

Zishaan Hayth, CEO and Founder,

Zishaan Hyath, CEO and Founder, Toppr

The goal to empower 15,000 schools is really promising. They can further mentor other schools in their region and help achieve NEP goals faster.

With the future of education being hybrid, we believe that edtech companies can act as true allies to the government and education ecosystem as a whole. Technological interventions can multiply government investment manifold and accelerate the implementation of NEP goals ie. focus on tracking and improving learning outcomes and holistic progress of students.

Vipin Sondhi, MD & CEO, Ashok Leyland

The Finance Minister has unveiled a well thought out Budget anchored by six key pillars. This could set out a virtuous cycle for Growth and Job creation spearheaded with a thrust on Public investment in Infrastructure and Health. The key will be in effective implementation. Four specific areas that we feel could provide the much-needed demand impetus to the CV sector.

- Firstly, the commitment to augment our country's road infrastructure with projects for building 8,500 km of highways and economic corridors augurs well for surface and road transport.

- Secondly, a Rs 18,000-crore scheme to augment public transport in urban areas with the addition of 20,000 new buses in a PPP model would ensure cleaner and efficient public transportation and ease congestion.

- Thirdly, the assurance of implementing a voluntary scrappage policy, for 20 years for personal vehicles and 15 years for commercial vehicles is positive. This is good for the environment and good for setting in motion a circular economy. However, we await further details of the policy, as the industry had requested for an incentive based Scrappage policy for it to be effective.

- Lastly, the emphasis on rejuvenating the manufacturing sector with double digit sustainable growth is reassuring as manufacturing would be a big job creator. The thrust on R&D for National Priority Projects and the PLI scheme will be key enablers to attain our Prime Minister’s vision for Atmanirbharta in the Manufacturing sector.

Anuj Mundra, Chairman and MD, Nandani Creation

With a focus on Aatmanirbhar Bharat, the announcement of the establishment of seven textile parks by the Modi government in Budget 2021 should be welcomed with open arms. It's a big boost for the local textile industry. And, this will help India become a world leader in the textile sector.

Finance Minister Nirmala Sitharaman in her Union Budget 2021 has clearly conveyed a message that this government believes in giving a big shot in the arm of textiles and local manufacturing with special focus on Vocal for Local.

Mohit Goel, CEO, Diagnocare solutions

The Budget is quite encouraging for startup ecosystem and innovators by extending the tax holiday and capital gain exemption for investment in this space.

Further, reducing the time of setting up one person company will further boost the ease of doing business and motivate upcoming entrepreneurs to innovate and provide valuable solutions.

Abhilash Pillai, Partner, Cyril Amarchand Mangaldas

Proposal to complete Eastern and Western Freight corridors by June 2022 will scale up warehouse business. Hope the govt will bring up a single-window clearance for setting up more warehouses, which currently takes more than three months to have all approvals in place.

Further,

- Expansion of Phase 2 metro in five cities will witness mixed-use development around these metro corridors. This will also help SmartCity missions and create more job opportunities.

- Govt’s decision to monetise surplus lands of CPSE’s, through sale or concessionaire model, will make prime commercial properties for development. This is expected to aid the birth of more business districts.

Avinash Raghav, Co-founder & MD, Shift Freight

The new economic corridor to boost road infrastructure and the decision to award 13,000 km of roads under the Bharat Mala project are welcome moves by the Centre.

This will not only create better connectivity but will add to job opportunities at the grassroot levels. Better connectivity will translate into better service to customers looking for quick and seamless service from logistics support providers

Rhitiman Majumder, Co-founder, Technologies

The infusion of money for road development in four states is a welcome move for smooth/faster logistics transport. This move will further ensure greater connectivity in Tier-II and Tier-III cities in these states. This is a very welcome move from the respected Finance Minister.

Further, the highest financial package for railways will add to the smooth connectivity between different points of the country and easy and faster freight movement.

Moin Ladha, Partner, Khaitan & Co.

One Person Company (OPC) requires only one person as a subscriber to form a company and such a company is treated as a private company under companies act. The primary advantages include complete control, lesser compliance burden coupled with limited liability.

Allowing NRIs to invest through this route can encourage startups and smaller business set up without the concerns of a larger compliance framework or minimum capital commitment.

Ram N Kumar, Founder and CEO,

The introduction of Aatmanirbhar health programme with an outlay of Rs 64,180 crore in addition to national health mission in the Union Budget 2021 is a step forward in ensuring a Healthy India and claiming its position as an undisputed leader on global health and wellbeing platform.

We expect Aatmanirbhar health programme to consider Aatmanirbhar Ayurveda as its integral part.

Other laudable initiatives are:

- Strengthening India’s sankalp of Nation-first, health and wellbeing being one of the six pillars

- A 137 percent of tremendous rise in healthcare spending

- Special emphasis on preventive and curative healthcare

- Proposed establishment of 17,000 rural and 11,000 urban health and wellness centres in the country

“We further expect special incentives from the huge healthcare spending outlay to create a robust ecosystem supporting world-class research, product development and drug discovery in the Ayurvedic sector so as to mainstream it for future generations to accept it as the first call of prevention and treatment.”

Amit Sinha, Co-founder,

Budget 2021 will surely enhance the agricultural sector. Increased credit target is a very positive step and will help build up distributed agriculture infrastructure which is very much needed.

In addition to this, the money in the hands of farmers through the MSP regime will keep the momentum seen during the COVID-19 times going in agriculture. With the new Budget announced, farmers and the sector stand to gain from the funding.

Kamal Narayan Omer, CEO, IHW Council

Recognising the interlinking of health and socio-economic and environmental factors such as malnutrition, safe water and air pollution also deserves a special mention — it will help reduce the burden of infectious diseases as well as fatal non-communicable diseases such as lung cancer which has been tightening its grip on the Indian population for some time now.

The voluntary scrappage policy for vehicles aimed at reducing vehicular pollution will require dedicated communication for awareness.

Rakesh Deshmukh, Co-founder and CEO,

The announcement of the National Language Translation Mission is a much-needed effort by the government to reach our citizens in the language they understand. At Indus App Bazaar, the usage of apps in Indian languages on our platform has increased 2.2 times last year.

We believe that with an enhanced app store ecosystem we will be able to break linguistic barriers and adding more value to the next half a billion Indian customers. Moreover, for Aatmanirbhar Bharat to be successful, the focus should be on technology innovation as a whole. We appreciate the government’s focus on innovation and R&D in the Budget 2021.

Mike Chen, General Manager, TCL India

We do welcome the recent PLI scheme of the government. However, we need to ease up the duty imposed on raw materials keeping in mind the make in India thought.

We should also be getting added incentives so that transformative measures can be taken. The industry contributes 25 percent of the country's GDP.

Nitesh Salvi, Founder and CEO,

Indian government launched the Startup India Initiative back in the year 2016 with the idea to increase wealth and employability - giving wings to entrepreneurial spirits. So definitely, for the old startups, another year of tax holiday has no importance.

As they would be well-funded by now and then paying tax would not be a challenge anymore. And the ones which are not well-funded have crossed the time-limit of tax holiday.

For the new and budding startups, it can definitely act as a confidence-boosting attribute but as a good entrepreneur and citizen, I would still want to focus on reducing operational costs and enhancing profits rather than saving taxes.

Siddharth Kothari, Chief Investment Strategist of family-run Om Kothari Group

A comprehensive Budget focused on structural growth, a follow up to the five mini budgets which were aimed at short term demand revival. With FY21 fiscal deficit at 9.5 percent of GDP, the government has been really brave in keeping their FY22 target at 6.8 percent of GDP.

- With an aim to spend Rs 200 billion on a Development Financial Institution, our govt plans to have a Rs 5 trillion loan portfolio in the next five years. This will ensure the expansion of our National Infra Pipeline from 6,835 to 7,400 projects seamlessly.

- Outlay of funds for the development of highways and corridors across WB, Kerala and TN, and to award 8,500 kms road works by FY22 end will ensure infrastructure pickup in our country, thereby leading to capacity revival and job creation.

- My favourite part in this Budget is the focus on stressed asset resolution, honorary FMs decision to set up an ARC/AMC to take over stressed loans will be a real booster for the country.

- Allowing customers to choose within multiple power distributors will ensure free market forces are able to play out in the industry.

- To achieve all this and more, the govt has planned to divest its stake in LIC, BPCL, Air India, IDBI Bank, two state-run banks and one insurance company. This sounds fair enough, as the need of the hour is to raise as much funds as possible, to keep our creditworthiness and currency rate sacrosanct.

Abhishek Gupta, Founder and CEO, Hex N Bit

In the National apprenticeship training scheme–the Indian government has now allocated Rs 3,000 crore for a national apprenticeship, which will create a skilled and talented workforce with the bilateral partnership with United Arab Emirates (UAE) to provide training, certification, assessments etc. Further appreciate steps such as:

- India will collaborate with Japan in order to adopt cutting edge technology, technique & vocational programs for scaling up the technology in India to newer heights

- The government of India has proposed the budget of Rs 50,000 crore over five years for innovation and R&D. There will be an expectation from the government to spend setting up the Innovation lab focusing on the technologies such as AI/ML, Data analytics, etc. which can showcase the solution to most of the problem statement in most of the field including medical, agriculture, defence or any natural disaster

- As proposed by FM, capital expenditure is now increased to Rs 5.54 lakh crore from Rs 4.39 lakh crore, hopefully, the state and centre will invest a considerable amount for digital connectivity, high-speed internet at an affordable rate as well as learning assets in a remote location so that aspirants can learn new-age technology to build New India.

- Even after the economic crisis due to COVID-19, an increase in capital expenditure with such a high number must be appreciated.

- Boost to start-up hub in India, as proposed by FM, there will be a plan to enforce incentives incorporation of one-person companies without any restriction on paid-up capital. Can set up this company in 180 days.

Anoop Gautam, Co-founder and CEO,

Union Budget 2021 has focused on strengthening 15,000 schools with all the components of NEP as a pilot project. Also, skill enrichment programs will be initiated in collaboration with the United Arab Emirates which will bring new opportunities for the youth of our country.

- FM Shrimati Nirmala Sitharaman also mentioned to initialise a collaborative training programme with Japan, which will be launched for more countries as well in the upcoming future.

- For startups, the government has proposed to reduce the margin money requirement from 25 percent to 15 percent. This will open a new door of opportunities for startups in upscaling their businesses.

- The government has also doubled the fund allocation for MSMEs, to a whopping Rs 15,700 crore for FY22.

Rajeev Tiwari, Founder, Technologies

In the Union Budget, to promote startups, the announcement of Incorporation of One Person Company, Easing of Definition of Small Company from the point of view Corporate Law Compliance are a welcome step. Further,

- Innovation and R&D will get a boost by allocating National Regional Foundation (NRF) a sum of Rs 50,000 crore and boost Innovation culture in startups.

- Announcement of Non-Auditing of Income Tax till Rs 10 crore and allowing startups to claim IT Exemption and Capital Gains for one more year will ease the compliance burden on startups and help in raising more funds.

- NEP (New Education Policy) has been given a thrust in the Budget. The plan to set up 15,000 pilot schools as a showcase for NEP, which can be exemplary for other schools, is a welcome step and will lead to promoting NEP in the School Ecosystem.

- Tribal School-Eklavya Schools with newer allocation in tribal areas will spur further development of education in tribal areas. Allocation of the National Apprenticeship Scheme for Rs 3,000 crore and increasing the contours of it will benefit companies.

- Innovation and R&D will get a boost by allocating National Regional Foundation (NRF) a sum of Rs 50,000 crore for the next six years. Research and innovation ecosystem to get substantial growth.

Karan Chopra, Co-Founder, Doc On Call

Especially like the move away from sick care to a more holistic well being with a focus on preventive care. However, the proof of the pudding will lie in implementation which hasn’t been great in the past. Would love to see how the government. thinks of accountability and non-performance.

Kanav Kahol, CEO, Divoc Labs

An allocation of Rs 35,400 crore for vaccines shows the commitment beyond the initial phase of 30 crore people and that the government may be considering expanding the vaccine program to cover the poor and the vulnerable.

With the commitment to increase healthHR, the Government plans to bring in a National Allied Healthcare Bill which will streamline and support the availability of skilled individuals in healthcare. This is a positive development which again can vastly increase the reach of healthcare in our vast country.

Seshadri Kulkarni, CEO, DigitSecure

The development of fintech hub in GIFT City and Rs 1,500 crore to promote digital payments clearly demonstrates the government’s strong commitment to a digital economy.

The RBI’s Payments Infrastructure — Development Fund of Rs 345 crore to drive merchant acceptance in rural India combined with today’s budget allocation are certain to boost digital payments benefitting all the stakeholders.

The government’s facilitation in setting up ‘world-class’ fintech hub will help bring together new technologies such as big data, AI and blockchain to transform the way that financial services are delivered, making them cheaper, more efficient, more convenient and more inclusive.

The fintech hub will also help facilitate interaction and collaborative learning between regulators, innovators, investors, startups and established players.

Shishir Kumar, Director General,

The Budget gives a runway to the dream of reaching a 50 percent gross enrolment ratio in India. We are at 25 percent today, and online degree programmes, focus on embedded courses in university and enabling colleges to work on their own curriculum are great accelerators.

The Budget helps a university in india focus on research based learning. The Budget is a four percent increase over last year and the innovative idea to use retired teachers as mentors will take us a long way.

The cream of the cake is in the implementation of the NEP 2020 and the budget sets the right direction over expenditure.

Sonesh Jain, EIR,

Budget 2021 is a pro-transportation, pro-development budget. While the 34.5 percent increment in capital expenditure will drive demand upwards, the reinforced focus on improving road infrastructure will help in delivering a faster, safer, and reliable supply chain.

The mention of the National Logistics Policy was completely missing. While the Budget has emphasised enough on building better road infra by announcing targets of adding 12 percent to National Highways and adding 30 percent to the Budget allocation of the Ministry of Roads, it focuses little on empowering small and medium commercial vehicle owners.

Tarun Lawadia, Founder and CEO,

The voluntary vehicle scrapping policy announced by the Finance Minister, under which vehicles will undergo fitness tests after 20 years for personal vehicles and 15 years for commercial ones will certainly strengthen India’s fight against pollution across cities and promote fuel-efficient vehicles and EVs in the country.

A capital investment of Rs 5.54 trillion towards developing road infrastructure around the country is expected to boost the sales and demand for commercial vehicles giving some relief to the auto sector. However, increasing customs duties on some auto parts to 15 percent will put more pressure on the already struggling auto manufacturing sector of the country.

The auto industry has always been a key contributor to India’s economic growth and job creation. We expected the Union Budget to be a game-changer for the badly-hit auto sector.

In the near future, we have high hopes from the government to encourage the startup ecosystem for new consumer trends such as used car leasing, car rental, car subscription models, etc., which are going to be the promising industries of the future and can boost the growth of Indian auto sector.

Varun Saxena, CEO and Founder,

Skill India empowers Indians to build a sustainable financial career around their interests. This is where the passion-economy-driven model of Bolo Meets adds value to the next half billion internet users of India, by letting them monetise their social capital and become Atmanirbhar. We welcome the increase in Skill India expenditure by the government.

Pradeep Misra, CMD, Rudrabhishek Enterprises Limited

As was expected and much needed, there is a massive emphasis on infrastructure in the Union Budget. The number of projects under the National Infrastructure Pipeline (NIP) has been extended to 7,400, which will help in generating immediate employment. Focus on the Affordable Housing section continues with the extension of eligibility to avail benefits for another year.

Plan to set up ‘Development Financial Institution’ with fund infusion of Rs 20,000 crore for financing infrastructure and development projects will further help in mobilising the long term capital, especially through debt instruments.

This should be vital in pulling out projects that are stuck or slowed down. The aim to complete 11,000 km of National Highways; seven port projects worth Rs 2,000 crore in PPP mode; extending the Metro line to Tier 2 cities and peripheral areas of Tier I cities etc., will collectively create vibrant economic conditions of growth.

As mentioned by the Finance Minister, fund infusion in the infrastructure sector will have to be accentuated by multiple measures, including monetisation of assets, creating institutional structure as well as raising the Union and State governments’ budgetary allocations. Overall, the Budget has set the tone for intense infrastructure development in FY 21-22 and for the following years.

Ketan Doshi, MD at PayPoint India

The government's move on the proposed Rs 1,500 crore fund for digital payments is a welcome move and will go a long way in strengthening payment infrastructure in the country and taking financial services to the last-mile. We will wait to see the fine print of where this fund will be allocated.

Waiver of Tax audit for companies with turnover upto 10 crs and a cash expenditure of less than 5 percent will push Small businesses to move towards Digital payments.

Rohit Kapoor, Chief Executive Officer, India & South Asia

It is heartening to see a Budget entirely focussed on revitalising the economy. On the back of the proposed reforms, we believe that a focus on growth-oriented measures, economic reforms, and inclusive growth will pave the way for extensive economic recovery.

The Government's focus on extending and improving transport (road, railway, metro) infrastructure with nearly 217 projects worth over Rs 1 lakh crore to be completed under National Infrastructure Pipeline will enable travellers to explore hidden gems, and therefore bolster the domestic tourism and hospitality industries.

Additionally, keeping up with the changing times, an overall focus on technology with interventions like incentivising and promoting digital payments will fast-track India’s transition into a digitally-enabled economy.

We are confident that with the series of interventions announced by the Honorable Finance Minister, Nirmala Sitharaman, our country is on the path of stable and quick economic recovery. With the mantra of 'Atmanirbhar Bharat' and initiatives reducing compliances for one-person-companies, a boost for MSMEs, the reduction in corporate taxation along with the steps to simplify GST for companies further and ease tax compliance will boost morale across industries.

The funds allocated to COVID-19 vaccines will also strengthen confidence among travellers and boost faster recovery in the service sectors.

The Government's efforts towards skilling the country's youth and collaborating with other countries will spur entrepreneurship and enable job creation as well. This budget truly has the potential for transforming India.

Harshil Mathur, CEO and Co-founder of

2020 saw an 80 percent increase in digital payments, especially from Tier II and Tier III cities, and the government has understandably focussed on capitalising on this momentum and incentivising the adoption of digital payments for the year ahead. I believe the Rs 1,500 crore incentive announced will open a plethora of opportunities for fintechs to innovate for the new normal, leading to large scale adoption even in the smallest of towns and villages.

I'm hoping the funds will be used towards developing alternatives to Zero MDR policy and initiatives towards bringing digital financial literacy in vernacular languages. These will instil trust in the system and accelerate adoption from MSMEs and entrepreneurs who are apprehensive towards moving money digitally.

Fintech in India has grown more in the last ten months than in the last two years, thanks to young Startups who’ve built tailored solutions and addressed markets never served before. And so, easing the norms around setting up of One-Person Companies (OPC), without any restrictions on paid-up capital and turnover, is a good step towards removing barriers to innovation amongst startups.

Also, the 1-year extension towards capital gains exemption will provide additional tax relief for startups, enabling ease-of-doing-business in this new order and allowing small businesses to prosper.

Ravi Narayan, CEO, T-Hub

The extension for startups on both, the eligibility for claiming tax-holiday and the capital gains exemption for investment by another year (March 2022) will make a major shift overnight in boosting the aspirations and enthusiasm of Indian entrepreneurs, especially for the ones whose businesses were affected downwards due to pandemic.

They will rethink before shutting off their operations, or might would want to restart any recently closed enterprise as they will see the silver-lining from the budget this year. The talented NRIs who were asked to return to India or the ones planning will also find a good reason to settle back in India and set up a tech product business. The revised norm and the opportunity to form One Person Company with zero turnover norms and without any restrictions is now accessible even faster in 120 days than 182 days earlier. The threshold of annual turnover for small companies being raised from Rs 2 crore to Rs 20 crore is yet another major boosting factor for the unborn, new, or existing startups.

I thank our Finance Minister for these steps. However, a lot more needs to be done in the areas of funding startups, R&D centres for budding entrepreneurs in Tier-II and Tier-III cities too as well as directing MNCs to value more or Indian innovations or creating more robust innovation centres in their campuses. Furthermore, we have realised over the years that the translation from a budget statement to its impact on the ground takes time. We need to shorten the time while maintaining the true spirit of the Budget.

Budget 2021 has been a pleasant surprise for the startup and innovation ecosystem as it announced everything best an entrepreneur could wish for. We can easily anticipate existing ventures grow confidently and more new ventures coming up rapidly due to some specific budget highlights. However, the ecosystem deserved it, as India’s startup ecosystem is now the world's third-largest with close to 38 unicorns and 12 of them came up last year.

Seema Prem, CEO and Co-Founder,

The Budget this year has given significant support to the startup ecosystem. This will help turbocharge their growth. The concept of One Person Companies (OPCs) with an option to convert into any other type of company at any time; reducing residency limit for an Indian citizen to set up an OPC from 182 days to 120 days; and allowing non-resident Indians to incorporate OPCs in India will certainly boost innovation. Collateral free loans and fund of funds for MSMEs will stimulate growth and provide solace to MSMEs hit by the pandemic.

The portability of One Nation, One Ration Card will be a boon for migrant workers and speedy implementation will ensure that migrants can move across boundaries without worrying about access to ration. The additional allocation to MNREGS will provide substantial relief to workers whose livelihood has been impacted by the pandemic.

Sandeep Lodha, CEO, OYO’s .in

"We are pleased to see the Government's efforts towards promoting the startup ecosystem in India. The wedding industry was in need of a booster shot to spring back in action. While there weren’t any direct reforms in the industry, the Union Budget 2021 has laid focus on the fundamentals that can spur the recovery of the sector - financial respite and economic development, strengthening of infrastructure, spotlight on health and relief to taxpayers.

Stimulus through the extension of tax holidays for one more year until 2022 will ease the stress caused on startups due to the nationwide crackdown. Incentivisation of the digital transactions will also go a long way in heralding a new wave in the wedding industry by addressing concerns pertaining to confidence, trust and unfair practices. It will eliminate financial gaps/slips caused due to human error.

The introduction of artificial intelligence in MCA - 21 will save us the hassle of paperwork and will be tailwinds leading to portfolio development, innovation and increased focus on customer-centricity. Increased focus on connectivity will also help us create tourism circuits or bring to the fore many less-explored destinations.

Although we did expect a slashdown on GST, we are hopeful that the increased focus on FDI and simplification of GST will bring about positive development in the wedding industry in India."

Aloke Bajpai, Co-founder and CEO, Ixigo

Tier-II and III cities have seen significant growth in demand for air travel and first time flyers post relaxation of lockdown norms. Monetisation of airports in these areas will help capitalise this growing demand by accelerating infrastructure development in underserved areas and strengthening regional air connectivity.

While these infrastructure measures will boost tourism in the long run, it’s sad to see that no extra spends or tax incentives were announced to provide immediate relief to the severely affected travel and tourism sector.

Rajnish Kumar, Co-Founder and CTO, Ixigo

Railway budget this year has a strong focus on passenger comfort, safety experience and industry revival. Progressive initiatives announced by the government on upgradation of railway stations, 100 percent electrification of broad gauge routes, green railways project and introduction of newly designed Vistadome coaches on popular tourist routes are welcome steps.

Focus on faster trains, better connectivity and new rail lines will fuel train travel demand and accelerate recovery of the industry to pre-COVID growth levels.

Shan Kadavil, CEO at

The proposal to extend tax holiday for startups for one more year till March, 2022 will be extremely helpful in these difficult times. Additionally, the extension of capital gains exemption for investment in startups by one more year will also incentivise investment in startups and help them bring in funds into these companies. Also, one-person company and relaxing the number of days for NRIs will help start up creation and help in ease of doing business.

Vivek Jain, Chief Business Officer of Shiksha.com

The budget gives a good boost to our education system where over 15000 schools will be strengthened under the National Education Policy. Also, the replacement of the ‘10+2’ structure with the ‘5+3+3+4’ model has the potential to upgrade the Indian education system to that of developed countries. The main challenge will be for the first few batches to adapt to the new structure. We are optimistic that the new structure will be positive for students.

Dr. Bijaya Kumar Sahoo, Advisor to The Odisha Adarsha Vidyalaya Sangathan (Rank of Minister of State), Govt. of Odisha

The Union Budget 2021 has touched all the sectors and rests on six pillars, i.e. Health & Well-being, Inclusive Development Human Capital, Innovation and R&D, Physical & Financial capital and infrastructure, Minimum government and maximum governance. The whooping Fiscal Deficit expected at 9.5% of GDP is to be contained at 6.8% in 2021-2022 which will be brought down to 4.5% by 2025-2026. Though a welcome measure, its implementation will be full of challenges. The 15th Finance Commission Recommendation of States sharing increased 41% will make each state stronger; however, it shall depend on the FRBM consolidation. Government has reposed more faith on the taxpayer by reducing reopening cases to 3 yrs making IT-AT faceless and exempting pensioner senior citizens from filing tax returns, it will certainly give relief to them.

Mandar Agashe, CMD, Sarvatra Technologies

We are happy that aspiring entrepreneurs and small businesses will benefit from the measures government has taken including broadening the definition of start-ups, simplifying regulations, providing income tax exemptions amongst others. We believe that this announcements will give startup economy a boost. The vision of the government is to be digital first, promote the domestic industry and create an adequate infrastructure and the budget lays down its foundation through focused policies in the same direction.

Sudarshan Lodha, Co-founder,

It is extremely encouraging to see that the budget bets big on the infrastructure industry to help kick-start the economy. Divestment and monetisation of assets across industry including airports, ports, railways and freight corridors is a big stride and will go a long way in making India Atma nirbhar in the real sense of the term. This will also offer a big impetus to fractional investment models in real-estate. Instead of solely depending on the developers for the supply side, the industry can expect big government assets on the block thereby opening up the industry further to retail investment.

Anand Kumar Bajaj, Founder, MD & CEO, PayNearby

Considering the challenging year faced by the Indian economy, the Ministry of Finance has put up a fine balancing act. On one hand, the Union Budget 2021 has various encouraging initiatives that will propel aspiring entrepreneurs and boost small businesses. On the other hand, it renders a lot of focus on uplifting the lower stratum of the society which includes the migrants, gig workers and farmers among others. The proposal to extend social benefits to gig economy workers and farmers along with a portal to register their details will pave the way to formalise the sector and create employment avenues amid a robust ecosystem to fulfil the government’s Aatmanirbhar vision.

Sanjay Bhatia, Co-Founder & CEO,

For most of the last year, the shipping & logistics sector has been under strain due to global headwinds. The industry was expecting short term measures to lower the current pressure faced by the industry. Having said the budget did include steps to boost the sector in the long term.

- Invitation to private players to manage the ports is a beneficial move for the industry.

- Private port management players having knowledge and competencies can transform the overall functioning, thereby increasing its potential in shipment handling.

- It can also lead to digitizing the entire port facility and providing an experience to the consumers and users.

- The launch of the scheme to promote merchant ships' flagging will further give a rise in employment.

- Additionally, the goal to double the ship's recycling capabilities is another move to generate career opportunities among the nation's youth.

- Aggressive road infrastructure push will help in smooth cargo movement to and fro from port to shipper.

- Overall it has been a reasonable budget for the sector, more investments or steps to digitize the industry could have made it even better.”

Murali Iyer, CEO and Principal Officer, InsureNearby

Increasing the FDI limit to 74% from the current 49% in the insurance sector is a welcome move by the government which was long overdue. Providing equal rights to foreign partners will help open up the sector while offering the much-needed capital infusion. This will provide a huge fillip to employment opportunities besides helping boost insurance penetration, especially in the hinterlands of the country. Additionally, the move will also help Indian shareholders to find new buyers easily, thereby eyeing a smooth exit.

Sanjeev Krishan, Chairman, PwC in India

The FM has done a prudent job of prioritising spending to address immediate needs and mid to long term goals across critical areas. Privatisation, a substantial increase in FDI in the insurance sector as well as other announcements around asset monetisation, INVITs/REITs are progressive measures that will definitely have a far-reaching positive impact on creating a conducive ecosystem for business and help address some legacy issues. The FM had an unenviable job of striking a balance on the fiscal deficit front without altering tax rates to fuel economic growth and must be complimented for having achieved it. The thrust on digital, affordable housing, inclusive growth, ease of doing business, innovation and R&D are steps towards making India future-ready. However, operational detailing and seamless execution will be critical.

Ravi Vishvanathan, CFO,

The 2021 Budget is extremely encouraging and growth-oriented. There is a great focus on infrastructure and this will go a long way in energizing the Employment scene as the economy finds its feet in the post covid phase. Another big positive initiative is the proposed privatization of a few PSU banks. This sends the right message that the government is serious about ‘Minimum Government Maximum Governance’. This also sets the tone for privatizations of PSUs’ in general. From a messaging perspective, this sends the right signals to the industry and investors about the intent of the government.

Tanul Mishra, CEO, Afthonia Lab

The final numbers for the year suggest that Indian startups have weathered the worst of the storm, and are moving into an ideal phase for growth. I was happy to see the steps announced by the government to help ease of business for the startups and the tax exemptions extended as I am sure it will foster more innovation and growth leading to job creation and fuelling demand for our economy too. The other initiative that I found encouraging in particular was the move of increasing the FDI limit from 49% to 74% for Insurance companies and allow foreign ownership and control with safeguards. Since InsurTech is a white space industry, an increase in the FDI limit will ensure innovations and disruptions in this sunrise sector.

Saumya Shah, Founder,

Overall, #budget2021 has a strong focus on economic growth. The government is expected to resort to borrowing, and divestment from several of its crown jewels in 2021 in order to fuel growth in the economy. No increase or additions in income taxes is certainly a delight for individual taxpayers. Extending the tax holiday for startups to March 2022 along with extending the capital gains exemption for investing in startups will surely encourage more investors to invest in the promising startup ecosystem of India. There are plenty of positives in this year's budget. However, the key will be execution. Divestment of PSU’s and achieving the FY22 Fiscal Deficit target of 6.8% of GDP is certainly going to be something to look forward to and is an ambitious goal set by the government.

Vaibhav Lall, Founder, Khojdeal

The finance minister’s decision to allow the incorporation of one person companies is in line with the ease of doing business initiative. It will allow budding entrepreneurs to bring their ideas to life. Furthermore, by allowing non-resident Indians to establish OPCs in India, the FM has opened the entry route for quality entrepreneurs and investors to set up businesses in India.

Kazim Rizvi, Founding Director, The Dialogue

The budget has been a balancing act that tried to push economic activity through better incentive structures. A sum of 1.5k crore was earmarked for the scheme that will aim to promote digital payments in India. There was also a mention of establishing a fintech hub, in an attempt to facilitate growth. FinTech in India is expected to increase at a CAGR of 20.2% during 2017-21 to reach $92 bn. In 2020, online transactions grew by 80% in India as compared to 2019.We welcome these steps from the FM at a time that is crucial for many fintech companies, in a post COVID world and this holds promise for driving growth.

Deepak Agrawal, founder,

It’s a great budget with excellent provisioning for Agri infra, Infrastructure, Bank re-capitalization, healthcare, affordable housing, defence, fiscal deficit containment and several such matters aimed at provisioning for money in the hands' of the common man - something that was a must because of COVID's impact. However, it’s a budget for a developing nation. So on one hand when we speak about reforms related to FDI and Atmanirbhar Bharat, the strategic focus and attention to high-tech industries be it indigenous development of core electronic manufacturing, communication infrastructure and other future technologies for industry 4.0, is glaringly missing.

Roopa Kudva, MD, Omidyar Network India

It is great to see the emphasis in the budget on using technology as an enabler for social impact and inclusion in critical areas like education, urban governance, and provision of benefits to migrant workers. A 45% increase in the allocation to e-learning and the launch of a new scheme PM e-Vidya to provide multi-modal access to education for teachers and students can go a long way in strengthening education delivery, especially post COVID. The proposal to create a platform for unorganized migrant workers to access benefits under various welfare schemes is an important step, as migrant workers have been left out of the social safety net so far. There is also a new target to digitize 125 civic services across 25 cities through the Smart Cities Mission. Digital infrastructure should continue to be given importance going forward. In addition to the technology, we will need good data governance and community engagement for the benefits to reach every Indian.

Sourabh Deorah, CEO and cofounder at

Lack of announcements in the direct tax front in Union Budget 2021-22 will be both a relief and disappointment for the salaried class. Relief for those who fall in the higher tax bracket and disappointment for those who were expecting changes in standard deductions and tax deductions centred around the costs incurred for a shift to remote working. On the other hand, the various announcements made for the startup sector will provide a much-needed impetus to the startup ecosystem in the country that took quite a significant blow due to the pandemic. Capital gains exemptions will incentivise funding for startups and propel their growth.

Achin Bhattacharyya, Founder, and CEO, Notebook

This budget indeed proposes steps that can considerably ease their lives by reducing the residency limit for an Indian citizen to set up an OPC from 182 days to 120 days As a measure to benefit Start-ups and Innovators, this budget proposes to incentivize the incorporation of One Person Companies (OPCs) by allowing OPCs to grow without any restrictions on paid-up capital and turnover and allowing their conversion into any other type of company at any time. Further on the taxation front, in order to incentivize startups this budget proposes to extend the eligibility for claiming tax holiday for start-ups by one more year - till 31 st March 2022. Also, in order to incentivize funding of the start-ups, it proposes to extend the capital gains exemption for investment in start-ups by one more year - till 31 st March 2022.

Samir Bhatia, Founder & CEO,

The Hon. Finance Minister has presented a budget which will provide tremendous stimulus to the economy, and in particular, the MSME segment. It was encouraging to see that development of human capital was one of the six pillars on which the government aims to make inroads. Coming out of an unprecedented year like the last one, the industry has accepted unconventional employment types including gig & contractual. The extension of social security to gig & platform workers is a welcome change and adds stability for this segment."

K. Ganesh – Serial Entrepreneur & Partner –GrowthStory

By including companies that have capital base up to Rs 2 crore in the category of small companies unlike the current limit of Rs 50 lakh would provide compliance benefits to over 2 lakh companies. Limited Liability partnerships are now decriminalized and there is a flexibility to convert a company to any form or LLP is going to increase the ease of starting business. The decision of extending the capital gains exemption for investments in startups as well as the tax holiday exemption for another year is highly appreciable, but, the eligibility criteria for such exemption is extremely complicated and simplification of the same is essential to make it available and beneficial for majority of the companies. The budget should have made a strong push for Government making purchases from Indian startups. This would increase the atma-nirbar India goals, drive employment in the startup sector and create a greater demand for indigenous startups. As of now, the stringent requirements, lengthy tendering, eligibility terms, EMD, and Performance guarantee obligations as well as long delays in payments make it unviable for startups to become a supplier or vendor to government sector despite there being large scale purchases from the government. This area needs attention. Overall, this is an encouraging budget with need for strong implementation and clarifications.

Rishabh Goel, CEO, and Co-founder,

The details of the bad bank and stressed assets cannot be revealed immediately during the budget, it will certainly ease the bad loan burden by taking over those assets and attempting recoveries. We see that the total stress in the banking system would be in excess of Rs 15 lakhs with limited capital and difficult to manage the NPA's. For the bad banks, the Asset Restructuring and Management Company has been announced to be set up to resolve the mounting bad debt. Further for the resolution of bad debts, the NCLT framework has been proposed for further strengthening. Banks have been granted a little flexibility in setting delinquency measures from the lending perspective, though this is not as much restructuring as we would have expected to see. With more and digitalization in the focus, the litigation be it for longstanding tax disputes or delinquency will continue ‘faceless’ and be done through e-courts and Appellate.

Shivam Thakral, CEO,

Blockchain is the biggest disruption of the 21st century and we are happy to see Government’s focus on Healthcare and sustainable economic growth in the budget. Blockchain technology is capable of playing an important role in achieving 5 trillion dollar economy dream for India and digital assets will ensure financial inclusion in the remotest part of our country. We have lot of hopes from ‘The Cryptocurrency and Regulation of Official Digital Currency Bill 2021’ that it will bring some positive regulations for digital asset industry and ensure a level playing field for all the stakeholders. The focus on digital payment scheme (INR 1500 cr allocated) and first digital census (INR 3800 cr allocated) will require major participation from Blockchain technology providers.. We are committed to working in tandem with government to make India the Blockchain capital of the world”.

Alok Sharma, CEO and Co-founder,

It is very encouraging to see India's infrastructure getting a big boost in Budget 2021. With the allocation of INR 1,70,000 Cr for transport infrastructure and the move of National Highway Authority of India (NHAI) to build 60,000 km of highways in the next five years, including 2,500 km of express highways is a welcoming news as it will positively impact freight movement. With the allocation of INR 103 lakh crore across 65 projects including logistics and warehousing- the industry is going to get a major boost this year as well. We also expected the government to introduce technological mandates for logistics networks As this would spur the use of technology in every pocket of the industry and make it more equipped to meet the current demands and future challenges."

Abhik Mitra, MD and CEO, Logistics

The government's dedicated effort towards allocating highest ever CAPEX of 1.08 trillion to the Ministry of Road, Transport and Highways are highly appreciative. We are glad that the government is further augmenting road infrastructure and planning new avenues for more economic corridors. With more than 13,000 km of roads awarded under Bharat Mala project and an addition of 11,000 km NH corridor by March 2022, it is going to strengthen the physical infrastructure sector and bring groundbreaking transformation in the logistics sector. We also expected the government to bring Fuel under the purview of GST which would have transformed the Indian logistics sector. Moving forward, we hope that the government will lay more focus on the increasing use of digital technologies and automation.

Vinay Sharma, Head of digital services, S.Chand and Co. (Mylestone and Learnflix )

2020 is likely to go down as the most eventful year in recent history for the entire globe. It was no different for the education space in India. We witnessed an unprecedented shift to online education as schools and colleges remained shut during the pandemic. Having played a critical role in helping schools and students continue the teaching-learning process in this period despite all challenges, the edtech industry was hoping that fund allocation for education in this budget would see marked focus on Digital infrastructure, online learning push and Teachers training etc. Therefore it was a little disappointing to see that the budget, which had many positives for education sector like setting up of new Sainik schools under PPP, qualitative transformation of 15000 schools in line with NEP and most importantly setting aside of 5000 crores for R&D, fell a bit short on capitalising on the opportunity to build momentum for digitisation in Indian education that could have had far reaching benefits for our young population.” - Vinay Sharma- Head of Digital & sevices, S.Chand and Co. (Mylestone and Learnflix )

Bala Parthasarathy, Co-founder and CEO,

Union Finance Minister Nirmala Sitharaman presented Budget 2021 in the Parliament today,Since we have seen that India is one of the fastest-growing Fintech Markets in the world. We have no doubt that the government’s support in creating and promoting a world-class Fintech hub at GIFT City will draw everyone’s attention, and can soon become the cradle of developing Fintech companies. We do see enormous growth not only in that region but also in creating jobs, drawing more people to work in Fintech. The exposure can bring in more innovation, technical know-how, help companies thrive in a joint collaboration set up, attract many incubators, investors, accelerators, help in creating an ecosystem for growth.

Regarding the Government’s Rs. 1500 crore influx to support digital payments, we all know that The Digital India Program is a flagship program by the Government of India. MoneyTap has also mirrored this goal in its aim to make more Indians digitally empowered, be able to use financial apps in better ways, improve knowledge and create apps that are easy to use, flexible, and can make people’s lives more secure. So, we are hopeful that any influx like this will help people get more convenience and accessibility to financial payments online.

Anil Pinapala, Founder & CEO, Vivifi India

While it is a welcome initiative to set up a FinTech hub at the GIFT city, the industry would benefit from an implementation that makes the Fintech hub virtual. The actual implementation should go beyond physical infrastructure and we hope that the Government provides a regulatory sandbox for all the Finctechs to experiment and innovate to meet the prime ministers objective of Digital India and Financial Inclusion.

On the ₹ 1500 Cr outlay for promoting digital payment, we hope the implementation is biased towards Indian firms in line with the Atma Nirbhar Bharat philosophy. Google which controls less than 40% of market share in India on payments spent ₹ 1200 Cr in rewards to its customers with the actual direct revenue of just ₹ 72 Cr. We hope and urge that the ₹ 1500 Cr incentive is only for the majority Indian owned and operated firms and specifically excludes foreign owned corporations from China and other countries.

Punita Kumar Sinha,Chairperson, InCred AMC

What a growth booster! Increased government spending and privatization has been much appreciated. Now we have to find the much needed private capital to buy these assets. Will be interesting to see how the bond yields react over the medium term with increased government borrowing.

Vivek Bansal,Group CFO,

A growth focussed budget for sure! Budget signalling big intent for decade to come. Much needed focus on health & infrastructure, greater transparency on fiscal situation, attempt to make the regulatory framework more efficient through tax, move to privatize struggling PSUs/PSBs are some path breaking changes. The government has also paved the way for the development of a world-class fintech hub at GIFT City in Gujarat. It has simultaneously pledged to set up a Development Finance Institution with Rs. 20,000 crores capital infusion which will augur well for long term growth and innovation. Another Rs. 20,000 crores have been earmarked for Public Sector Bank, which should further strengthen ability to lend . NPAs will be tackled separately with the constitution of Asset Reconstruction Management Company in a bold move which will make the financial sector stronger for future. All in all, the budget has lived up to its expectations in the current landscape and we await to see the fine prints.

Piyush Khaitan, Founder & Managing Director, Pvt.

The Union Budget 2021 announcement on significant budget outlay on healthcare, capex, privatisation, setting up of a bad bank, FDI increase in insurance companies and infrastructure investments, has come in at the right time for the much-needed revival of the economy. The earmarking of INR 1,500 Crores as incentive for digital payments and enhancement in exemption from tax audit limit for companies doing most of their business through digital modes, will further boost digital payments adoption in the country. The business for NeoGrowth is consumption facing and the untouched tax regime for both corporate and income tax will have a positive impact on the purchasing power and thereby overall consumption. These measures are in the right direction for Growth, Employment and Consumption.

Deena Jacob, Co-founder, CFO & Head (Revenue and Growth),

Focus on capex spends and measures to boost health infra is a welcome move in the current environment, both for recovery and for the much-needed health sector. The Finance Minister’s measures for the MSME sector, which includes an allocation of INR 15,700 crores to ease their burdens caused by the pandemic is a great move which implemented in collaboration with multiple channels to reach out to the right target would be a good measure for overall recovery. We are pleased to see the efforts outlined to ease compliance requirements for the start-up community as well as the introduction of incentives such as tax holidays and an extension in capital gains exemption by a year. Delighted to see the digital push with the INR 1500 crore scheme to spur digital payments and the steps such as the increase in tax audit exemptions for companies doing business via digital modes to reiterate the strong intend for digitisation.

Parthasarathi Patnaik - Chief Risk Officer, Vayana Network

While the vehicle scrappage policy seems voluntary at this stage, I think this may be the first of many bold steps the government is likely to take to aggressively curb use of polluting vehicles and usher an era of electric vehicles in line with global trends. This measure portends well for the auto sector in the medium term as it is likely that a large number of older commercial and private vehicles will be replaced by newer fuel efficient vehicles, thus requiring large additional investments by auto and auto parts manufacturers.

Siddhant Wangdi, Founder of Meatigo.com.