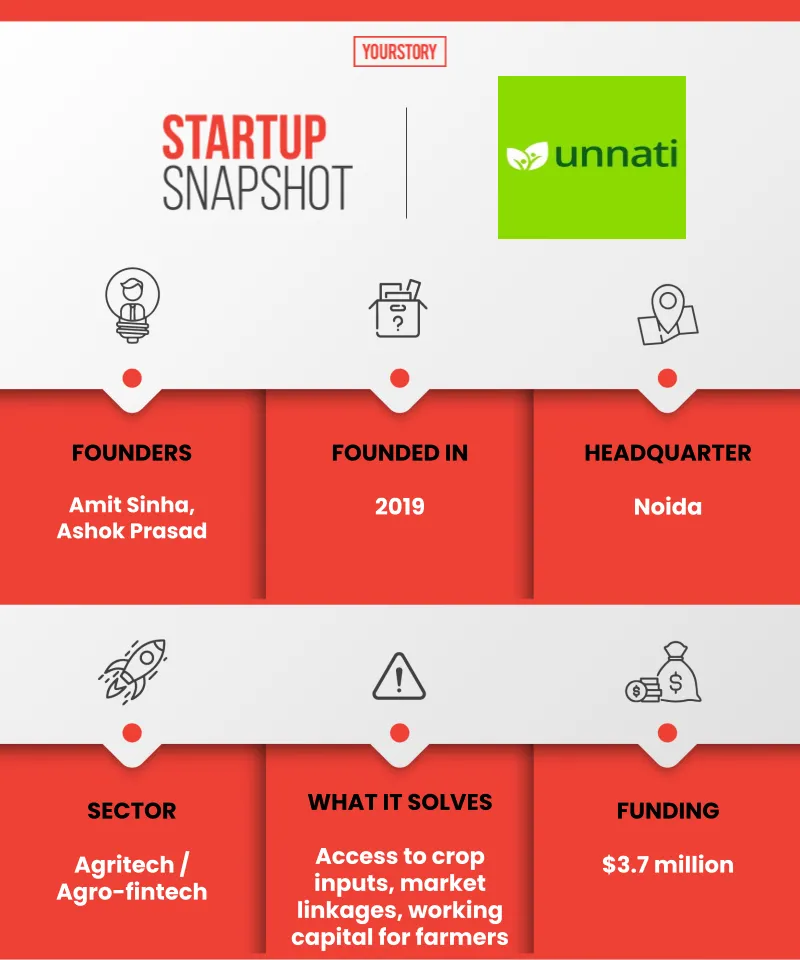

Fintech to farming: Why Amit Sinha quit Paytm to build an agritech startup, backed by VSS, NABARD

In 2019, Paytm Mall’s former COO Amit Sinha founded Unnati, a fintech-powered agritech startup. It is backed by NABARD’s venture capital arm, Vijay Shekhar Sharma, and other members of the ‘Paytm mafia’.

Startup veteran Amit Sinha’s LinkedIn bio reads: “I have been deeply involved in building 2 large unicorns in India (Paytm and Paytm Mall).”

Over two stints across 12 years at the fintech decacorn, Amit served as its CFO, Head of HR, COO of , and Business Head for Paytm Insurance. Then, in 2019, he launched his own agritech startup . Joining him as the co-founder was Ashok Prasad (friend and former colleague from Paytm).

But why agriculture, given his rich experience in fintech and financial services?

“I’ve done every role in building an organisation from bottom-up to billion dollars; started from zero multiple times. So, never thought twice before having to start from zero again,” Amit tells YourStory.

Despite agritech and finance being completely different ecosystems, Amit says he’s building Unnati (meaning ‘improvement’ in Hindi) with a fintech core.

The Noida-based startup calls itself a “fintech-powered digital farming company”.

Unnati Co-founders Amit Sinha (L) and Ashok Prasad

Essentially, Unnati makes technological interventions to ‘improve’ every stage of a farmer’s crop cycle — from seed buying and crop guidance, to supply of inputs (pesticides, fertilisers, etc.), market linkages for the sale of produce to the fulfilment of his working capital needs, and more.

Unnati’s overarching goal is to empower farmers and enhance their productivity with the best of technologies. It wants to create ‘farmer entrepreneurs’ who can take control of their input and output.

Amit elaborates, “The farming ecosystem is a complex and risk-prone one. So many variables are out of control. Because of the structure of the industry and the landholding system, people [businesses] find it difficult to reach out to farmers. Either their solutions don’t get delivered at all or the cost is very high because they are delivered through a long chain of intermediaries."

"This was the core problem statement when we started Unnati,” he says.

Building a ‘tech backbone’ for agri trade

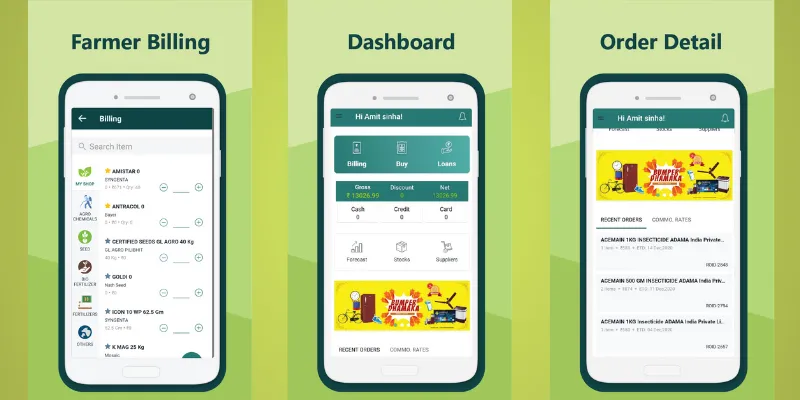

Unnati is developing an end-to-end “tech backbone” for all stakeholders in the agri trade. It bundles everything from pre-harvest guidance to post-harvest services to working credit for farmers under a unified platform.

On the input side, registered farmers can buy seeds, pesticides, fertilisers, etc., from scores of branded suppliers and sellers listed on Unnati.

And on the output side, they can sell their produce directly to food processors and agribusinesses that the platform connects them with. This way businesses (buyers) get raw and authentic products while the farmer earns a better price.

Amit says,

“Every player in the agri chain impacts the farm output. But these services [stakeholders] don’t interact with each other. We are making the farmer the centre of the agri trade and telling him that if he has to control his farm output, he has to control X, Y, and all other variables by himself.”

To eliminate the burden of seasonal irregularities, Unnati commits a price to farmers at the start of every season.

So, his income remains stable despite potential uncertainties. Farmers can book products online and pick them up from Unnati’s partner centres and retailers across states.

“We direct the farmer to a store where he can go and close a transaction,” says the founder.

Infographic: YS Design

Business model and growth plans

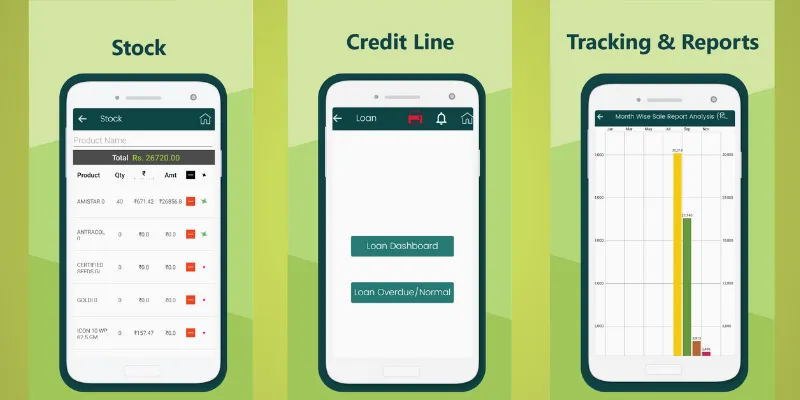

In 15-odd months, Unnati has created a network of 4,500 on-ground partner stores for selling agri inputs to farmers in 48 districts across India.

It has registered over 2.75 lakh farmers from Uttar Pradesh, Madhya Pradesh, Bihar, Maharashtra, and Odisha, and sees about 20,000 transactions per day.

By 2022, Unnati is planning to scale up to 15 states, starting with Haryana, Rajasthan, Andhra Pradesh, and Telangana, and expand its farmer network to one million.

It recently tied up with fertiliser brand Mosaic India to digitise the operations of over 1.5 lakh small agri input retailers in rural India.

The startup’s current focus is on non-perishable crops such as sugarcane, paddy, corn, soya, and select vegetables. But it also looks to get into the category of “semi-perishables” like mustard, cotton, potato, and onion.

Unnati also provides a unique card (ID) to farmers that can be used to avail small-ticket loans. They can get a digital KYC done by scanning the QR codes on those cards. Unlike several farm financiers, Unnati offers “non-collateral and flexible loans” to farmers, which means there is no minimum repayment cycle.

Amit explains,

“It is a daily interest product… more a credit line than a loan. It means farmers can take and return it multiple times, depending upon the products they’re purchasing. Their transaction history drives the credit ratings. Not just working capital, but cardholding farmers can use their ID for all transactions on Unnati.”

The startup gets a cut from the seller or purchaser, i.e., whoever transacts on the platform. Without revealing numbers, Amit says Unnati’s revenue is growing 3X-4X.

“We’re seeing huge traction. We ensured that produce was sold at best prices even during the lockdown," he states.

Funding from VSS, ; agri landscape

Last October, Unnati raised $1.7 million in a Pre-Series A round from , an agriculture-focused venture fund floated by NABARD.

At the time, GR Chintala, Chairman of NABVENTURES, said,

“Unnati has created a platform to digitalise the major components in the food and agribusiness value chain. The predictive capabilities of the data captured by the platform enhance efficiencies, while its transparent processes help in building trust among farmers and FPOs. Unnati has the potential to be a nationwide platform for multiple services in the agricultural value chain.”

Prior to that, Unnati had raised $2 million from Gemba Capital, and prominent angel investors, including Paytm founder Vijay Shekhar Sharma, and other members of the ‘Paytm mafia’ — Renu Satti, Ajay Lakhotia, Vikas Garg, and Shankar Nath.

Unnati has on-ground partner stores in 48 districts in India

Speaking of the investment, Co-founder Ashok Prasad had said, “Since we cater to a multitude of farming needs, the capital injection will allow us to expand our value proposition in terms of innovative digital tools that we offer. This funding will help us invest in technology, and in increasing our geographical and crop footprint.”

Unnati competes with AgroStar, Gramophone, Kisan Point, Agribazaar, DeHaat, and the likes on the farm input and marketplace side, and GramCover, Spoon Money, farMart, Jai Kisan, Farm Infinity, and so on on the agri-fintech side.

Tech-led agriculture is only getting started in India, with the market poised to be worth $24 billion by 2025, according to EY.

Amit sums up by saying, “Agriculture is 13 percent of India’s GDP; the whole of it is our market. Every crop is a multibillion-dollar industry. There are many agritech startups today, and it is not a winner-takes-all market.”

Edited by Saheli Sen Gupta

![[Startup Bharat] How agritech platform Gramophone increased crop yield for 5L farmers in MP](https://images.yourstory.com/cs/2/dc9aa1302d6c11e9aa979329348d4c3e/WhatsAppImage2020-06-25at4-1593081675909.jpeg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)