Indian insurance companies can now invest in FoF

After the unicorn parade we saw this week, there's more reason to cheer for Indian startups, thanks to the IRDA's move to allow Indian insurance companies to invest in Funds of Funds.

After the unicorn parade we saw this week, there's more reason to cheer for Indian startups, thanks to the IRDA's move to allow Indian insurance companies to invest in Funds of Funds.

The latest IRDA move will mean greater inflow of domestic capital into the startup ecosystem and comes close on the heels of the recent decision of the government to allow private retirement funds to park certain percentage of their capital in Alternate Investment Funds (AIFs).

Indeed, experts believe the inflection point for any startup ecosystem to be when domestic institutional capital is allowed to start investing into the local ecosystem.

"This move by the IRDA and the move by PFRDA last month shows the government's intent to accelerate institutional rupee funding to startups, which will help in economic growth and job creation," said Siddarth Pai, Founding Partner and CFO at 3one4 Capital, and Co-Chair at Regulatory Affairs Committee.

This announcement to boost domestic capital in India comes after IvyCap Ventures recently made a 22X return of Rs 330 crore after partially exiting beauty startup Purplle, marking a turning point for institutional investors in India.

The Interview

Rolling out new processes can disrupt the functioning of large businesses, especially multinational companies. Such changes may impact parts of the businesses or impede the functioning of the business across geographies. Puma India's Amit Prabhu, AWS’ Sachin Punyani, and ClearTax’s Rohit Razdan talk about how businesses can build an e-Invoicing strategy.

Editor’s Pick: The Turning Point

Mohan K had always wanted to start his own company. While developing a payment gateway at Foloosi, he decided to bridge the gap of last-mile fintech problems in India and launched IppoPay in June 2020 to cater to small businesses in Tamil Nadu. The startup claims to have garnered Rs 800 crore transaction within less than a year of its launch. Read more.

Startup Spotlight

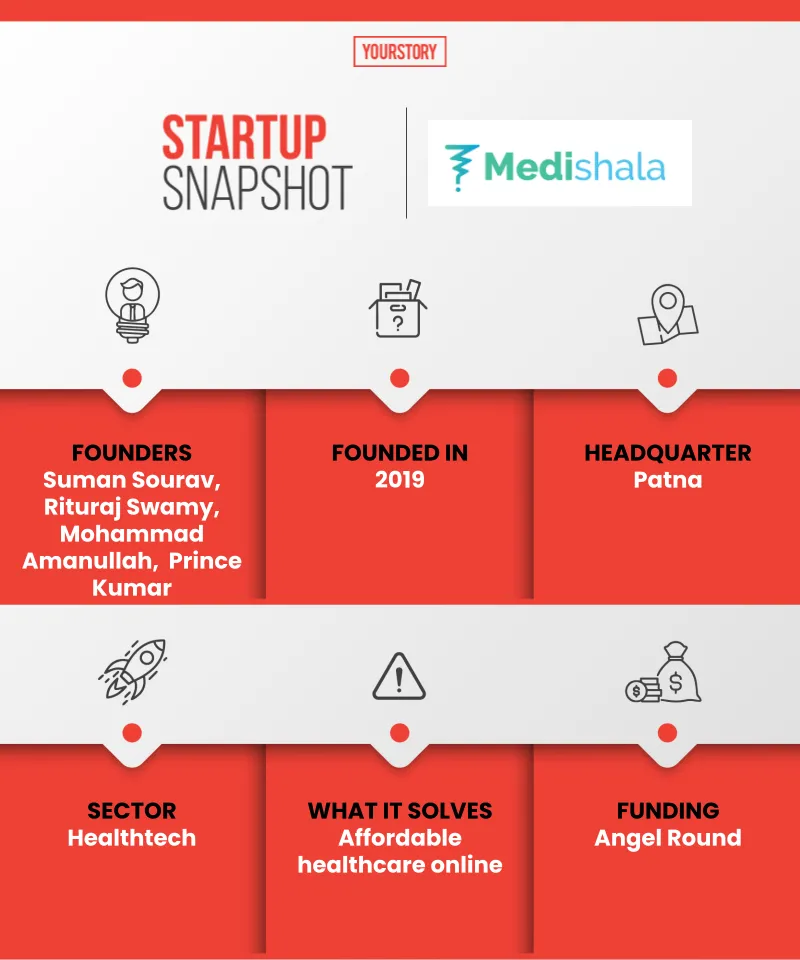

Providing people in rural areas access to affordable healthcare

While studying at BIT Mesra, Patna, Suman Sourav, Rituraj Swamy, Mohammad Amanullah, and Prince Kumar realised that a number of people from rural areas had been asking them to book medical appointments in Patna. So, they started Medishala, an online healthtech platform that aims to bring the best of doctors and medical experts to patients in the hinterlands. Read more.

News & Updates

- True North sold a part of its holding in PolicyBazaar to five independent buyers – Ashoka India Equity Investment Trust Plc, Triumph Global Holdings Pte Limited, Serum Institute of India, IIFL Special Opportunities Fund Series 8, and India Acorn Fund Limited. In October 2020, it had conducted the first tranche of its stake sale in the company.

- Domestic micro-venture capital fund Speciale Invest has raised Rs 140 crore in its second fund. With this second fund, Speciale Invest is looking to invest in 18-20 startups in enterprise software, SaaS, and frontier technologies.

- Alteria Capital announced the close of its Alteria Capital II fund, which has been heavily oversubscribed and has exceeded the target fund of Rs 1000 crore within four months of its launch. The fund now has an AUM of Rs 2300 crore across two venture debt funds.

- Amazon has moved the Supreme Court challenging the Delhi High Court's division bench order that had vacated a stay on Kishore Biyani-led Future Group proceeding with its Rs 24,713 crore asset sale to Reliance Industries. Amazon sought a stay on the March 22 order of the division bench, terming it illegal, random, inequitable, and unfair.

- Another first for women in India: the appointment of India's first-ever woman underground mine manager by Udaipur-headquartered Hindustan Zinc. Mining engineers Sandhya Rasakatla and Yogeshwari Rane became the first Indian women to be appointed at the managerial level in an underground mine.

Before you go, stay inspired with…

Siddarth M Pai, Founding Partner, 3one4 Capital

“The government has provided considerable support to many institutions in the country which has enabled them to come out with their incubators.”

— Siddarth Pai, Managing Partner, 3one4 Capital

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!