IVCA elects new executive committee for a two-year term

The executive committee of the Indian Venture and Alternate Capital Association (IVCA) is constituted by nine elected members, six co-opted members, and special invitees, at the discretion of the committee.

The Indian Venture and Alternate Capital Association (IVCA), the apex, a non-profit body for all alternative investments in India, on Friday announced that it has elected its new executive committee (EC) for a two-year term (2022-24).

IVCA has 228 members on board, including marquee Domestic - Alternative Investment Funds and Global PE/VC funds, LPs, Family Offices and other important industry stakeholders. It acts as a go to body between the government, policymakers and regulators representing the PE/VC industry.

The executive committee is constituted by nine elected members, six co-opted members and special invitees, at the discretion of the committee. Four of the six co-opted members have been inducted in phase I, taking the current EC strength to 13. Phase II, is expected to be completed shortly, with the addition of the rest of the co-opted members and special invitee members.

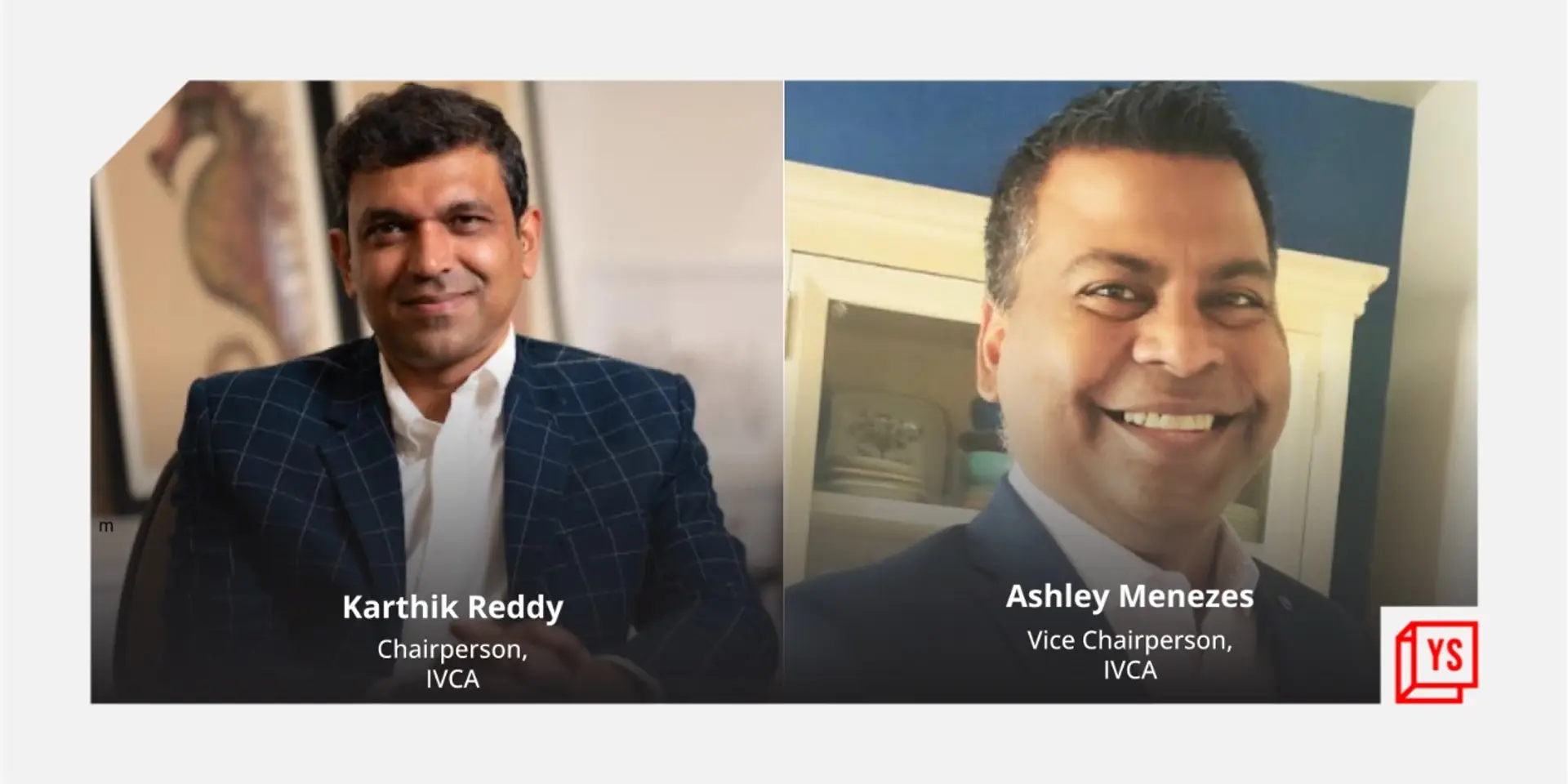

The elected members are - Karthik Reddy (Chairperson, IVCA and Co-founder and Managing Partner, Blume Ventures), Ashley Menezes (Vice Chairperson, IVCA, Partner and COO, ChrysCapital (Chair, Regulatory Affairs Committee, IVCA - 2020-22)), Amit Jain (Managing Director, Co‐head India, Carlyle India Advisors Private Limited), Nipun Sahni (Partner, Apollo Global Management), Prashanth Prakash (Founding Partner, Accel Partners India LLP), Rajan Anandan (Managing Director, Surge and Sequoia Capital India LLP), Sandeep Naik (Managing Director, General Atlantic), Siddarth Pai (Founding Partner, Chief Financial Officer and ESG Officer, 3one4 Capital) and Vineet Rai (Founder, Aavishkaar Group and Managing Partner, Aavishkaar Capital).

Four co-opted members are — Pratibha Jain (Head of Strategy, Everstone Group), Rema Subramanian (Co-founder and Managing Partner, Ankur Capital), Padmaja Ruparel (Founding Partner, IAN Fund), and Rochelle D’Souza (Managing Director, Lighthouse Funds).

Karthik Reddy, Co-founder and Managing Partner, Blume Ventures and Ashley Menezes, Partner and COO, ChrysCapital have been appointed as the Chairperson and Vice Chairperson of the executive committee respectively.

At Blume, Karthik Reddy has led a large share of the investments, and advises and serves on the boards of some of the leading investments at the firm.

Ashley Menezes has been with the firm for over 22 years. He is a member of the advisory committee and is responsible for diligence, regulatory/industry relationships, legal, compliance and operations. Menezes is a private equity veteran and has served on the board of the Indian private equity association for almost eight years. He is the past chairperson of the Regulatory Affairs Committee, IVCA.

Karthik Reddy, Chairperson, IVCA and Co-founder and Managing Partner, Blume Ventures, said,

“The IVCA and the new EC will look to further mobilize domestic capital participation through fund of funds as well as ease additional flows from domestic and global avenues. With the new Expert Committee announced in the union budget, we intend to work closely with the government on the existing regulatory matters. The current government and policymakers have been engaging with the industry body frequently and have acted on several pressing policy matters in the past, and together we intend to create a ‘frictionless economy’, accelerating the 2047 goals for the country.”

The executive committee is focused on helping achieve the goals and objectives of IVCA, PE/VC ecosystem at large, in improving the environment for private equity and venture capital, interacting and helping grow the ecosystem in India including regulators, general partners, limited partners, and other stakeholders related to the PE and VC sector. It is helping grow innovation and entrepreneurship, presenting Indian PE and VC opportunities at suitable forum in India and abroad and submitting representations to governmental authorities as and when needed.

Edited by Kanishk Singh