Chiratae Ventures

View Brand PublisherIndia’s consumer tech industry to grow to a $200-250B opportunity by 2025: Chiratae Ventures report

Chiratae ventures and PGA Labs recently launched a ConsumerTech report presenting a detailed analysis on how technology offers a strong value proposition to brands catering to daily consumer needs.

Technology has long been used to improve the quality of life. Concepts like consumer tech existed even back in the 19th century when innovations like radio and television were revolutionising the entertainment industry. With advancements like AI, ML, and IoT today, tech is now used by the masses to interact with family and friends, order food, book transport, improve health or simply enjoy movies and games in the most interactive ways.

Companies are betting big on consumer technology – a large category of products and services providing better day-to-day experiences to improve the lives of consumers.

Citing the ConsumerTech report, Sudhir Sethi, Founder, Chiratae Ventures said, “The consumer tech sector has seen an evolution that has set the stage for Indian consumer companies going global. Within our portfolio, we have good examples like Lenskart, GoMechanic, FirstCry, Emotix, and HealthifyMe, which have gone global and dominated several niches outside India. At a fund level, 10 percent of revenue, ~$1.7 billion of Chiratae’s portfolio companies come from international markets. In fact companies like Playshifu and Emotix have 90 percent revenues from abroad. We have urged our consumer companies to explore International markets, Middle East and SouthEast Asia being natural extensions and US opening up as well, through both organic and inorganic routes.”

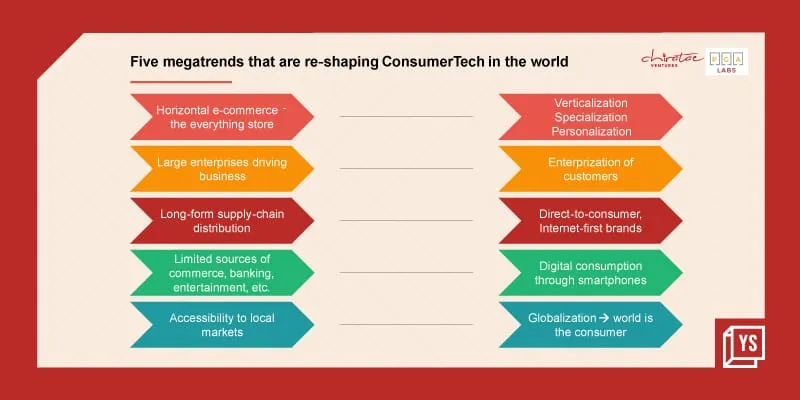

Mega trends reshaping consumer tech in the world

The March 2022 study on consumer tech by Chiratae Ventures and PGA Labs presented some of the opportunities and trends that are going to dominate the industry for the years to come. The report suggests that more than $42.4 billion has been infused in the space with a significant increase of investments in areas like edtech, social commerce, gaming and media, and the creator economy.

Trends have changed from horizontal e-commerce to verticalisation and personalisation, long-form supply chain distribution channels are now being replaced by direct-to-consumer and internet-first brands. Some of the other emerging trends in the sector include increased adoption of digital payments, enterprise-ization of customers and globalisation.

Sectors that will revolutionise consumer tech

The report also deep-dives into areas that have witnessed huge consumer interest and have been advancing with constant innovation. These are e-commerce 2.0, creators’ economy, online gaming and entertainment, and electric vehicles.

E-commerce 2.0

Trends like fast delivery and easy payment methods mostly dominated the first phase of the e-commerce revolution. However, e-commerce 2.0 is all set to further democratise online selling as the focus shifts to value-conscious buyers from India’s smaller cities and towns who buy affordable unbranded products.

Commerce 2.0 can be primarily structured as Social Commerce and Digital. Brands, with enablers that drive effective implementation of these opportunities.

- With social commerce, new-age brands can enable selling through alternative channels like live videos, social media etc. This mainly caters to the low to mid-income segment through trust-based selling of unstructured product categories.

- The second phase of the e-commerce revolution includes the D2C ecosystem where brands sell directly to consumers with no involvement of middlemen.

- Lastly, the emergence of digital enablers has made it possible for brands to ensure a smooth end-to-end consumer purchase experience. From product discovery to last-mile delivery, checkout processes to customer data, digital enablers use the most advanced technology to help online sellers reach a large number of consumers.

E-commerce 2.0 is witnessing players innovating and developing capabilities such as ecosystem partnerships, scalable service models, content-led commerce, and others to remain competitive in their respective segments.

Creators’ economy

According to a global study by Forbes, the average daily time spent consuming content is now six hours and 59 minutes, which includes phone, TV, and other forms of digital media. There has been a constant rise in online consumption of content, especially after the COVID-19 pandemic when people switched to online platforms for both education as well as entertainment.

Whether it is an enterprise or an individual, creators leveraging tech to reach out to the masses have hugely benefited from this boom.

Five major business models arise throughout the value chain of the creator’s lifestyle – SaaS tools, vertical marketplace, patronage platforms, fan platforms, and creator support. These models have led to the creation of new opportunities across segments, including creators across knowledge, passion, lifestyle, celebrities, health and fitness, gaming, patronage platforms, fan community, and education.

Online gaming and entertainment

Along with online content consumption, the COVID-19 pandemic also led to the rise in online gaming in India. The sector is expected to reach US$ 2 billion by 2023 driven by growing internet penetration, rise in consumption of vernacular language content etc.

Emerging gaming trends include real money gaming, cloud gaming, e-sports, casual gaming, play-to-earn games.

Play-to-earn games will see a wide range of consumers being introduced to the world of gaming, providing viable earning opportunities and will likely drive the growth of the gaming sector in India over the next decade.

Electric vehicles

Whether it is the private sector, startup ecosystem or the government, all stakeholders are working in collaboration towards increasing the adoption of EVs in the country. Electric two-wheeler and three-wheeler markets are projected to grow to $1.8 billion and $1.5 billion respectively by 2025.

Startups are emerging in the space of manufacturing made in India EV components. Bounce, which is a popular bike-sharing app recently ventured into manufacturing electric scooters at an affordable price and the ability to battery swap via the Bounce network.

Sharing his thoughts on the insights of the report, Anoop Menon, Principal, Chiratae ventures said, “Hybrid lifestyle in urban and semi-urban areas and discerning consumer behaviour have led to the significant impetus to new business models/product categories such as quick commerce, live commerce, sustainability linked choices in food and mobility. Today’s consumer likes being heard with more choices to experiment with. Building engagement and loyalty would be the critical anchor point defining success for consumer brands.”

Click here to download the report.