[Startup Bharat] Indore-based Shootih is helping SMEs and MSMEs invest their idle money

Founded in 2021 by Vinita Rathi as part of software development company Systango, Shootih aims to help businesses invest their money in liquid mutual funds and other risk-free investment asset classes. The startup has over Rs 10 crore in AUMs at present.

Software development company Systango’s CEO Vinita Rathi was perplexed when she couldn’t find any solutions that could easily help her multiply the idle cash sitting in the company coffers. An ex-Goldman Sachs banker herself, she knew there was a way to make money work for her, but solutions that catered to mid-cap companies like hers were few and far between.

When she spoke to other business owners in her network, she realised she was not alone. Between payrolls, over holiday weekends, and expenses that were still several weeks away, businesses largely left cash in their accounts inactive. And even if one was actively looking for ways to invest that money, figuring out how much money there was to invest, tracking forthcoming expenses, and then finding safe instruments to invest it in was a time-consuming, manual process.

As a financier with a special interest in financial technology, Vinita decided to solve this problem by using artificial intelligence, and help businesses like hers use their idle cash to generate returns.

She set up , an online investment platform for SMEs, MSMEs, and mid-cap companies, in 2021, under Systango.

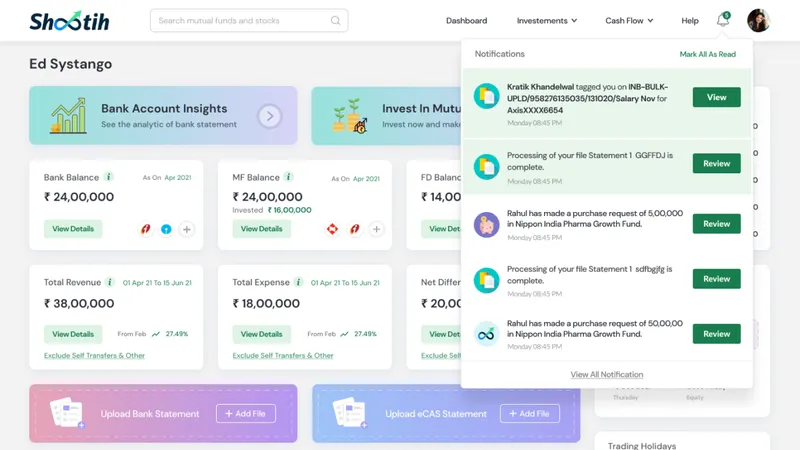

Shootih's dashboard (Image source: Shootih)

How it works?

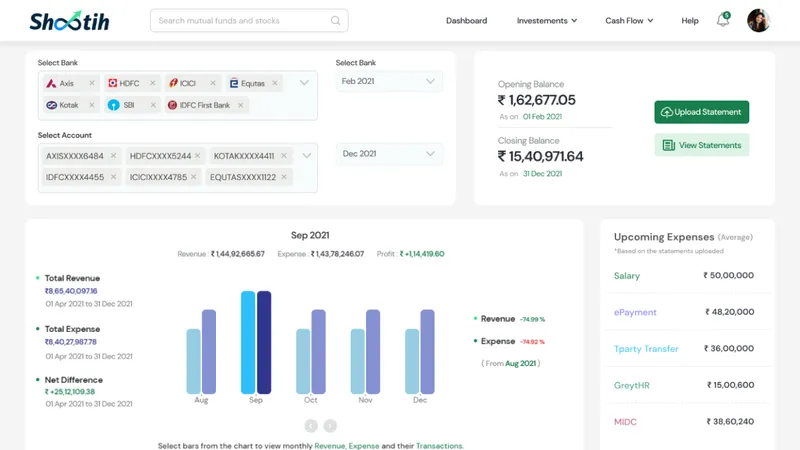

The Indore-based startup essentially helps businesses track their finances, provides business owners real-time alerts whenever they have idle cash in their accounts, and helps them invest that money in risk-free asset classes like mutual funds and money market instruments. The software foresees any long holiday weekends, big gaps between payrolls and other expenses, and alerts businesses whenever an investment opportunity presents itself — even if it’s just over the weekend.

"Our vision is to become a one-stop business wealth management platform for SMEs and MSMEs, which offers everything -- from cash flow insights to investment opportunities, access to different asset classes for quick and effortless investments, and tax-harvesting opportunities," Vinita tells YourStory.

The startup has onboarded 11 companies on the platform so far with whom it’s running a pilot project. It targets businesses in the IT and services sectors since they generally have more cash in rotation, and is currently managing Rs 10 crore in investments.

Business model

Shootih helps businesses make better financial investments based on their cash flows and future outflows — and it does this across a business’ bank accounts, giving them a 360-degree view of their monies.

Some of the features offered on the platform include:

- Alerts: Pings business owners when they have idle cash, an investment opportunity, and suggests investment options best suited to that context.

- Recommendations: Shootih gauges the investment appetite of the business and the duration the funds will be available for investment and suggests mutual funds that can be invested in.

- Aggregated view: Provides businesses a 360-degree view of their investments, as well as view transactions across bank accounts in one place.

Shootih makes money on every investment traction its platform enables for the entirety of the investment period. The startup, which launched its alpha in February this year, has generated around Rs 1 lakh in revenue.

Initial investment in the platform has been around Rs 75 lakh, supported by its sister company, Systango. The bootstrapped venture hopes to raise seed funding in July 2022.

An example of the cashflow analysis Shootih does (Image source: Shootih)

Outlook

Shootih says its total addressable market opportunity is around Rs 4 lakh crore, given that of the Rs 20 lakh crore money not invested by NBFCs, 20 percent is expected to come from SMEs and MSMEs.

Vinita says Shootih will add tax-harvesting features on the platform soon, as well as the option to invest in multiple asset classes such as fixed deposits, B2B private loans, etc.

The startup is also looking to expand to the UK next and hopes to manage around Rs 5,000 crore in investment assets.

Shootih’s competitors include , and the likes of and other online brokers that allow online investments, but not for businesses, specifically.

Edited by Megha Reddy

![[Startup Bharat] Indore-based Shootih is helping SMEs and MSMEs invest their idle money](https://images.yourstory.com/cs/2/f49f80307d7911eaa66f3b309d9a28f5/Featureimages-newdeck-1650893428365.jpg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)

![[Startup Bharat] Raipur-based Eloo is reimagining toilets for women on Indian highways](https://images.yourstory.com/cs/2/f49f80307d7911eaa66f3b309d9a28f5/Featureimages-newdeck28-1650459535607.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)