[YS Exclusive] Prem Watsa backed Digit Insurance when it was just an idea. Here’s why

In an exclusive interaction with YourStory, Prem Watsa talks about his investment in Digit Insurance and how the success of the insurtech startup is proof of a “changed India”.

Prem Watsa needs no introduction. The founder of Fairfax Financial Holdings has often been referred to as the “Canadian Warren Buffet” and is the name behind several top businesses worldwide. His investments in India include stakes in Bangalore International Airport, and Catholic Syrian Bank, among others.

But it was his investment in Indian insurtech unicorn that made heads turn when it made a whopping $1.4 billion gain after a recent share sale by the startup. When the opportunity to invest in Digit first came to him, it was nothing more than an idea.

But he still went ahead and put money into the private general insurer, making many wonder why. During a short visit to Bengaluru, Prem revealed to YourStory the logic behind the bet.

Why Digit Insurance?

Prem says he and Kamesh Goyal, Founder of Digit Insurance, were clear that digital was the way forward. “I left India in 1972, at the age of 22. And I wasn’t the only one, there were tonnes of people leaving India for the US, as they simply couldn’t get a job here. I had just finished my graduation from IIT Madras, and I couldn’t get a job… Today, the country is different, and I had started seeing that, and that is what Digit is a proof of, a changed India.”

His bet in Digit was made when the team had simply only the MVP (minimum viable product) in place. “I had known Kamesh earlier, we met in Monte Carlo in 2011… When he had the idea of Digit Insurance, Kamesh explained to me what he was planning to do. Knowing Kamesh’s expertise and knowledge of the space it was simply a no-brainer to invest in the startup,” says Prem.

He explains he always knew Digit Insurance was set to grow significantly within 10 years. “Today when you look at it, the industry grows at 20-25 percent, and Digit grows at 40 percent plus.”

Starting without a plan

While Prem was confident, Kamesh says his plan for starting up in the sector wasn’t fully fleshed out. “It is the only thing I know, insurance. It is the segment I have always operated in. So when I wanted to start something it was in this space. And the good thing is when I met Prem, he never asked for a business plan,” says Kamesh.

Prem points out that not having a concrete plan is, in fact, good. “When you are starting something, you really don’t know what will happen. Today, we have a war in Ukraine, we faced two years of a pandemic, and inflation is skyrocketing. As an entrepreneur, you need to be flexible enough to change the plans,” says Prem.

But the journey to build Digit started on a long-winding road in Germany. During a trip there, Kamesh had tried explaining to his teenage son how insurance works. “My son simply gave up after a while and said ‘It is okay Dad, I will try understanding it later’,” explains Kamesh. This made Kamesh realise how complicated insurance can be.

“I have been in insurance all my life and, yet, I wasn’t able to explain it to my own son.” And from there on, Kamesh got thinking of starting something in the space that is digital and easy enough for a layman to understand. This led to the birth of Digit Insurance in 2017.

The growth

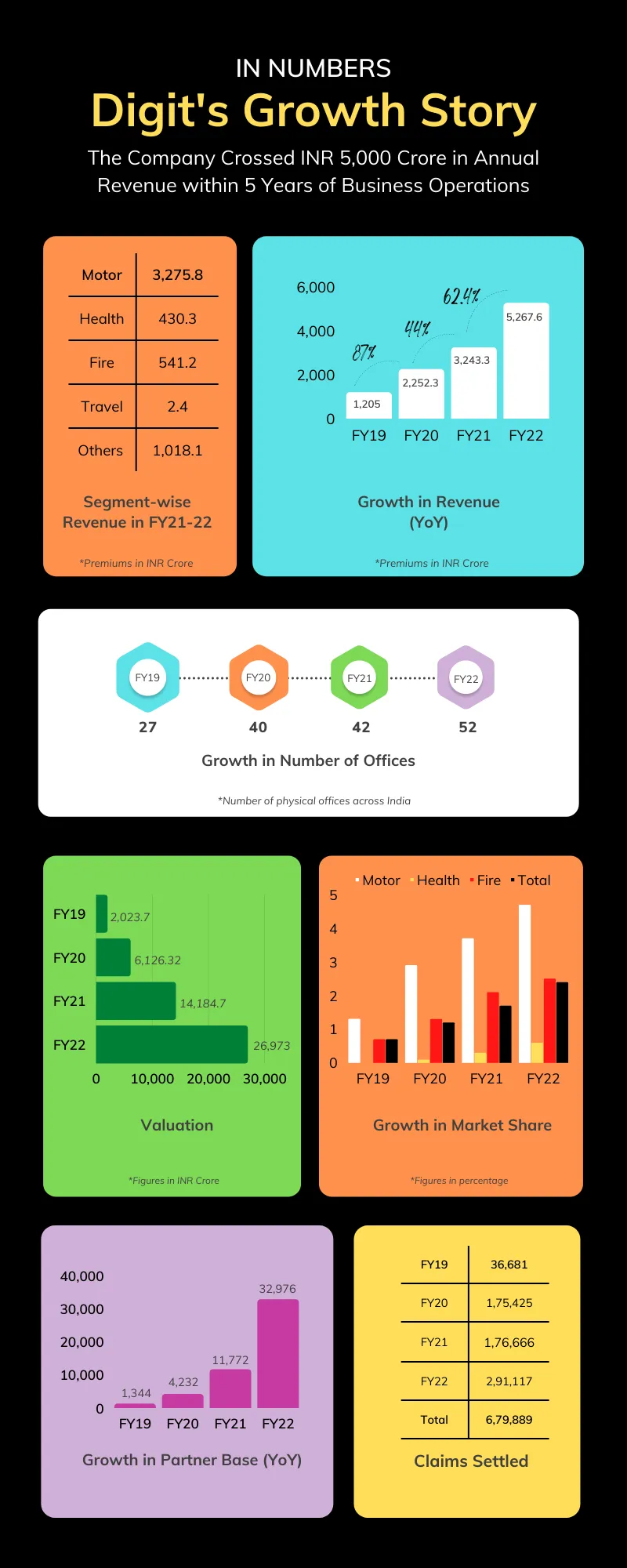

In FY 2021, Digit Insurance had gross written premiums of Rs 3,243 crore, up 44 percent from Rs 2,252 crore in FY20. For FY22, its gross written premiums were Rs 5,268 crore, a 62 percent growth from the previous year.

“The growth the company has seen is phenomenal. Kamesh wasn’t an entrepreneur before. What I saw evolving with time was him choosing really good people… he went with hiring the right talent wherever it was. The company is now competing with the big guys. ICICI Lombard, HDFC… they are competing with the big guys,” says Prem.

But the journey has had its challenges. Kamesh explains that these are growing pains that every startup and entrepreneur has to go through. He still remembers an incident in early 2018, when the team was big on two-wheeler insurance.

“Many people were buying two-wheelers, and I was in Delhi and at 11 pm, I heard that the system had simply crashed. We didn't realise what happened, but it never came up, and we don’t know even today what went wrong. Then when COVID-19 hit, our revenues went to zero. We were big on motor insurance, and now there was a lockdown. It simply meant shifting and changing gears,” says Kamesh.

The team invested in infrastructure and got in the best experts to handle the tech, and in September 2019 they had become the third-largest issuer of mobile policies, because almost all other companies were struggling with volumes. Then with COVID-19, it moved to health insurance, and the company continued its growth trajectory.

Image credit - Digit Insurance

The insurance industry in India is estimated to be worth $280 billion, reveals India Brand Equity Foundation (IBEF). However, the penetration levels of insurance across the country remain below 5 percent.

According to the Insurance Regulatory Authority of India (IRDA), the overall insurance penetration level for FY21 stood at 4.20 percent of which the life segment was 3.2 percent and non-life at just 1 percent.

Additionally, premium volumes generated by the Indian insurance sector in 2020 stood at $107.99 billion of which $81.25 billion came from life insurance and non-life was $26.74 billion.

Kamesh says the future for the general insurance segment looks bright with annual growth of 11-12 percent.

Competition and future

However, he adds that in the short term, competition is going to be intense. Other startups in the sector include ACKO Insurance, Coverfox Insurance, and PolicyBazaar.

Kamesh believes Digit still stands out with its focus on the product. Advising entrepreneurs he says,

“Build the company to keep, not to sell.”

Prem chips in by saying that entrepreneurs should do something that they are always passionate about. “It shouldn’t be about the money, you have to do it because you're passionate about it, this is what you want to do, as you will have to work extremely hard and you will have a lot of challenges.”

At the same time, flexibility is important. “Be flexible. There will be challenges, and you have to be able to move and have a view that you're going to survive it and you're going to be smart about it and you're going to move forward.”

Edited by Jarshad NK

![[YS Exclusive] Prem Watsa backed Digit Insurance when it was just an idea. Here’s why](https://images.yourstory.com/cs/2/a9efa9c02dd911e9adc52d913c55075e/DigitInsurance-1652082796280.jpeg?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)