Kabaddi on blockchain

Sportzchain, a blockchain startup aims to “empower” fans of kabaddi so that they engage actively with the team of their choice and participate in team decisions using tokens (crypto assets).

This week, one funding deal lifted the spirits of the startup ecosystem. After a paltry $111 million raised last week, Indian startups grabbed nearly $300 million, boosted by upGrad closing a round worth $210 million.

Meanwhile, Life Insurance Corporation of India (LIC) reported a multi-fold increase in consolidated net profit for the quarter ended June 30. The insurance company recorded Rs 602.78 crore profit in April-June, compared with Rs 24.36 crore during the same period last year.

In other news, an Indian man won a 22-year-old legal battle in a consumer court case against the Railways. The plaintiff, Tungnath Chaturvedi, had been charged Rs 20 extra for two train tickets in 1999 in Mathura. After the clerk did not offer a refund despite his complaint, he decided to file a case against the railway authorities, as well as the booking clerk.

Now, “more than 100 hearings later”, the consumer court ruled in Chaturvedi’s favour last week. It ordered the Railways to not only refund the Rs 20, at an interest of 12% per year from 1999 to 2022, but also pay him a fine of Rs 15,000 rupees.

Oh, and here’s a video of an intoxicated bear high on “mad honey” to start your extended weekend.

Time to get beared up!

Kabaddi on blockchain

What if instead of cheering a game of kabaddi from the sidelines, you could influence your favourite team’s gameplay?

Enter , a blockchain startup that aims to “empower” fans of kabaddi so that they engage actively with the team of their choice and participate in team decisions using tokens (crypto assets).

Hu tu tu:

- The fan engagement platform is built on , an infrastructure provider.

- The polls take place on the Ethereum and Polygon blockchain platforms. The votes are stored on a blockchain, thus eliminating voting bias and the possibility of rigging.

- The Sportzchain platform currently has 1,200 sign-ups from users for its alpha application and is hoping for 10K sign-ups in September.

Using ML to track emotions

Ever been asked a question in a meeting that you couldn’t answer because you weren’t paying attention? Well, one startup has made it its mission to help companies track users’ engagement levels.

uses machine learning (ML) models to detect the emotions of participants in video conferences or when they are consuming content. These are shared in real-time with admins (or the meeting host) to evaluate the engagement and interest of participants.

Pay attention:

- The Mumbai-headquartered startup’s technology looks at human faces and maps emotions—such as joy, anger, sadness—and engagement levels.

- Its base unit of analysis is a face frame, which it captures by taking screenshots and analysing faces in those screenshots.

- The startup says its accuracy ranges from 70% to 85% across different emotions depending on factors such as resolution and clarity of the image, and lighting conditions.

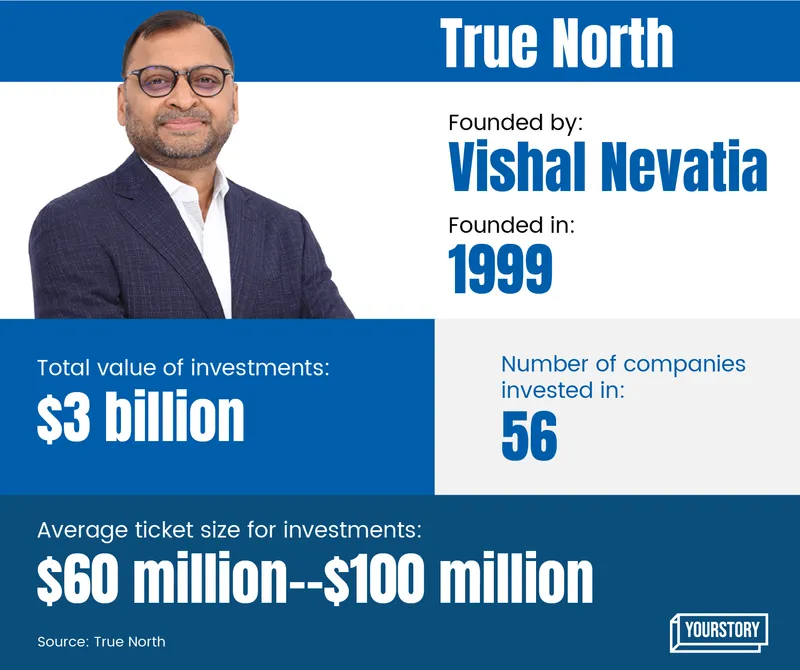

True North’s next startup bets

Indian private equity funds, which typically don't back startups, are on an active hunt to find the next big bet, investing in businesses that have proved their market value.

Mumbai-based True North is one of these PE firms.

Founded in 1999, mostly invests in mid-sized, India-focussed businesses across four sectors: healthcare, financial services, consumer, and technology. It has invested around $3 billion across six funds so far.

Writing cheques:

- True North’s first venture in the startup space, in terms of investment, was PolicyBazaar in 2017, where it invested around $50 million in total funding.

- It has so far made 61 investments across 56 companies, including Keya Foods, Fincare, ACT Fibrenet, Biocon Biologics, and Manipal Hospitals.

- The firm is now putting together a seventh investment fund, 25% of which it has allocated to investing in tech-driven, late-stage and pre-IPO startups.

(Design credit: Aditya Ranade, Team YourStory Design) =

Now get the Daily Capsule in your inbox. Subscribe to our newsletter today!