Inside PE firm True North’s investments in late-stage Indian startups

The Mumbai-based private equity firm typically invests in mid-sized companies. But it has now set its sights on domestic startups, particularly those heading to a public share listing.

’s initial public offering in 2021 was a defining moment for Indian startups as the first internet-tech company to make a stock market bid. Since then, a number of late-stage startups have made a beeline for public markets.

Proportionately, interest in late-stage startups and pre-IPO deals has seen an uptick, and, after a two-year decline, private equity firms are finally returning to the ecosystem.

Global PE firms such as Blackstone, KKR, Carlyle and TPG have always actively invested in mid- to late-stage, and even some promising early-stage, startups. But in the Indian diaspora, PE funds have historically kept away.

With bigger startups finally getting their public market listing plans in place, Indian PE funds are on an active hunt to find the next big bet, investing in businesses that have proved their market values.

Mumbai-based is one such PE firm.

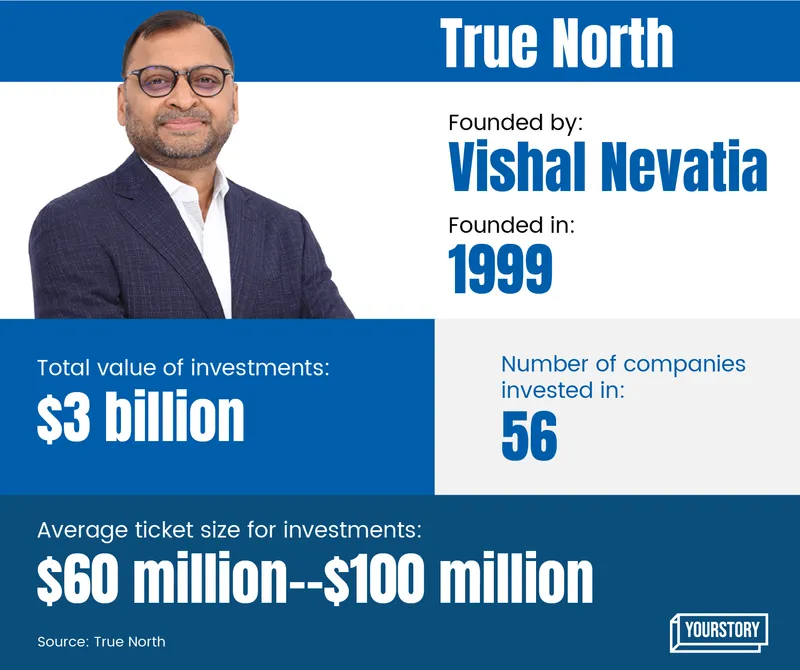

Founded in 1999, True North mostly invests in mid-sized, India-focussed businesses across four sectors: healthcare, financial services, consumer, and technology. It has invested around $3 billion across six funds so far.

Its first venture into the startup space, in terms of investment, was in 2017, where it invested around $50 million in total funding. It sold a part of its stake in the insurance aggregator in 2021, but not before setting up the company for an initial public offering.

To deepen its stake in the startup ecosystem, True North is putting together a seventh investment fund, 25% of which it has allocated to investing in tech-driven, late-stage and pre-IPO startups.

Specifically, the firm wants to invest in healthtech, fintech, consumer tech and other digital technology ventures, Maninder Singh Juneja, a partner at True North Co, tells YourStory, adding that the firm is also exploring the personal care, and meat and seafood sectors for potential investments.

Without naming any names, Maninder said the firm is already in talks with potential investment companies, and has reached late-stage discussions with a few.

But True North is not your typical investment firm.

For starters, its investment evaluation criteria are quite different from the kind seen in the startup ecosystem, where the founder is everything—even the product.

Most late-stage investors tend to focus less on the founder and their teams, and more on business fundamentals—and so it is at True North, which says it’s laser-focussed on investing in pre-IPO/post-growth-stage ventures.

True North’s investment criteria

Maninder says for True North to get interested in a company, it has to be a late-growth stage—maybe a Series E or a Series F—venture.

More important than the stage of funding is the market size a startup’s targeting, its current value proposition, and what value proposition it is trying to attain.

"In our minds, they should have the core model in place. Some things may change, but at least that core model shouldn’t be undefined," Maninder says.

(Design credit: Aditya Ranade, Team YourStory Design)

Other values True North considers include execution strategy—how well the startup is able to fulfil what it has set out to do; the expertise deployed and the processes devised by the leadership to address the needs of the sector; how the startup is different from its competition; where it’s positioned in the market; and the impact potential of the venture.

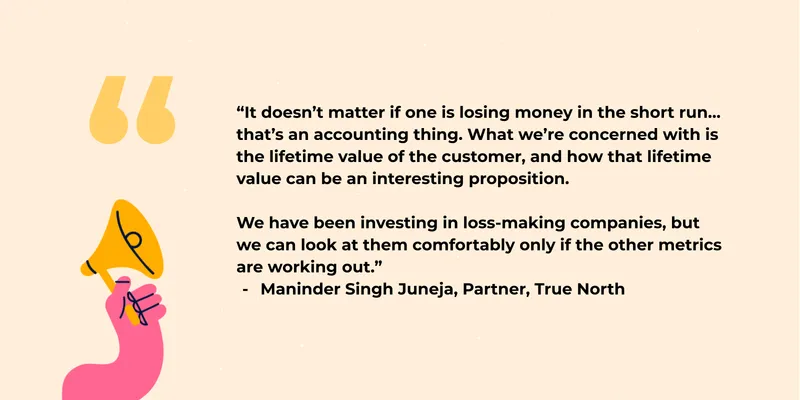

Apart from the fundamentals of the business and its revenue model, True North also looks at profitability metrics closely.

In fact, over the last few months as a funding winter descends on the ecosystem, funds smaller than True North—ones that typically invest in early or growth-stage ventures—have been asking founders to map out their paths to profitability, or at least show positive unit economics, which didn’t happen a lot earlier.

Asked if the recent funding recession had changed anything substantially for how the PE firm approaches investments, Maninder says bottom lines were always something True North had focussed on, even before the ‘winter’.

But absolute profitability isn’t a criterion.

Earlier, the PE firm used to seek companies that had the potential to turn profitable within 4-5 years of the initial investment. Now, though, parameters such as digital sourcing, how easily a company benefits from automation, and the channels customers are coming up (i.e., paid versus unpaid traffic) are the ones that hold more weight.

True North’s typical investment horizon is 5-10 years.

Cash is king

With global markets under pressure, private investments have taken a hit.

Over the past few months, startups have been struggling to secure funding and are laying off employees to cut costs and extend their runway.

Investors have also been sounding the foghorn for their portfolio companies.

US-based investment firm Y Combinator has advised its portfolio companies—the likes of , , and —to ‘plan for the worst’, while Sequoia Capital has said that the current times are a ‘crucible’ moment.

“We do not believe that this is going to be another steep correction followed by an equally swift V-shaped recovery like we saw at the outset of the pandemic,” Sequoia said in a 52-slide presentation.

The message across the board has been “brace yourselves”.

To stay afloat and weather this economic turbulence, startups need to become more nimble and keep a very close eye on their cash reserves, Maninder advises.

In fact, if a company were to find itself in dire straits, he espouses fundraising even if at a lower valuation.

"There are always ways to raise valuations later if your business proposition is solid. Perceptively, there’s no right or wrong way to do this. Businesses have to make decisions which are most appropriate to the times they are in," he says.

True North has so far made 61 investments across 56 companies, including Keya Foods, Fincare, ACT Fibrenet, Biocon Biologics, and Manipal Hospitals.

Edited by Feroze Jamal