MobiKwik raises more debt, tweaks ESOP policy amid IPO delay

The digital payment provider has been raising small amounts in debt since the last few months in contrast with its reported plans to raise $100 million in equity as a run-up to public listing

Following reports of ’s plan to raise $100 million in equity, the IPO-bound digital payment provider has been raising small amounts of debt in tranches. The company has also made changes to its ESOP (employee stock ownership plan).

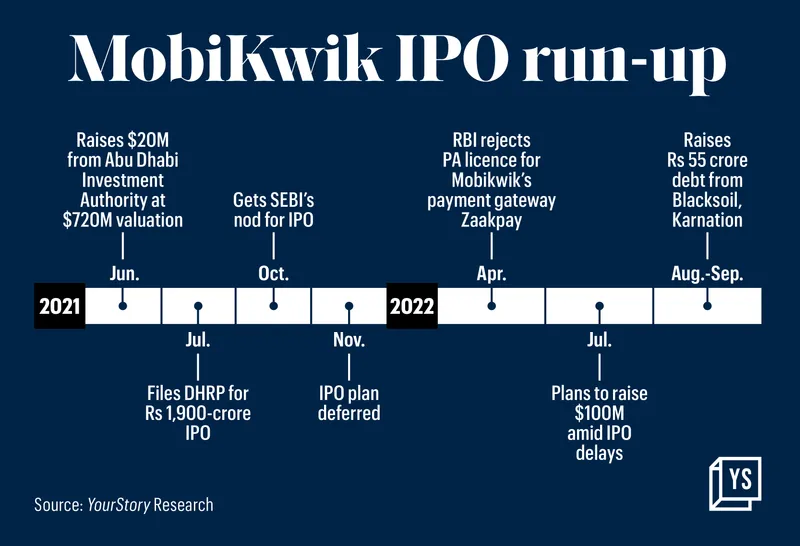

According to two separate RoC (Registrar of Companies) filings, MobiKwik has raised a total debt of Rs 55 crore since August from BlackSoil and Bengaluru-based Alternative Investment Fund, Karnation.

The board at MobiKwik had passed a resolution to allot 900 non-convertible debentures (NCD), in two separate tranches of 700 and 200, respectively, at an issue price of Rs 5,00,000 each to raise Rs 35 crore and Rs 10 crore from BlackSoil.

In response to YourStory's queries on this development, Mobikwik spokesperson said, "We ended FY22 with strong topline growth and two profitable quarters. So far in FY23, we are tracking at breakeven EBIDTA and a low cash burn. Therefore, we do not see a reason to raise large amounts of capital. Raising less in current climate means lesser dilution thereby, creating more value for our investors when we go public. We recorded 80% growth last financial year and should register double-digit growth in FY23 as well."

In September, 200 NCDs at a face value of Rs 10,00,000 each aggregating to Rs 10 crore were issued by Karnation, a SEBI-Registered CAT-II Alternative Investment Fund.

The debt raise comes almost 14 months after its last equity fundraise, in June 2021, from Abu Dhabi Investment Authority, which had valued the fintech company at $720-750 million.

Earlier, The Economic Times reported saying that the company was struggling to find foreign institutional backers at the right valuation amid growing skepticism around fintech business models. Sources aware of the discussions said the fintech firm has been advised to not go ahead with its IPO as it may be hard to find enough demand from institutional investors—foreign and domestic, it said.

MobiKwik received the market regulator’s approval to float a Rs 1,900 crore ($255 million) initial public offering (IPO) in October last year. Of this, a fresh issue will be for Rs 1,500 crore, and the remaining Rs 400 crore will be an offer for sale by existing shareholders. The 11-year-old startup counts Sequoia Capital India, Bajaj Finance, American Express, Cisco, and Abu Dhabi Investment Authority among its investors.

Following a deferred IPO in November 2021, reports about the company being in talks with investors to raise $100 million to expand its business surfaced in June 2022. Co-founder Upasna Taku had told Bloomberg that the “company still plans to launch an IPO, but at a more opportune time. For now, it will deploy the fresh funding for marketing, hiring people and making acquisitions”.

As per sources, MobiKwik has been eyeing an IPO valuation between $1.5 billion to $1.7 billion, and has been deferring its plan to go public since last year due to a lack of investors interest as well as concerns following the disappointing public listing by Paytm and other startups.

"As is evident from recent Indian startups' IPO market performance, a poorly timed one can be difficult to overcome, so we are looking to maximise the value for all our stakeholders - investors, employees and customers alike, and will file for an IPO when we reckon market conditions are favourable," MobiKwik spokesperson added.

ESOP tweaked

As per the RoC filings, MobiKwik has tweaked its ESOP, extending the time frame within which employees can exercise the options in the event of their termination or resignation, in case the company gets listed.

The resolution was passed during the Annual General Meeting held on September 28, to amend one of the clauses of ‘MobiKwik ESOP 2014’ that determined the specified period of time within which the employees can exercise the options in the event of termination or resignation.

As per the existing rule, an employee can exercise the options within three months from the last day of his/her employment, in case of voluntary resignation. The condition could be waived by the NRC at its discretion based on certain criteria.

As per the new rule, this period has been extended to six months, in case the company gets listed. “In case the vested options are not exercised within the aforesaid time period, then they shall lapse”.

On the other hand, in case the company is unlisted, i.e the current scenario, the period has been extended to three years, which means an employee can exercise the options within three years from the last day of employment of the option guarantee; or six months from the date of listing, whichever is earlier.

“The NRC and the board of directors are of the view that the criteria for exercising the vested option by the employees who have voluntarily resigned needs to be reasonably framed in the best interest of the option holders. Further, considering that the company is the process of listing, it is desirable to classify the exercise period in case of voluntary resignation (other than due to cause) broadly under 2 scenarios—i.e. listed and unlisted, in order to cater for the unlisted scenario,” the filings read.

Several of the employees are expected to cash-in on the IPO via exercise of options with the fintech reserving 4.5 million equity shares or 7% of its equity for its ESOPs in the impending public issue.

The company had said that seven of its employees had stock options worth more than Rs 10 crore, and 31 have more than Rs 1 crore each. It also said that 118 employees, or one-fourth of the total, have seen their stock options cross Rs 10 lakh in value.

The board also passed a resolution to re-appoint the co-founder and CEO of the payments business, Chandan Joshi, as the director of the company. He was elevated as the third co-founder in 2020, in addition to Bipin Preet Singh and Upasana.

(The copy was updated to add a new image and response from MobiKwik spokesperson)

Edited by Affirunisa Kankudti