BYJU'S, PharmEasy among Prosus’s ‘underperformers’ in India portfolio

Prosus earned profitable returns from other Indian firms, including Swiggy (7%), Eruditus (22%), PayU India (30%), Meesho (32%) and Elastic Run (31%).

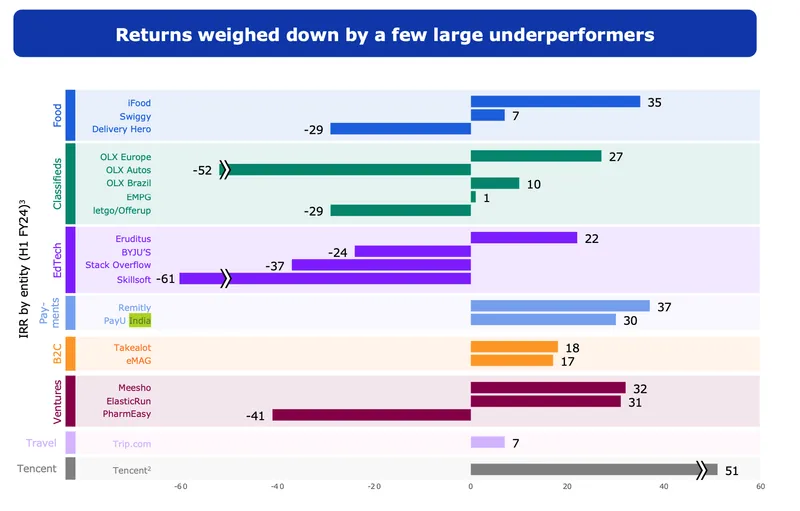

Edtech firm and healthtech startup were among the biggest 'underperformers' in Prosus’s India portfolio, hitting the Netherlands-based investment major’s internal rate of return (IRR) in the first half of 2024.

According to the company’s presentation, Prosus reported a significant fall in its IRR across its portfolio, at 5% in the first half of FY24, compared with 18% in the first half of FY22, because of a few large underperformers.

Prosus said its IRR for BYJU'S stood at -24% while for PharmEasy, it was at -41%.

Meanwhile, Prosus earned profitable returns from its other Indian portfolio firms, including (7%), (22%), India (30%), (32%) and (31%).

Valuation markdowns

Further, the firm marked down the valuation of the underperformers, starting with BYJU'S to less than $3 billion, a senior Prosus executive said, during a post-earnings call with reporters. In November last year, Prosus first slashed the fair value of BYJU'S to $5.97 billion from its peak valuation of $22 billion in October 2022 when it raised $250 million.

“We have written it (BYJU'S) by a further $315 million. We do that from time to time. It does not reflect our long-term view of the business. It reflects current trading circumstances,” he said.

Prosus has invested $536 million in the edtech startup since 2018.

PharmEasy was marked down to half from $5.6 billion.

“Another is a write down in PharmEasy of about $118 million, and that's really driven by the need for Pharmeasy to raise money to settle debt. We actually participated in that round which expresses our confidence in the business going forward,” the spokesperson said.

“PharmEasy is still an early-stage business in India, a market that is ripe for tech startups, and we have conviction that Pharmeasy will become more valuable as it executes on its strategy, which has been refocused on the B2B operations and profitability," he added.

Edited by Affirunisa Kankudti