Can Ola Maps plot its way to success on Google's turf?

Last month, Ola took a new turn with the launch of Ola Maps, spurring a price war of sorts. Short-term impact apart, can the company make a big dent in the navigation tech space and challenge Google’s dominance in the long run?

“It’s time to #ExitGoogleMaps. Switch to OlaMaps,” reads the banner on the landing page of Ola Maps’ website.

This audacious proclamation comes as no surprise given that Ola’s founder Bhavish Aggarwal has been–for a while now–urging Indian developers to build their applications and shift from Google Maps, the dominant player in the ecosystem.

Not just that.

Aggarwal has also been dangling many financial incentives for developers to use 's navigation tech platform–including a year’s free access to Ola Maps and free credits of over Rs 100 crore.

To walk the talk, the startup has completely shifted all its business units, including ride-hiding and electric vehicles, from the Google Maps platform to its in-house navigation platform built on the company’s Krutrim Cloud.

Ola, which spent a whopping Rs 100 crore every year on Google Maps’ services, claims to have cut down expenses on licensing and services to zero–thanks to its in-built Ola Maps, launched in July.

Establishing an Indian-origin navigation system isn’t the first attempt by Aggarwal to ‘Indianise’ Ola's business units and take on global giants. In May, the -backed firm migrated its workload from Azure–a cloud computing platform from software major Microsoft–to its own Krutrim cloud.

Ola’s exit from Azure could cost Microsoft from Rs 5-25 lakh every day, while switching from AWS might lead to losses of Rs 30-40 lakh for Amazon, according to a now-deleted social media post by Aggarwal, a vocal advocate of indigenous tech.

Focus on navigation tech

Now Aggarwal’s attention has moved to navigation tech as he strives to tackle the distinct challenges on Indian roads–by enhancing navigation in crowded areas, adding regional language support, and using India-specific algorithms.

“We’ve been using Western apps to map India for too long and they don’t get our unique challenges: Street names, urban changes, complex traffic, non-standard roads, etc. Ola Maps tackles these with AI-powered India-specific algorithms, real-time data from millions of vehicles, leveraging and contributing massively to open source,” said Aggarwal on X.

He also claimed that Ola has made five million updates to enhance the accuracy of its mapping solution.

Soon after Ola’s #ExitGoogleMaps campaign, Google invested in Moving Tech Innovations Ltd, the parent company of mobility apps Namma Yatri and Yatri Sathi, in a $11-million funding round led by Blume Ventures and Antler.

Google has also introduced India-specific pricing for maps, slashing prices by 70% on most APIs and accepting payments in Indian rupees. The tech giant is also collaborating with the Open Network for Digital Commerce (ONDC) to offer developers building for ONDC up to 90% off on select Google Maps platform APIs.

In response, Aggarwal took to X to announce a price cut of 50% of Google Maps’ reduced rates and a freemium model for ONDC-based small and medium-sized businesses. He also announced five million free API calls a month for Indian developers and startups. An API call lets developers integrate Ola Maps’ features into their apps.

Besides spurring a price war, can Ola’s desi answer to mapping woes woo Indian developers and businesses onto its platform? YourStory does a deep dive.

Challenging Google: A marathon, not a sprint

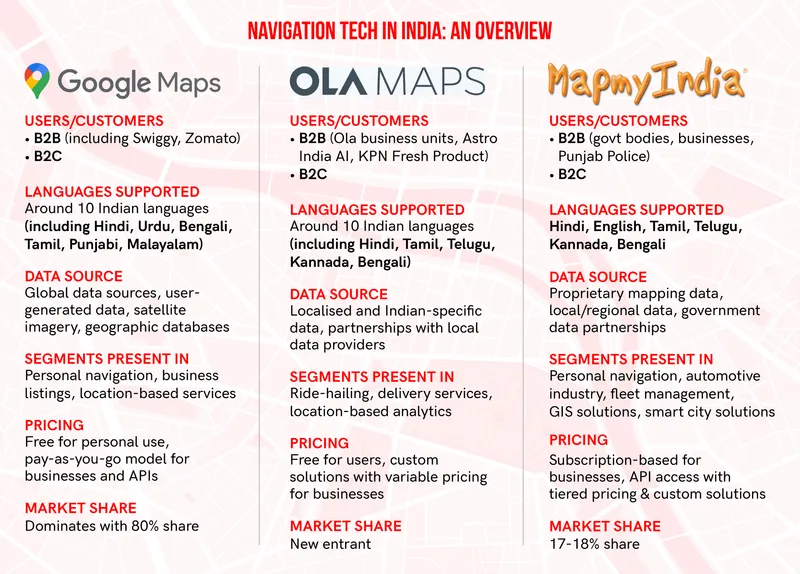

The navigation technology sector in India is not an unchartered territory. Apart from , , , Dutch-based HERE Technologies, and OpenStreetMap are some of the other players vying for a piece of the same pie.

Ashutosh Sharma, VP & Research Director at , says that Google dominates the maps market in India with a nearly 80% share, followed by MapMyIndia with 17-18%. The rest is split between OpenStreetMap and other providers.

Standing up to a big tech company like Google will not be an easy task–for Google Maps has been navigating the choppy terrains of the country since 2008.

For nearly a decade, Google Maps has been using artificial intelligence (AI) to map millions of kilometres of roads and over 300 million buildings in India. It processes over 50 million searches and provides directions for 2.5 billion kilometres each day.

Sharma opines that taking on Google in the mapping game is not a quick sprint.

“Mapping is a very intensive business. You just can’t create a great mapping service in a very short amount of time unless you put in a huge amount of meticulous effort,” he says.

According to Sharma’s estimate, Google has around 30,000 B2B customers in India, including large players such as Swiggy and Zomato.

Google has been in the business for more than 20 years now globally. “I cannot say that Ola Maps will quickly get there. They still have a lot of work to do to build it out,” he adds.

However, Shivani Palepu, Principal Analyst, Gartner, is more optimistic about Ola’s chances.

“Ola can gain market potential and give competition to Google and other players due to a deep understanding of the Indian context–by understanding Indian cities, traffic patterns, roads, networks, local landmarks, and so on,” she says.

The Indian government’s Make-in-India thrust can also give Ola the impetus it needs.

“With the government saying we have to do something on our own, it could bring in a lot of strength to Ola’s marketing strategy,” she adds.

Mapping the navigation tech market in India; Design: Nihar Apte

Tackling other competitors

MapmyIndia is another serious contender in the mapping and navigation business. The Delhi-based company, which was founded in 1995 by Rakesh Kumar Verma and Rashmi Verma, has a good presence in the government sector, enterprise solutions, and the automotive industry. It is well known for its data accuracy and robust coverage across urban and rural areas in India.

MapmyIndia has teamed up with various government bodies to boost its mapping tech. Last year, it joined forces with Punjab Police to roll out the Mappls app to deliver real-time traffic updates and safety alerts to commuters in the state.

And then there is Dutch mapping provider HERE Technologies, which launched WeGo, a web mapping and navigation software, in 2020. It has partnered with SMEs in automotive, transportation, and logistics for delivery and route optimisation.

Whichever way one dissects it, B2B remains the stronghold of most navigation tech players.

So, where can Ola find an opening?

Opportunities for Ola

Google Maps is deeply rooted in major cities such as Delhi, Mumbai, Bengaluru, and Hyderabad. Thus, it could be tough for many customers to make a switch in these cities, notes Palepu.

While targeting the consumer market may not offer quick returns, focusing on a B2B strategy in Tier II and III cities could be a game-changer for Ola, which can offer businesses a localised, cost-effective option, she adds.

Pricing will be the deal breaker for small and medium enterprises, opine industry experts.

“For instance, WeGo introduced a freemium model in India to make it easier for developers to access high quality location data. Companies who are competitors to Google in the global space take pricing as a big strategy, because that’s where these smaller startups can actually benefit,” explains Palepu.

Ola could create a new market by offering a single app for various transportation modes, Palepu suggests–similar to how European mobility player Tier integrates e-scooters with Google Maps in Europe.

Google Maps has also partnered with ElectricPe in Bengaluru, allowing users to access information on EV charging points' availability and status in real time.

“Google offers extremely accurate real-time information to customers during a journey. Through this partnership, EV users can plan all journeys well in advance,” says Avinash Sharma, Co-founder and CEO, ElectricPe.

“Offering essential discovery solutions like maps at a lower price provides significant and direct benefits to the end customer as it improves accessibility and offers better pricing,” he adds.

Vaibhav Khandelwal, CTO and Co-founder of logistics provider , uses Google Maps for some of his startup’s operations.

“We appreciate the real-time traffic data that Google Maps provides. Given that open source solutions are set up in our infrastructure, they provide lower latencies and allow us to run more complex logistics,” Khadelwal notes.

“However, it is still expensive for businesses in our sector,” he adds.

Interestingly, Shadowfax has a built-in system SFMaps—an AI tool that improves delivery accuracy by simplifying complex address data from over 1 billion past deliveries to make deliveries efficient.

Commenting on paying customers, Forrester's Sharma makes a pertinent observation.

“Of the 30,000 customers (of Google), how many are really paying customers? The majority of them tend to be small stores that have put themselves on Google Maps just to be located,” he points out.

If Ola can offer a competitive alternative that goes beyond mere presence, it could create an impact. The future of navigation calls for solving the day-to-day problems of businesses and charging them for the same.

Ola Maps’ launch comes at a time when many logistics players and aggregators in the country are grappling with difficulties in service and delivery. Inconsistent address formats, unclear pin codes, and regional language issues are some of the challenges that Ola, as an Indian solutions provider, can try to solve.

Traction so far

Though it is still early days, with Ola Maps just about a month old, the company has managed to create a tiny buzz in the navigation market.

In its early days, Ola partnered with ISRO’s IRNSS (Indian Regional Navigation Satellite System) programme to provide accurate GPS data, said sources familiar with the matter. Astro India AI, an AI-powered astrology platform, and KPN Fresh Product, a Chennai-based e-grocery delivery app, have also tapped into Ola Maps for their services.

Lawsuit from MapmyIndia

Meanwhile, amidst all the action in mapping tech, CE Info Systems–the parent company of MapmyIndia–has slammed a lawsuit on Ola Electric, accusing it of data theft.

MapmyIndia has alleged that Ola cached and stored its proprietary data, resulting in an unauthorised merging and reverse engineering of its licensed technology. This reportedly breaches the terms of their 2021 contract, Forbes reported.

In 2015, Ola forged a multi-year licence partnership with MapmyIndia for access to its mapping data.

Aggarwal responded by calling MapmyIndia’s move “opportunistic”.

“It is opportunistic of them (MapMyIndia). There are opportunistic players everywhere … Such behaviour is widespread across the industry. We will respond to them at the right time," said Aggarwal, during a press briefing.

Rohan Verma, CEO of MapmyIndia, declined to comment when YourStory reached out to him with queries on the issue. Ola Electric also declined to comment.

Long road ahead

Aggarwal, who seems to be a man in a hurry, certainly has his work cut out. Besides dealing with the lawsuit, he also has to ensure that his decision for Ola to enter the navigation business was the right move at the right time.

This means tackling a tough consumer market, boosting Ola Maps’ features to attract B2B clients, and carving its own niche in a market dominated by Google. While the freemium model appears promising, winning over developers and startups cannot happen overnight.

At the moment, Ola has a lot on its plate, with Ola Electric going public and other business units looking to up the ante.

While the company–under Aggarwal’s bold leadership–may nurture a large appetite, has it bitten off more than it can chew? Is Ola Maps a valuable addition, a risky bet, or an over-ambitious move? Time will tell.

(Disclaimer: Shradha Sharma, Founder and CEO of YourStory, is an independent director in Ola Electric.)

(The copy was updated with an infographic.)

Edited by Swetha Kannan