Espresso: Zomato's listing day, and Intrinsic by Alphabet

Your daily dose of news in business and technology.

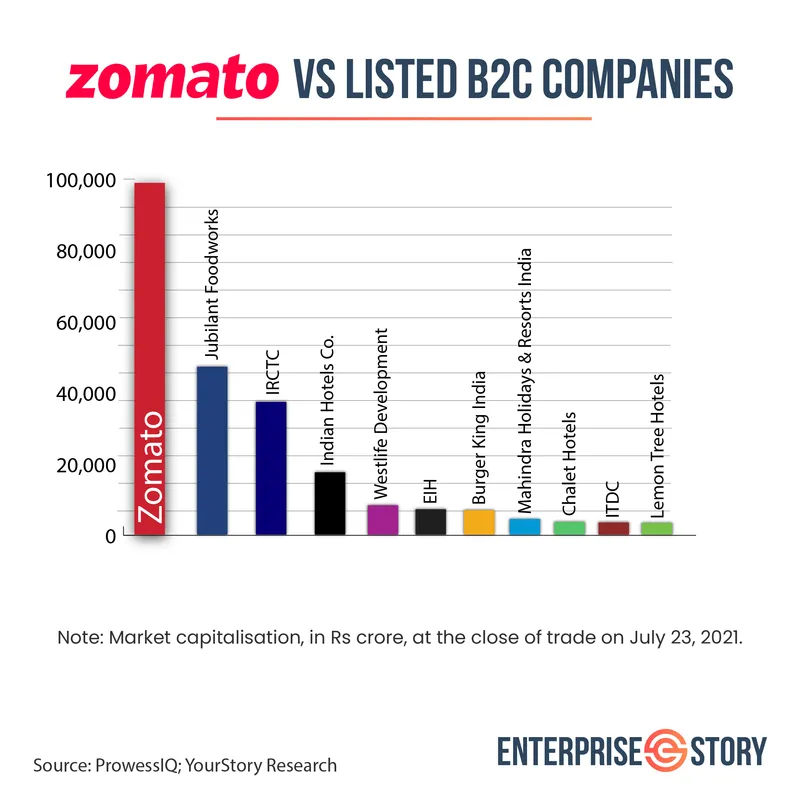

Zomato’s m-cap crosses Rs 1 lakh-crore on debut

The Rs 9,375-crore initial public offering (IPO) of food-tech unicorn Zomato tapped the market between July 14 and 16, witnessing oversubscription by over 38 times. Well, Zomato got listed yesterday.

While Zomato allotted shares at Rs 76 per share—the upper end of the Rs 72-76 price band—it debuted on the Bombay Stock Exchange (BSE) at Rs 116 a share. It marked a premium of 51.3 percent to the issue price. At the day’s high of Rs 138, the premium to issue price shot up to 81.6 percent, when the market capitalisation (m-cap) soared above Rs 1.08 lakh-crore.

At the close of Friday’s trade, at Rs 125.85 per share, Zomato’s premium to issue price stood at 65.6 percent.

Its closing m-cap of Rs 98,372 crore made Zomato the 39th-most valued company—ahead of India Inc bigwigs like Tata Motors (Rs 98,165 crore), Mahindra & Mahindra (Rs 94,961 crore), and Britannia Industries (Rs 82,850 crore).

Compared to other listed B2C companies, Zomato's m-cap accounted for close to 99.4 percent of the total m-cap of its peers. Individually, it was more than two times the m-cap of Jubilant Foodworks (Rs 47,107 crore), 2.6 times IRCTC (Rs 37,214 crore), and 12 times Westlife Development (Rs 8,211 crore).

Alphabet unveils robotics software company

Alphabet, the parent company of Google, will launch a software company called Intrinsic to tap “the creative and economic potential of industrial robotics” for businesses.

It will be launched under its semi-secret R&D facility X, the moonshot factory. Intrinsic will focus on improving the efficiency and flexibility of industrial robots that are used in manufacturing.

The project has been underway for more than five years at “the moonshot factory’s rapid prototyping environment,” said Wendy Tan-White, CEO of Intrinsic, in a blogpost. It is “ready to become an independent Alphabet company,” she added.

Persistent Systems’ Q1 profits up 9.8 percent

Persistent Systems reported a consolidated net profit of Rs 151.3 crore in the quarter ended June 30, 2021, up 9.8 percent compared to Rs 137.8 crore in the previous quarter, according to a stock exchange filing.

The net profit for the first quarter of the current fiscal was 68 percent higher on a year-on-year basis. Persistent Systems’ revenue from operations increased 10.5 percent to Rs 1,230 crore in the June 2021 quarter.

“We won several large digital engineering and enterprise modernisation deals,” said Sandeep Kalra, CEO and Executive Director of Persistent Systems. “These deals reinforce the differentiated value we deliver to both technology companies and enterprise clients,” he added.

JK Cement steps up digital quotient

JK Cement digitised its entire value chain in the past year, including the introduction of blockchain in smart contracting, according to its latest annual report.

The company grew revenue by 15 percent in the 2020-21 fiscal year to Rs 6,233 crore, with net profit of Rs 602.8 crore.

Its applications includes eSourcing and supplier lifecycle management, digitising the sales function through an omni-channel approach, and enabling e-visits to customers during the pandemic.

JK Cement has applied technology to optimise logistics, in-plant operations using RFID, and enabled track-and-trace in real time through a GPS-enabled application.

Nachiket Pantvaidya is Balaji Telefilms CEO

Entertainment company Balaji Telefilms appointed Nachiket Pantvaidya as the Group CEO. He was previously Managing Director of Asianet News Media and Entertainment.

“It’s a homecoming for me with Ekta (Ekta Kapoor) and team, however with a larger mandate now,” said Nachiket Pantvaidya, Group CEO of Balaji Telefilms. He had left Balaji Telefilms in March 2021 as its Group COO, and CEO of the company’s subsidiary ALTBalaji.

SBI Cards and Payment Services' results

SBI Cards and Payments Services reported a net profit of Rs 305 crore, up 74 percent on a quarterly basis. Last quarter, the company reported a profit of Rs 175 crore.

However, the net profit was 22.5 percent lower than the Rs 393 crore a year ago. The fall was attributed to a rise in the company’s bad loans, which increased 33 percent to Rs 645 crore from Rs 485 crore in the same quarter last year.

The company’s total income stood at Rs 2,451 crore, up by 11.6 percent compared to Rs 2,196 crore in the same quarter last year. It was marginally (0.7 percent) lower than the previous quarter.

Edited by Kunal Talgeri