Succession Certificate- 12 Important Points to note

1. What is Succession Certificate?

A Succession Certificate establishes who the legal heirs are and the authenticity of the successor. It is a Certificate given to the successor of a deceased person who dies without leaving a will. The list of debts, securities and assets of the deceased is mentioned. It indicates the relation of the petitioner with the deceased. Along with providing details of other surviving legal heirs and that the deceased died intestate. And the information about the time, date and place of death of the deceased. It means that the certificate holder has authority over the deceased person’s assets of the deceased. The assets may include Insurance, Mutual Funds, Pension (in Employees Provident Fund or otherwise), Retirement Benefits or any other service benefits. In other words, it helps the grantee or the receiver, to recover the debts due to the deceased person.

In the absence of a will, this is the primary certificate through which the heirs can stake a claim to the assets of a deceased relative.

Moreover, it protects the payer that the debt released by him has gone to a certified person.

The successor would receive assets as well as inherit any debts/loans to be paid, as per the Indian Succession Act, 1925. The governing Sections are 380, 381 & 382.

2. Intestate

The Legal Term, for when a person has died, without making a legally valid will. Intestate may be the entire assets or some particular ones only. In other words, intestacy is either total or partial.

Total intestacy is when the deceased has not named any beneficiary to any of his property. In other words, the will wasn't made or doesn't exist.

Partial intestacy is where the deceased effectively disposes of some of the beneficial interest in his property by will. But not all.

Key Elements:

- If the deceased has left no will. He has died intestate in respect of the whole of his property.

- When the deceased has left a will appointing someone as his executor. However, the will doesn't contain any other provision. Then it is understood that he has died intestate in respect of the distribution of his property.

- If the deceased has bequeathed his whole property for an illegitimate or illegal purpose. In such a case, legally, he has died intestate.

- When a will is partially incapable of being operative. For example, he has bequeathed Rs. 1000 to A and Rs. 1000 to the eldest son of B. Made no other bequest. And has died leaving the sum of Rs. 2000.00 and no other property. B dies before the deceased without ever having a son. Then he has died intestate in respect of the distribution of Rs.1000.

3. Which Authority issues Succession Certificate?

Indian Succession Act, 1925 governs the procedure and has laid down the mandatory requirements for Succession Certificate.

A succession certificate is issued by a district judge. The relevant judge is from the court that has jurisdiction in the district where the deceased person ordinarily resided. Where no such place is available, the jurisdiction within which any property belonging to the deceased may be found.

4. Particulars required when applying for Succession Certificate?

The legal heirs of the deceased must file an affidavit petitioning their claim to the property. The petition is to be made to the District Judge or in High Court. It needs to be signed and verified by the applicant. It must include the following details:

- A copy of the death certificate has to be produced,

- The time of death must be mentioned on the death certificate,

- The ordinary residence of the deceased before death. Or if no such address is available, then the details of his property that falls within the jurisdiction where the petition has been filed,

- Address, Name & other details of the legal heir, family or other near relatives, as per the Act,

- NOC or No Objection Certificate (from legal heirs other than the petitioner)

- Any legal heir who wishes to relinquish his right to the estate, he must declare so in an affidavit.

- Name, Address, and occupation of the petitioners,

- Copies of their Ration Cards or Passports,

- The right of the petitioner has to be mentioned,

- The debts and securities for which the certificate is being applied for,

- A declaration to be made for the absence of any reason to invalidate the grant of the certificate.

5. Court's Grant of Succession Certificate

The procedure after the petition has been submitted to the district judge of the high court:

Step 1: The petition is submitted along with court fees. The Court Fees Act, 1870, prescribes a specific percentage of the value of the estate. This is to be paid in the form of judicial stamp papers. This fee varies from State to State, in India.

Step 2: The Judge will inspect the application. And make it public by issuing a notice in the national newspapers. And send a notice to all the respondents. The notice calls for objections, if any, to issue a succession certificate. It generally provides a period of 45 days to protest, with necessary documentary proofs. After 45 days are over, he will fix a date for the hearing.

Step 3: At the date of the hearing, the judge will decide if the applicant is within his right to apply. If satisfied, he shall grant the certificate. The certificate would specify the debts and securities set forth in the application. It will mention the powers granted to receive interest/dividend or to negotiate/transfer/both.

Step 4: The Judge may also require the applicant to sign an Indemnity Bond to secure the entitled persons. This Bond may also require a Surety or some other security. That'll ensure no possible loss arises out of the use or misuse of such certificate.

6. The validity of the Certificate

The succession certificate is valid throughout India. For a resident of a foreign country, a certificate may be granted. Provided it has been approved by an Indian representative, accredited to that State (as appointed by the government). of such foreign country. And it must be stamped in accordance with the Court Fees Act 1870 to have the same effect in India.

7. Who can Apply?

An adult person of sound mind and having an interest in the estate of the deceased can apply. The interest may be in the form of a relative of the deceased, a person having a beneficial interest in the debt of the security etc.

The applicant cannot be a minor. However, the succession certificate can be granted to a minor through a guardian.

Sometimes, it gets difficult and time-taking to establish a relationship for those claiming to be legal heirs. In such cases, a succession certificate can be granted to establish a relationship. The rights of the grantee towards debts/investments are valid even before the legal heir to the property of the deceased is established.

8. What if more than one application has been filed?

When more than one application has been filed, the judge will decide whom to issue the certificate. He will take into consideration, the interests presented by the applicants. The reasons provided and the supportive documents would be considered.

9. What if some Debts/Securities were left out?

As per Section 376, the succession certificate can be extended for any debt or security not originally specified. If such extension/amendment is ordered, it shall have the same effect as the original certificate. The District Judge would extend, on an application by the holder/grantee and not of any other person.

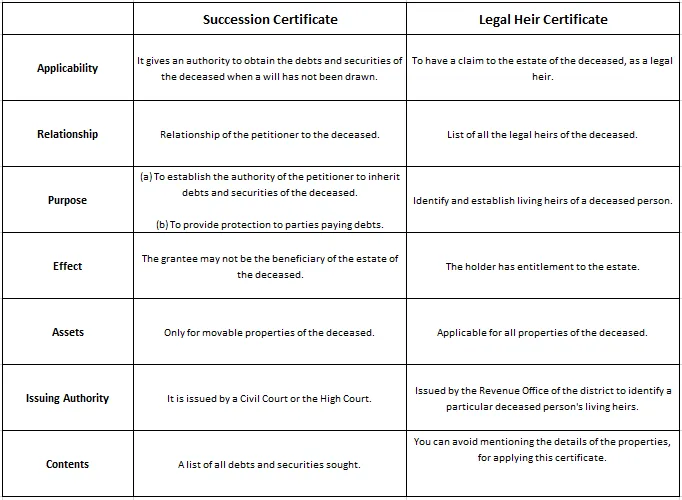

10. Difference between Succession and Legal Heir Certificates

Difference between Succession and Legal Heir Certificates

A Succession Certificate is necessary, but may not be always sufficient, to release the assets of the deceased.

11. Laws Governing various Religions

Under the Indian legal system, the property is divided amongst the heirs, as per the religion of the deceased. The laws of the Religion will be applicable in case of Intestate Death. Otherwise, a valid will supersedes the succession rights as per religion.

Hindu Law:

For Hindus (including Buddhists, Jains and Sikhs) the Hindu Succession Act, 1956, and Hindu Succession (Amendment) Act, 2005 are applicable.

If a Male Hindu dies intestate:

- His property goes to Class I heirs. They include Son, daughter, widow, mother of the deceased. Son, daughter and widow of a predeceased son, if any. Son and daughter of a predeceased daughter, if any. Children and widow of predeceased son of a predeceased son, if any.

- If there is no Class I heir, it will go to Class II heirs. It includes father, brother, sister, brother's son and sister's son, among others.

- When there's no Class II heir either, then the property will go to Agnates. Those relatives of the deceased that may be related by blood or adoption. The lineage must be wholly through males.

- And in case the Agnates are absent too, then to Cognates. Distant relatives, by blood or adoption, and not wholly through male lineage.

- If any Cognate doesn't exist, the assets go to the government.

When a Hindu female dies intestate, her property would devolve as below:

- First, to husband, sons and daughters (including children of predeceased son or daughter). Divided in equal measures.

- Second, to husband's heirs.

- If the husband doesn't have any heir, then to mother and father of the deceased female.

- When the parents have expired, then to heirs of the father.

- If none of the above exists, to heirs of the mother.

Many cases occur when a Hindu Female has inherited property from her parents. In that case, if she has no children, the property shall devolve upon the heirs of her father. The term children here include children of any predeceased son or daughter. However, if a property is inherited from in-laws, it shall go to the in-laws’ heirs. In case of absence of children or grandchildren.

Hindu Undivided Family or HUF

The property of a Hindu Joint Family devolves by survivorship. If the Karta dies, the property devolves upon the surviving members up to four generations. Here the property will not devolve according to the Hindu Succession Act, regardless of the fact that the heirs are Hindu.

But a Class I relative may make a claim on a share of the property. In such case the property would devolve upon the claimant as per the Hindu Succession Act.

Muslims (covered by Shariat)

As per the Muslim law in India (Shariat), the father is the absolute owner of the property. The property is inherited by the heirs on the death of the father. So a father can alienate the property as an absolute owner and deprive the heirs of inheritance. But he cannot dispose of more than one-third of his assets without the consent of his heirs.

The property is considered after the payment of funeral expenses and debts.

The remaining property is the legal right of his heirs after his death.

The Qazi (judge ruling according to Islamic religious law) considers the burial expenses. Makes a list of the assets of the deceased that need to be distributed among wife and children.

Muslim law recognises two types of heirs- Sharers and Residuaries. Sharers are entitled to a certain share in the deceased's property. Residuaries take up the left-over share in the property.

Moreover, agricultural land has been kept outside the Shariat Act, 1937. Hence, the succession to it continues to be governed by Local Tenancy Law.

Besides, when the marriage of the deceased was solemnised under the Special Marriage Act, 1954. Then the rules of Muslim personal law cease to apply, towards the succession.

Christians (covered by the Indian Succession Act)

Any property, insofar as he is an Indian Christian, shall devolve as per the rules contained in Chapter II of the Act.

- One-third of the property goes to the wife. And the rest will be divided among children (including grandchildren of predeceased son or daughter). To be divided in equal measures.

- If there is no wife or has expired, the property will be divided, equally, among the children.

- When there are no children, the property is shared equally between the wife and the husband’s relatives.

- If the relatives stated above do not wish to claim, the assets will devolve upon the parents of the deceased.

Parsis (covered under the Indian Succession Act)

- Half of the property goes to the wife. And the rest to be divided among children (including grandchildren of predeceased son or daughter). In equal measure.

- If there is no wife or has expired, the property will be distributed, equally, among the children.

- When there are no children, the property will go to the parents of the deceased.

12. A few more points about the Certificate

The essential purpose of this certificate has been to provide protection to all parties paying debts. When these payments have been made in good faith. The grantee also has powers to receive any interest/dividend on the securities and negotiate or transfer them. Thus any payments made to and by the grantee on behalf of the deceased person are legally valid.

The Grantee has the right to:

- Claim the moveable assets of the deceased person.

- This certificate is not applicable to inherit the immovable assets. For immovable properties, you need letters of administration from the court.

- Represent the deceased in collecting any payment towards debts and/or securities due.

- Inherit the liabilities of the deceased person, as well.

- It can be granted even if there is a nomination in the deposits, investments, insurance etc.

- Further, it doesn't necessarily make the certificate holder, a legal heir or the owner of these assets. There is a separate procedure of law to determine the legal heir(s).

- Above point means that the grantee is authorized to act only as a trustee to the legal heirs.

- A Legal Heir certificate doesn't substitute the Succession Certificate.

- It can be revoked/cancelled under certain situations. These may be fraud, defective proceedings, etc. Thereafter, the certificate becomes useless.

- The court, even if there is more than one heir, will only issue a single succession certificate.

The Succession Certificate affirms that there has been no will. And denotes the legal heirs of the deceased. The beneficiary will, additionally, carry with him the full responsibility and liability of honouring any debt or security attached to that particular property.

Sometimes, the bank only asks for it in case another legal heir is contesting the nominees claim. On the other hand, if the matter goes to the court, it will be necessary. It isn’t the aptest document in case of properties. For this, a letter of administration would be required. A letter of administration is an explicit document granting a person the authority to administer the property of the deceased. The procedure to get this document is the same as the procedure for getting the succession certificate.

The article has been written by Reema, in the capacity of a content writer with LegalRaasta. India's top portal for professional help related to legal, finance and business such as ITR filing, Company Registration, GST registration, etc.

![Top 10 Cheap Indian Press Release Distribution Services [Updated]](https://images.yourstory.com/cs/1/b3c72b9bab5e11e88691f70342131e20/LOGO-DESIGN-PR-INDIA-WIRE-03-1595693999405.png?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)

.jpg?mode=crop&crop=faces&ar=1%3A1&format=auto&w=1920&q=75)