Reality check: Are NFTs dead?

The Non-Fungible Token (NFT) market has crashed in recent months, leading to the question, are NFTs finally dead? Now, a new type of NFTs, promising to unlock the truly transformative potential of blockchain-based digital asset ownership, seeks to revive the NFT revolution.

There’s no doubt about it: Non-Fungible Tokens (NFTs) are in trouble. The bull run that existed all throughout 2021 has long been left behind in the dust. Now, liquidity has dried up and trade volumes have plummeted, with the most popular marketplace OpenSea reporting a decline of over 90% in daily trading volumes since its peak around May.

Things turned for the worse as laid off about 20% of its workforce in July to tide through the adverse market conditions. Those who entered the market at this juncture are left wondering where their profits are.

“During this winter, I expect that we’ll see an explosion in innovation and utility across NFTs. With the hard (but important) changes we made today, we’re in an even better position to capture what will soon become the largest market on the planet,” says David Finzer, Founder of OpenSea.

Finzer’s optimism is not unfounded. The transformative potential of NFT technology is yet to be truly unlocked, say many industry watchers. But before we dive into that, it’s important to learn when the nose dive began.

Breaking down the numbers

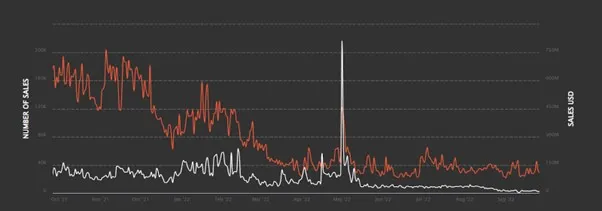

NFT market data tracking and analytics firm NonFungible found that NFT sales per day hovered well above the 160,000 mark between October and December 2021 and declined to between 80,000 and 120,000 between this January and March.

It must be noted that total sales volumes (in USD) rose during the same period, corresponding with a rise in the perceived value of NFTs.

Source: NonFungible.com

However, daily sales numbers have plummeted to just around 40,000 in the period since, while daily sales volumes have also declined.

As of September 26, NFT sales per day were recorded at below 30,000 while daily sales volumes stood at $9.2 million. This is a sharp drop compared to the markets’ strongest months—January and May—where daily sales volumes frequently topped $150 million.

As per the recent Bloomberg report, NFT trading volumes have tumbled 97% since January, the report implies that the fading NFT mania is a component of a larger $2 trillion wipeout in the crypto sector caused by a rapidly tightening monetary policy that is depriving speculative assets of investment flows.

Ex-Gaana CEO’s NFT startup FanTiger allows you to invest in songs, earn royalty income

Are NFTs dead?

The slow downtrend for NFTs can be attributed to larger market downtrends, as well as leading NFT project assets being prohibitively expensive compared to other assets in the web3 space—with no legitimate link to assets of value and strong utilities.

“Typically, many NFT projects derived their value from relying on giving free tokens, merchandise, doing real-life events, selling virtual land, etc. These are the same narratives we’ve been seeing for the last two years. No new dynamics have played out,” says Vish BR, Strategy and Operations Lead- India, SGC, who also holds a blue-chip NFT Bored Ape.

The motivation for these NFT sales was to acquire and resell these digital assets without much thought to the real-life problem statement it set out to achieve.

“There were always a few projects, such as BAYC, CryptoPunks, fighting for the top spot. But these projects were not doing anything different from each other,” adds Vish.

Then there is the question of these assets having a high barrier for entry. Take a Bored Ape NFT, for example, which typically costs north of $100,000, and can sometimes even run up to millions depending on the token. This can be a deterrent to most investors trying to get into this space.

Those running NFT projects have woken up to the reality that this doesn’t work. Anticipating liquidity to dry up, some have resorted to experimenting with fractionalising to increase demand.

Enter fractionalisation

Simply put, fractionalising involves breaking down a certain asset into several smaller fragments, each of which represents an ownership or stake. This method seems to be on the uptick, with projects such as Unic.ly and Fractional.art, experimenting with fractional ownership, particularly for expensive NFTs.

The concept is not novel by any means. It is commonly done in traditional finance for objects with high-value like luxury homes or private jets. By bringing this to NFTs, companies target the liquidity problem at its core—allowing, in theory, any investor to own an expensive NFT for cheap. While this sounds practical, there is a downside risk.

Say you manage to break down a Bored Ape, which is essentially a profile picture, into fragments—it is not likely to have any value thereafter.

This is besides the fact that owning a piece of a Bored Ape does not allow a holder exclusive access to the community or any other incentives. Even if it did, distributing exclusive benefits equitably to a thousand individuals pose a monumental effort. Further, if there’s no healthy market to buy and sell these fractions, it becomes a problem.

“Once an NFT is fractionalised and the ownership is widely distributed, issues of governance may crop up around who decides how the original NFT can be used in new opportunities,” says Himanshu Yadav, General Partner and CIO, Woodstock Fund.

Nevertheless, Woodstock Fund still believes it is early days in the NFT revolution, and sees NFTs, Web3 gaming, and Metaverse-building activities making a strong case for virtual worlds interacting with physical worlds.

“Deeper NFT markets, combined with tooling that can solve existing issues, as well as education around NFT fractions will be required. For it to become mainstream, it may take another 2-3 years optimistically,” Himanshu says.

Tokenisation: First step

Ambitious early-stage startups—such as Estate Protocol, FanTiger, Artfi, and more that are led by Indian founders—are working to create fractionalised versions of tokenised assets such as real estate, music, fine art, etc.

With all fractional ownership on digital platforms, the first step is tokenising the asset. Some assets are easier to tokenise than others. Digital assets tend to be easier to tokenise than physical assets, maintains Rohit Jain, MD, CoinDCX Ventures.

“Tokenising and transferring physical assets such as land and property takes a lot more effort. With real estate tokenisation and fractionalisation, there should be a regulatory framework in place to recognise the custodian, as well as protect all parties involved,” says Rohit.

Estate Protocol, which fractionalises real estate on the blockchain, is betting on NFTs of real-world assets becoming a popular investment option for traders.

Real Estate Investment Trusts (REITs) have existed for a while—where asset managers pool money from investors to purchase real estate properties—but these options are sometimes limited to commercial properties and are often limited by jurisdiction.

However, the global and decentralised nature of NFT ownership makes it challenging to come up with jurisdiction-specific policies to regulate and protect all parties involved, which is a critical requirement if fractional NFTs have to take off.

Commenting on generating supply for said NFTs, Parv adds, “The hurdle that needs to be overcome is one of education about the use cases for NFTs, and it would happen as projects using NFTs for assets other than JPEGs start gaining traction. I expect fractional NFTs representing ownership in real world assets to be mainstream only by 2025.”

Fractionalising fine art

Moving on from real estate to fine art, where the challenges appear similar as laws and regulations around transfer of ownership of blue-chip art assets are fairly specific to the jurisdiction in concern.

Early stage startup Artfi is building a new way to own a piece of fine art. Launched by art entrepreneur Asif Kamal, the startup is working on a platform for purchasing and selling NFTs representing an investment in iconic blue-chip artworks of renowned Indian artists such as VS Gaitonde, Sacha Jafri, and more.

“We accept artworks on consignment rather than paying for them outright. We then offer the painting to the public using Web3 infrastructure, so that anyone with the money to invest can own a share of a blue chip work of fine art,” says Artfi Founder and CEO Asif Kamal.

Music on blockchain: How The Swaraj Projekt is helping indie artistes earn through NFTs

Investing in music

On a broader level, startups like Artfi and Estate Protocol, and investors, believe in a future where most assets will be tokenised. While regulatory clarity is essential to creating such a reality, it is also critical to build awareness and education among end users about the advantages of fractional NFTs as a new asset class.

Another NFT player, FanTiger, which creates fractional NFTs of songs, is banking on the popularity of Indian music stars to drive awareness around their NFTs.

Co-founder Prashan Agarwal, who is the ex-CEO of music streaming service Gaana, says,“The larger narrative has to be to educate users on the benefits of fractional NFTs, and how this is a new asset class that needs to be added to their portfolio for diversification. Once users understand the benefits for the creator economy enabled using NFTs, they will drive usage and mainstream success.”

Not all doom and gloom, yet

Despite the current market, one indicator for betting on NFT innovation and future adoption could be that the number of daily users isn’t declining as rapidly as sales numbers and volumes.

According to crypto and Web3 financial data aggregator Token Terminal, the number of daily active users on OpenSea dropped to 45,000 on September 26, compared to its peak (around 65,00) in January.

NFTs may pick up steam only if the economics of such a model can be figured out in such a way that value is distributed fairly and sustainably to the startup building the platform, end users, as well as auction houses/museums.

The narrative around fractional NFTs has existed for a couple of years but it remains to be seen how this new wave of experimentation will play out. Since they are starkly different from blue-chip NFTs, they address some fundamental challenges faced by the first wave of NFTs.

Being more affordable, having a link to real-world assets and providing real-life utility are some ways fractional NFTs are different. It also must be noted that these experiments are emerging in response to blue-chip NFTs undergoing a bear market, and it is hard to speculate how successful they may end up becoming in matching supply with demand.

Broadly speaking, fractionalisation could bring about more democratisation to NFTs and could see more acceptance, as well as potentially bridge web3 to the rest of the internet in the near future.

(The copy has been updated to reflect the latest data on NFT trading volumes.)

Edited by Akanksha Sarma