The crypto wave and India’s currency to leadership

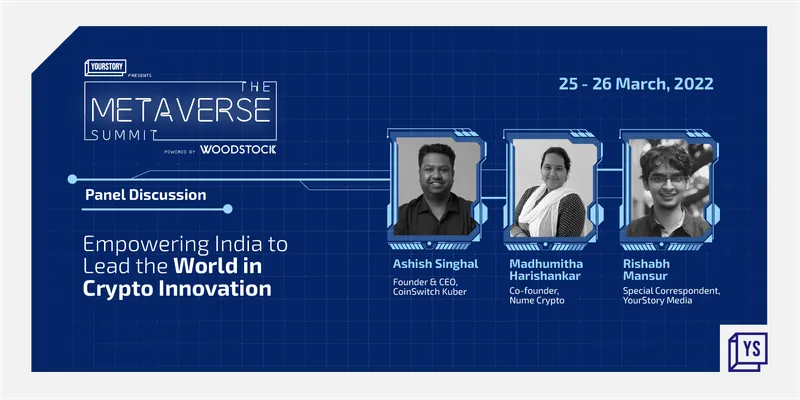

Cracking the crypto code and India’s roadmap to leading the space globally were Ashish Singhal, Founder and CEO, CoinSwitch Kuber and Madhumita Harishankar, Co-Founder, Nume Crypto at The Metaverse Summit, 2022.

The big question: Is India uniquely positioned to emerge as a world leader in this space? If so, what are the advantages and challenges that lie ahead?

To throw light on this conversation gaining momentum each passing day, Ashish Singhal, Founder and CEO (chief executive officer), CoinSwitchKuber and Madhumita Harishankar, Co-Founder, Nume Crypto joined YourStory’s Risbhabh Mansur at The Metaverse Summit, 2022.

One of the leading crypto technologies, CoinSwitchKuber is an exchange to buy, sell and trade crypto, and the second Indian crypto startup to enter the unicorn club. On the other hand, Madhumita along with Niveda Harishankar launched Nume Crypto last year, building a low-cost and scalable mechanism on Ethereum for processing payment transactions. Their first product, Nume Pay, makes it easy and economical for merchants and companies to accept crypto payments.

Setting the conversation in motion was Madhumita as she concurred, “India's already emerging as a world leader in the crypto space.” She cited how India has shown an extraordinary aptitude for quick tech adoption in the last few decades — a tendency to “leapfrog, sometimes multiple generations of technologies” — be it quick smartphone or 4G adoption, responding to disruptive price points.

“When we talk about crypto, there are two aspects to it. One is development and the other, adoption. In terms of development, India is already home to some leading crypto technologies as well as many early-stage startups. The Web3.0 startup ecosystem is also booming,” she explained, adding how Nume has its own in-house policy of hiring college students, giving them the necessary early push to plunge into the crypto movement. In terms of adoption, Madhumita shared some revealing figures: With 100 million users in India, India has the largest crypto adoption base in the world.

As the metaverse is expected to peak in the next five to 10 years, the world of education and gaming are also expected to be redefined. From a funky jacket to a gun in a game, everything can be built on the blockchain ecosystem. And Web3 would act as a base layer of the metaverse itself. The best part is today, with Web3.0, India has its chance to build the infrastructure layer of the internet itself unlike in the ’90s when the country didn’t have the necessary skill base to develop for the internet.

“This time, we are ready, we have the right skills, we have an amazing engineering population of over 4 million engineers in India; 12,000 of them are blockchain engineers. So, not just as a service provider, India is emerging as a platform builder in Web3,” highlighted Ashish.

The digital rupee - the way forward

With the Central Bank Digital Currencies (CBDC) gaining momentum, the digital rupee has grabbed the eyeballs.

Madhumita highlighted how blockchain whales pave for greater accessibility than the traditional closed banking system. The actual cryptocurrencies that we transact on these whales are the currencies issued by the Central Bank. And unlike stable coins, the pure cryptocurrencies like Bitcoin and Ethereum are new asset classes, often associated with volatility.

Nume works on enabling payments for retail use cases in crypto. “One of the biggest feedback or concerns we have heard from merchants again and again is what if their money depreciates in value between getting the money and before cashing it out. So, I think stable coins are going to become our key in accelerating crypto adoption,” emphasised Madhumita.

Rather than from a user standpoint, Ashish emphasised how the real value of this innovation is for the backend systems. “If you take UPI (unified payments interface) for example, if I'm transferring money to someone in Russia, it might take a few seconds to transfer through UPI. But say your transaction fails today, it takes seven days to get your refund, because the backend system is not meant for real-time processing. That's where blockchain can help. I personally believe that a CBDC use case would be realised when people don't even know that in the backend, it's actually a CBDC transaction happening,” proclaimed Ashish.

Trust and acceptance

In this evolving landscape of cryptocurrency, bridging trust deficit and building legitimacy and awareness about crypto exchanges remain key challenges.

Ashish pointed out that the unicorn status does help a bit with credibility but the bigger question is how to make sure that money is equal for everyone in India. This would mean going beyond crypto and merging traditional finance with new finance. From having superlative KYC (know your customer) and onboarding guidelines to ensuring high-risk individuals are not a part of the ecosystem, the focus is on making users aware of risks.

“We give merchants the choice to select what tokens they get to accept their payments in. We also offer a cost perspective to merchants to ensure that they're comfortable keeping their money. We are also introducing USDC, USDP, and DY, which are the three most proper stable coins that kept coming up in all the merchant feedback,” shared Madhumita.

As they signed off, the experts left us with some thoughts for the future — from the importance of the growing crypto community to empowering crypto users.

To join The Metaverse Summit login here or visit the website.

Edited by Ramarko Sengupta