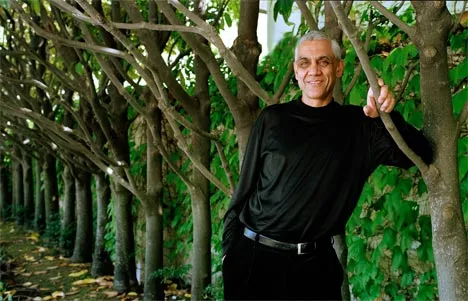

At 58, Silcon Valley legend Vinod Khosla says: “No plans to slow down for the next 25 years”

What do you do on a long-haul flight? Most people would snooze, read, watch movies, work on a presentation, play games or get drunk. On his way from the US, Vinod Khosla, VC maven and Silicon Valley legend decided to speed read his son’s computer science book on algorithms, to keep up with what’s happening at present. It tells you a bit about the 58-year old’s hunger for knowledge and an undiminished childlike curiosity. After having co-founded Sun Microsystems, incubated Juniper Networks, voted as the Silicon Valley’s most successful VC and founding a bouquet of venture capital firms, Khosla is brimming with energy to create large-scale economic, social and environmental disruption. He says he has no plans on slowing down, not for the next 25 years at the very least.

He was talking to R Sukumar, editor of business newspaper Mint, in a fireside chat dubbed ‘Against conventional wisdom’ in Bangalore on Thursday. In a freewheeling chat, where he was addressing a select group of entrepreneurs, media, VCs and tech enthusiasts, he spoke about his early days, innovation, how to fail fast and why he’s hopeful of India’s future.

Here are edited excerpts:

On innovation and startups:

Innovation only comes from startup world. NBC didn’t change media, but Youtube did. NASA did not reinvent the space exploration but Elon’s Musk’s Spacex did. GM didn’t innovate on the electric car instead it was Tesla that did it.

Khosla made a very bold claim when he said that he’s yet to find a significant innovation that happened because of a large company instead placing the burden of innovation on startups.

On product innovation in India:

He asked the audience to raise their hands on how many folks worked in product startups and spent time in Silicon Valley. Three years ago, when he asked these questions, he saw no hands go up when asked about product-oriented startups.

In 5 years, we will see something like Google from India. I’m an optimist, in times of doom and gloom, the best people leave and do startups and companies do their best work. When funding is hard, startups test their plans more and they are better equipped to solve risks.

On sectors that are hot:

Mobile apps is particularly relevant, it can slash costs of health by 90 pc, eliminate 90 pc of things docs have to do. It will happen in India because it is short of resources in terms of doctors, it might result in healthcare that might become better quality better than the West, and it will become cheap, almost free.

I’ve already seen 4-5 plans from India in that area that’s interesting. IT related areas like machine learning, data intelligence, that combine computing power and data. This can help in finding new drugs or capture terrorists. In the next 10 years, it might cause as much change as mobile created in last 10 years

On his investing philosophy:

I won’t invest in something that’s bad for society like gambling or oil. If I can make more impact and less money, I rather do that. I tell investors that I’m not trying to maximize profit. In last 100 investments, we never calculated a rate of return and we don’t know of other investors who do the same thing.

I’m committed to work for 25 years, my partner has just started to slow down and he’s 83. I want to be a pain for bigger companies, its lots of fun, never easy but very rewarding.

Khosla Impact is a special fund, there are no other investors other than me, it means that I only invest in companies that deliver goods and services for the bottom of the pyramid. Like Driptech, that provides irrigation solutions for farms that are less than an acre. Impact matters more than return.

On investments in clean energy:

Clean energy has not been easy but for the wrong reasons. We have done well, if we look at returns in clean energy compared to any other VC firm we have done well. Investors operate like herds of cattle. When it was hot everybody invested when it got cold follow-on capital got difficult.

We have raised $500 million for a dozen clean tech startups and every single one was at increased valuations. Why? We made long term bets and not short terms bets.

On entrepreneurship:

Don’t be swung by what everybody is doing. Do what you believe and it will have long term potential. Entrepreneurship can be depressing, so when bad times comes, because you believe in the religion you don’t give up. Those who started up just to be acquired will give up.

On following the herd:

Most investors are going with the herd, investing in the fourth e-commerce company selling shoes and the really good ideas are not getting investment traction.

95 per cent of population do what everybody else is doing. Only 5 per cent think for themselves.

Why India has not had big successes:

There are no successful role models like Larry Page (co-founder Google) and Mark Zuckerberg (co-founder Facebook). Once we have a few successful startups, entrepreneurs will say I will do something bold and try my passion. Investors will say that was a bold idea, its a vicious cycle. It takes little bit of luck and a good role model. In the US, you have an ecosystem, like Stanford University and big storied companies. Patience is needed, if you just started, it takes 5 years, 50 good ideas out of 10,000 will result in that. A big startup is much more likely in India than in UK or Germany, the ecosystem is getting better.

The India advantage:

Where do you have a billion people in a growing economy? India skipped the generation of the land-line and may skip banking and credit cards.

There is a vibrant environment but will take mentors and coaches that have done it before. It needs a quality of people who have done it before.

More than ever people (Indians) in US working in companies like Google are saying, we want to go to India and do a startup.