With 15,000 branches, SBI's ePay will be a strong force to reckon with

SBIePay is the aggregator service by the State Bank of India that was recently launched to provide better electrical connectivity between financial institutions and merchants. Arundhati Bhattacharya, Chairman, State Bank of India, launched SBI ePay at the Corporate Centre, Mumbai. The aim is to facilitate e-Commerce/m-Commerce transactions between merchants, customers and various financial institutions for all kinds of payments. State Bank of India is India's largest bank with a network of over 15000 branches and five Associate Banks and this reach makes this move very important.

Electronic payments in India have grown at a rate of around 32% (2008-2012) to INR 47,349 crores. SBI ePay comes at a point when other players in the field are way ahead in the product curve but SBI ePay is in the process of rolling out Electronic Bill Presentment and Payment platform (EBPP) and IVRS for making payment over phones as well. Private players like Citibank, HDFC, CCAvenue, etc. have the bigger piece of the pie in the space.

State Bank of India, State Bank of Bikaner and Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala, State Bank of Travancore, United Bank of India and ING Vysya Bank are the partners for SBI ePay and is planning to work with 40 more banks.

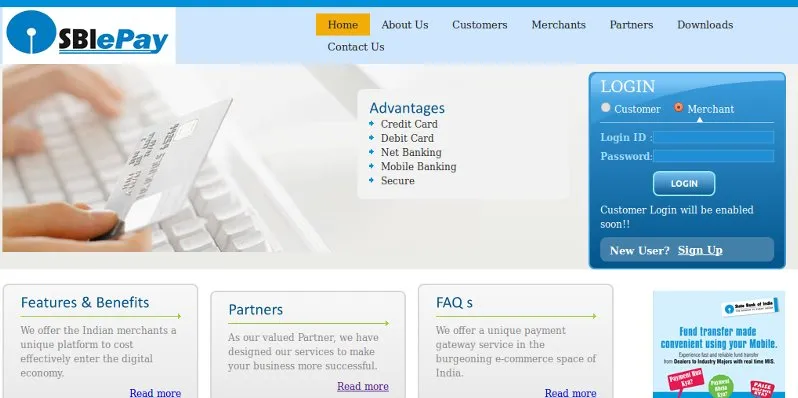

The merchant login is active but the customer login is still not enabled on the website. The documentation for a merchant is solid and in time, we'd also come to know how strong and merchant-friendly the product is. More information about it here.

Startups in the payments space

Payments have been a huge challenge for Indian e-commerce to overcome and this was duly recognized by the startups in the space in India. Here are some of the startups in the payments space:

Payment Gateways: PayU, ZaakPay, Citrus Pay

A wrapper on payment gateways, JusPay

Making selling online easier, Instamojo

Recharges and online transactions, Paytm, Freecharge