The backstory of how ARM reached a milestone of 86 billion chips in 25 years

Cells are considered to be the basic building blocks of life, and in a similar vein, chip microprocessors constitute the building blocks of modern day computers and related ecosystems, which now include smartphones and Internet of Things (IoT) devices. Investing in research and development (R&D), laying out blueprints and finally fabricating and manufacturing microprocessors based on custom needs is not an easy task. Only a handful of companies globally have been successful in cracking parts of this value chain.

Headquartered in Cambridge, England, ARM Holdings, then short for Acorn RISC Machines, is one of the earliest pioneers in the semiconductor and design space.(ARM no longer stands for Advanced RISC Machines but the company’s ethos remains the same). Established in 1990, ARM Holdings has an amazing history, spanning over 25 years. SoftBank Group (SBG) and ARM Holdings created history on Monday as the former officially announced its intent to acquire ARM for $31.4 billion.

Related read: SoftBank acquires ARM for $31.4bn, to leverage IoT wave

Image credit- ARM

Going forward, ARM will continue to function independently as a subsidiary under the SoftBank Group. Industry experts and laymen alike have been taken by surprise by this acquisition and the fact that SBG paid a 43 percent premium for ARM. But digging into ARM’s history and potential future applications puts things in perspective.

The accidental discovery

Today, we take the processing power and sleek form factor of smartphones and laptops for granted. But a few decades ago, it was considered nearly impossible to achieve the current size and scale. Experts believed that processors had reached their apparent physical limits, and that bulky laptops and desktops couldn’t be made sleeker, owing to overheating and other issues.

But then Cambridge engineers at ACORN, through a chance experiment and accidental discovery, changed the course of technology for the better. While working on a way to make a faster and cheaper processor, Cambridge engineers came up with the design of a new chip that was based on an American idea called Reduced Instruction Set Computing (RISC).The prototype worked and the engineers were overjoyed, but then they noticed a weird anomaly-

The chip wasn’t being powered by an external source, and hence, shouldn’t have worked. On further digging, they found that the chip that they had built was so power-efficient that it was able to run on residual power from nearby components.

History and progress of ARM

ARM was originally founded in November 1990 as Advanced RISC Machines Ltd, structured as a joint venture between Acorn Computers, Apple Inc. and VLSI Technology. The company’s first press official release in 1990 spoke about its long term goals and short term strategies-

(Read the full press release here)On November 27th 1990, Advanced RISC Machines got spun out of Acorn Computers with a mission to create a new global microprocessor. Based out of a barn in Cambridge, the team refined their first microprocessor further and it was used in Apple’s Newton device. Though Newton failed to take off as expected, it proved that small portable computers were possible. ARM chips then went on to be utilised in a wide variety of smartphones, including Apple’s iPhone, and is estimated to be in about 95 percent of the current smartphones worldwide.

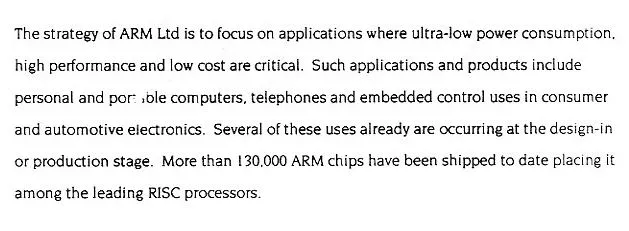

From an estimated 9 million units in 1997, ARM's partners have shipped an estimated 12 and 15 billion ARM based chips in 2014 and 2015 respectively.

Image credit- Wikipedia

Between 1999 and 2015, ARM also went on to acquire 21 companies as it constantly grew its global footprint. Cambridge-based software consulting company Micrologic Solutions was ARM’s first acquisition in 1999. But one of its most notable acquisitions occured in 2006 when ARM acquired Norwegian company Falanx Microsystems AS for £13.4mn. Falanax developed graphics accelerator IP and software, including its Mali GPU, for System on Chips (SoC) vendors. ARM considers the acquisition to be the cornerstone of its multimedia business unit.

On April 17th 1998, ARM changed it name to ARM Holdings and announced its IPO on the London Stock Exchange and NASDAQ, priced at £5.75 per share ($29.17 per American Depositary Share). At launch ARM had a market capitalization was £264m while its current market capitalization in 2016 is estimated to be around £15bn.

How ARM works

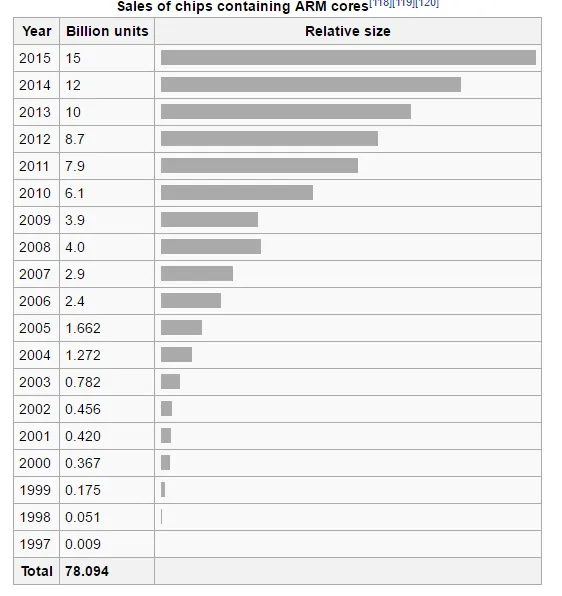

ARM is in almost all of the world’s devices, and it is estimated that over 86 billion ARM-based chips have been shipped so far since inception (including 2016). But ARM doesn’t manufacture any of its chips. A 2015 Techcrunch report titled 'the battle is for the user interface' made an interesting comparison,

Image credit- Wetpaint

Unlike most other chip design companies, ARM works on a licensing model based on its intellectual property rights. It works with companies through two main licensing terms-

- Core licence- ARM’s primary business is selling its customer IP cores, which licencees can use to create CPUs and systems-on-chips (SOCs). In essence, devices manufacturers combine ARM’s core with other parts to assemble and produce a complete device

- Architectural licence- Based on their custom needs, companies can also obtain an architectural licence to design their own CPU core using ARM’s instruction sets. The caveat here, though, is that developed cores must comply with ARM’s architecture. Companies like Apple, Qualcomm, and Samsung Electronics are some of ARM's partners who have chosen such a licence.

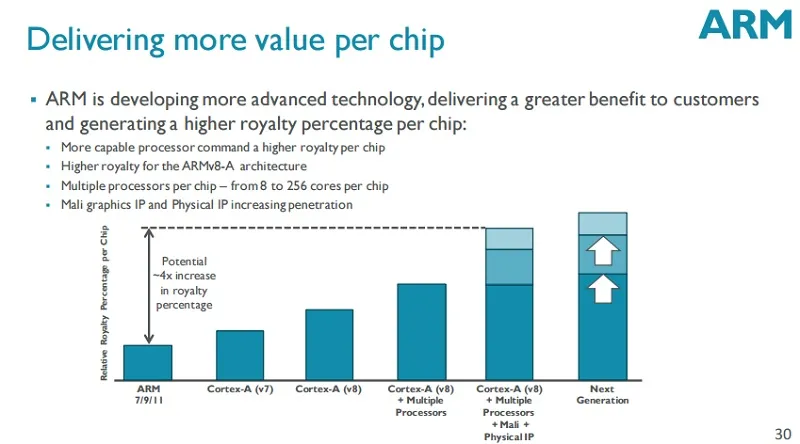

ARM has been successful for over two decades because of its operating model and long term strategies. The company invests heavily in research and development, where it incurs a large portion of its costs. Then, ARM partners with companies that want to utilise its architectures and IP, and earns revenue through licensing and royalties.

Image credits- ARM

ARM then continues earning royalties for longer time periods for those chips, though the amount may decrease with time as advances in technologies force both ARM and its licencees to focus on newer chips introduced through continued research and development life cycles.

Processors based on designs licensed from ARM are used in a variety of devices ranging from smartphones, tablets, laptops and smartwatches to microcontrollers in embedded systems, servers, sensors and even supercomputers, as well as many other applications, including GPS navigation devices, digital cameras, digital televisions, network devices and storage. The Cortex-M processor from ARM is the CPU behind most existing and new embedded, IoT andwearable devices in the market. In 2009 ARM launched Cortex-M0, a 32-bit processor in the embedded computing market, which went on to become the fastest licensing ARM processor with 15 licensees signed in nine months.

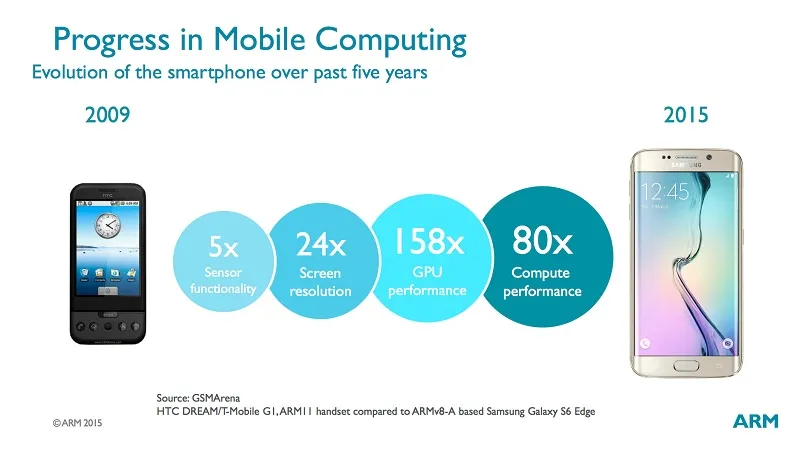

ARM’s prowess and ability to innovate constantly can be best judged in the progress of smartphones over the past five years.

Through its mbed initiative, which is a platform and industry consortium of around 55 hardware and software companies, ARM works with partners on upcoming and new technologies like IoT, which they feel can go mainstream in the future. The core themes behind mbed are around open standards, security, low power and inter-operability.

Some of the interesting early-stage initiatives include a reference design for a wearable device with 8 weeks of battery life and the BBC Microbit, a pocket-sized computer positioned as a learning tool. On November 19 2015, ARM, along with Cisco Systems, Dell, Intel, Microsoft, and Princeton University, founded the OpenFog Consortium, to promote interests and development in fog computing.

The next frontiers?

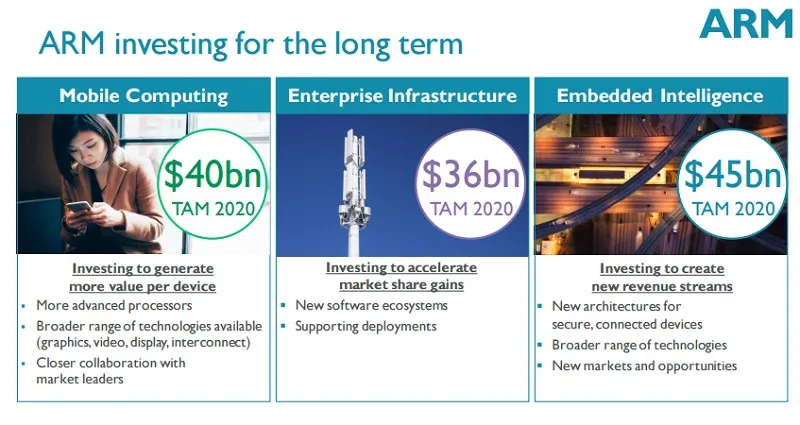

While ARM has a firm grasp on the mobile market- which includes tablets, clamshells, candy bar phones, ARM based chromebooks- with an estimated 85 percent market share, its share of the smartphone market is estimated to be 95 percent. Going forward, the company aims to develop more advanced chips which deliver higher value to users and also generate more royalties for itself.

Apart from smartphones, ARM has also achieved success in grasping 15 and 25 percent market share in enterprise infrastructure and embedded intelligence respectively, and aims to invest heavily in these sectors going forward.

Website- ARM