How 27-year-old Nikhil Kumar and team built the BHIM app in just 3 weeks

Since November 8, when PM Narendra Modi announced the demonetisation of Rs 500 and Rs 1,000 notes, digital payment has been a hot topic of discussion. The government came up with a number of strategies to help people cope with the cash crunch and move towards the Digital India ideal. One such step was the launch of the Bharat Interface for Money (BHIM) app on December 30, 2016, which has witnessed 15 million downloads since.

Speaking during a session titled ‘Digital Payments: Waiting for the WhatsApp Moment of Indian Finance’ at the Times LitFest in Bengaluru, Nikhil Kumar, Head of Developer Ecosystem at India Stack, a set of APIs that allows the government, startups, and developers to leverage a unique digital infrastructure to address problems, said, “What the US did to GPS years ago, we are doing it with digital identity and payment now.” Nikhil, 27, presided over the session with FreeCharge CEO and Chairman Govind Rajan. The open API team at iSPIRT has been a pro-bono partner in the development of these apps.

“BHIM is built on a technology called the Unified Payment Interface (UPI). Why is UPI a remarkable achievement in India? It is IMPS on steroids as it allows any bank to acquire any bank’s customers and allows to send money from any app. Basically, we are saying that you can do banking from any app by giving you the security,” said Nikhil. IMPS or Immediate Payment Service allows instant interbank transfer of funds over mobile phone.

Nikhil recalled how he and his team would go to banks and startups like FreeCharge and Flipkart to promote UPI, which was launched in February 2016. UPI allows customers to make payments through a single identifier like the Aadhaar number or virtual address. Before demonetisation all the big banks had scoffed at the idea of adopting UPI for fear of losing customers.

However, the scenario took a U-turn after demonetisation, when the dearth of cash had everyone mmaking a beeline for digital platforms.

How the BHIM app was born

To remedy the cash crunch caused by demonetisation, Modi came up with the concept of going digital and using Unstructured Supplementary Service Data (USSD) and UPI. However, Modi also realised that terminologies like UPI and USSD were creating confusion in the minds of people. It was in the last week of November that the government felt the need for a payment mechanism with a simple interface which could be used by all, leading to the birth of the BHIM app.

When Nikhil’s team was asked how long it would take them to build this payment app, Nikhil replied, “Ok let’s do it in three weeks.” There was some confusion initially, as according to Nikhil, the government officials took it to mean three years. Finally, Nikhil was given three weeks.

The first week was spent on conceptualising, designing, and prototyping of the app while its development took the remaining two weeks. By December 25 the team had the app ready, and Nikhil and his team then went to Delhi to demonstrate the app to government departments like the NITI Aayog and the PMO.

Recounting those days, Nikhil said, “All were very excited. I actually remember the IT secretary turning to the CEO of NITI Aayog and saying that this was game-changing and that they had to launch the app dramatically. The fun factor was that the name BHIM was picked by Modi.” The average age of the team that developed the app is between 24 and 25. Nikhil worked as a volunteer on this project with NPCI, JusPay to design and develop BHIM. He added that there were a number of volunteers who worked as pro-bono behind the scene to make this magic happen.

How does BHIM work?

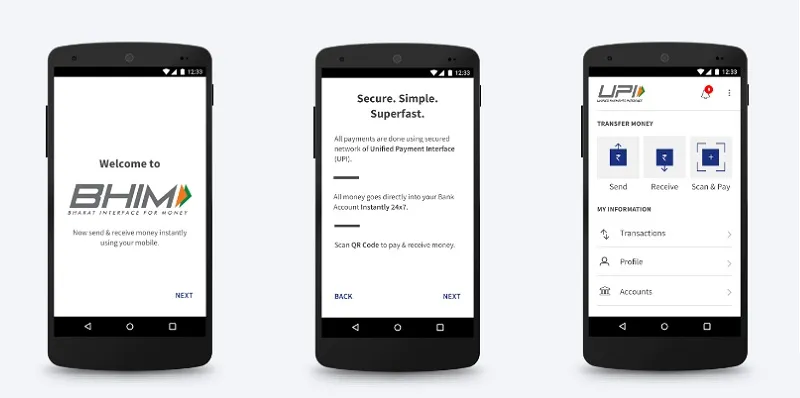

Interoperable with other UPI applications and bank accounts, the BHIM app was tailored to enable fast, secure, and reliable cashless payments through mobile phones. One needs to register a bank account with BHIM and set a UPI PIN for it. The mobile number serves as a payment address, thereby simplifying the transaction process.The application is around 1.24 MB in size.

On opening the app, users are asked to send an SMS, enrol the mobile number, set a four-digit password, and choose the bank account. The BHIM app is available on both Android and iOS. According to Nikhil, the app has replaced the National Unified USSD Platform (NUUP).

BHIM has taken on the likes of Paytm, MobiKwik, FreeCharge, and all the other mobile payment apps which had gained traction after demonetisation. While launching the app, PM Modi made a payment using the app to Khadiindia, a portal selling khadi apparel as well as other goods from Khadi Gramodyog and Khadi Village Industry .

Nikhil recalled the first transaction that the PM made using the app, Nikhil said he found the PM to be tech-savvy and added that it took only five minutes for the PM to understand the features of the app.

How secure is BHIM?

If somebody has to initiate a transaction, there is an app passcode which is encrypted and known to the users. There is something called a UPI pin which is required to finish the transaction. Nikhil ensured the security aspect of using the BHIM app and said that the risk factor with BHIM is only one percent. However, lots of awareness needs to be created among users to ensure the safety of transactions.

The BHIM app’s recently launched updated version (1.2) comes with enhanced security features and user experience. The latest version is also available in seven regional languages — Odia, Bengali, Tamil, Telugu, Malayalam, Kannada, and Gujarati. Moreover, a new payment option called ‘Pay to Aadhaar Number’ has been introduced to this new version which allows users to transfer money to the Aadhaar number linked with beneficiaries’ bank account. Another new feature is SPAM Report, which enables users to block unknown persons requesting money.