A year after demonetisation, why is cash still king?

Old habits die hard. You can take cash away from the Indians, but you cannot take Indians away from cash. The whole thing is that ‘ke bhaiya sabse bada rupaiya.’

“No people whose word for 'yesterday' is the same as their word for 'tomorrow' can be said to have a firm grip on the time.” - Salman Rushdie, ‘Midnight's Children’

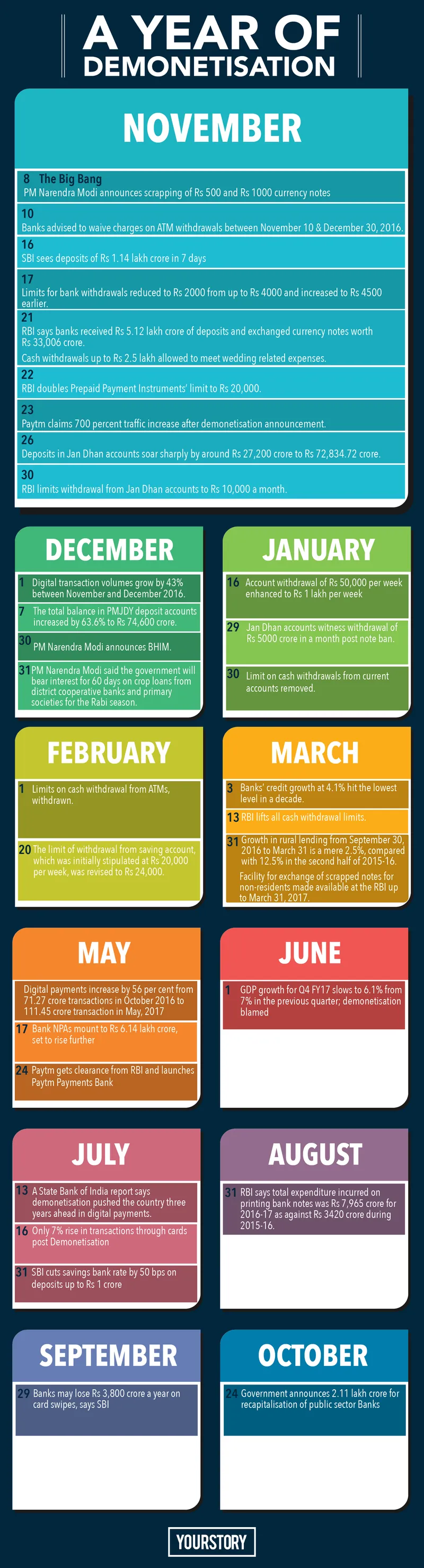

And at no other time in recent history perhaps did the immediacy of a situation separate the two ‘kals’ (the Hindi word for our yesterdays and tomorrows) as the late night announcement on November 8, 2016.

In one stroke, the government made Rs 500 and Rs 1000 denomination notes invalid, leaving the 1.344 billion people of the country in a limbo where their tomorrow would never again be the same as their yesterday.

Cold cash, warm feeling

At exactly this day last year, as I was settling into my seat on the Chennai Mail feeling warm and fuzzy with some cold hard cash, all in Rs 1000 notes, that I received as prize money (for an article), my co-passengers announced that Modiji had demonetised the high-value notes.

Suddenly, the bulge in my wallet seemed a heavy burden. In a matter of a few hours, the crisp notes were soiled, rendering them just pieces of paper with no value. While the gentleman on the opposite seat punched his fist in the air in a mock attack on “saale, black money hoarders, this will teach you,” I sat with a pasted smile on my face unable to fathom the impact of this ‘surgical strike’ as it came to be known soon after.

What followed the next day and for many days to come is by now well documented. Suffice it to say that the train was no longer chugging. It was out of control. And it would take a lot of tears, sweat, and blood of the aam aadmi before the situation could settle into some sort of semblance at least for people like us.

Towards a cashless society

Somewhere around the time when the ATMs ran dry and the queues outside seemed unending, the narrative in favour of demonetisation shifted to include the fact that this move will usher in a society that is cashless. A push towards the government’s Digital India vision bringing in the much-needed transparency and corruption-free India to accelerate the country into the next century.

In an economy which is 90 percent cash-reliant, this was easier said than done. But with 86 percent of the currency out of circulation, it seemed like the most logical step forward -- push people to transact online.

As Bhaskar Chakravorti, author of The Slow Pace of Fast Change, and Senior Associate Dean of International Business & Finance at The Fletcher School at Tufts University and founding Executive Director of Fletcher’s Institute for Business in the Global Context, wrote in an article in HBR, “...how do we evaluate the potential impact of the demonetisation move in getting digital payments past a tipping point? I would argue that, despite the high costs of cash, telling people – as the Prime Minister did — to go cashless is putting the cart before the horse. The horse in this case is the digital infrastructure and establishing a threshold of trust in the system; beefing up this digital ecosystem should come first. India’s digital state (it ranked 42nd out of the 50 countries we studied in our Digital Evolution Index), does not engender the threshold of trust needed for cashlessness to take hold in a meaningful way.”

A year after demonetisation, it is worthwhile to see how far we trust our digital infrastructure and how successful the government has been in weaning us away from cash. Lucky for us, we do not have to go far to arrive at our thesis that cash still remains king in India.

It is all about infrastructure, infrastructure, infrastructure

Every year, as a part of Global Information Technology Report, the World Economic Forum releases the Networked Readiness Index (NRI) or Technology Readiness. This year, it placed India at number 91 out of 139 countries. This index measures the impact of IT on a country and how it has leveraged it to grow. Singapore is at number one position followed by Finland and Sweden.

Incidentally, India has slipped down the rank over the years. In 2015, it was ranked 89th, in 2014, 83rd, and in 2013, it was placed at 68th rank.

What this essentially means is that reasonably well-educated city dwellers like me say a small prayer every time they stand in the queue at the payment counter of a shopping mall while handing out their debit or credit card to the cashier. What if there’s something wrong with the POS machine? Or what if there’s no network and the machine is unable to connect with your bank’s server? We are constantly asking these questions.

Incidentally, as of July this year, the Reserve Bank of India (RBI) data notes that the number of debit cards issued by various banks was about 69 crores while the number of credit cards stood at more than 2 crore. Clearly, the benefit of moving to online transactions is not lost on us if only we can trust the infrastructure.

Google India and The Boston Consulting Group predict that by 2020, “Digital transactions will happen at 10 times the current level.” So yes, demonetisation may well be forcing us to change our habits of relying less on cash and more on online transactions.

'Cash is fast, no'

Last week, two of our intrepid reporters jumped on an autorickshaw zigzagging their way through one of Bengaluru’s suburban markets to find if cash still ruled the small and medium businesses in India. According to an Ernst&Young report, there are around 600,000 distributors and 12 million mom-and-pop retailers in India.

Long used to Ola Money and Uber Pay, they fished out their smartphones to pay the autorickshaw fare, but ended up having to break their new Rs 2000 note for a Rs 60 ride, as the driver nonchalantly claimed, “Madame, cash is quicker.”

RBI data shows that as of April 2017, Rs 2,171 billion was withdrawn just via ATMs. UPI transactions at that point were at Rs 22.41 billion, meaning that UPI replaced cash by one percent. Cash withdrawals, which were at a low of Rs 850 billion in November last year, saw an increase to Rs 2,262 billion in March this year. Pre-demonetisation in October 2016 and September 2016, this was at Rs 2,223 billion and Rs 2,551 billion respectively. This suggests that the economy is back to cash again.

Yes, ATMs are no longer dry and they better not be if you are deciding to take a road trip as this reporter did and ended up having to pay for most things in cash.

According to her report, “NPCI data showed that as of May 2017, BHIM had over 14.54 million downloads. But the downloads don’t match up to the 300 million smartphones in India. From hotel stays to restaurant food bills to other miscellaneous expenses, either the machines refused to accept my card or the staff didn’t care much about digital payments.”

Cashless, a new habit

An old habit my mother tried to inculcate in me (but failed, alas) is the one that all middle-class housewives take pride in -- stashing away some money in a safe corner of their almirahs to be fished out triumphantly in times of family emergencies.

It was heartbreaking to see the axe of demonetisation fall on this neat stash, as many women stood exposed; their families unable to decide whether to marvel at how much they had ‘saved’ over the years or be offended by the act of deception.

It is just as well that demonetisation is forcing them to adopt a more formal way of saving. And though we can go on about the merits and demerits of demonetisation, one thing is clear, it is time to start changing old habits that stop us from going cashless. If nothing else, the satisfaction it will give you in the event of a burglary in your house is well worth it.

(For more stories on demonetisation visit here )