Ladies, you are smart investors – just #BeMoneyConfident

Women constantly tell me they find investing boring and complicated. They tell me they wouldn’t like to lose their hard-earned money in what appears to be a casino – the sharemarket. They tell me they don’t want to spend their precious time looking at financial investments. Here’s the thing. All these statements show women have the skills to be smart investors.

Yet we see mostly men investing, even if it’s on behalf of the women in their lives. We see women’s retirement savings lower than those of men. We see them relying on the good graces of men. So what gives?

Women are doing a lot of things right. They are just missing a few key things that will make all the difference. So I made a series of three videos, just two minutes each, to highlight these little tweaks that can make all the difference.

Investing is simple; just match investments with goals

In the first video, I show that investing can be as intuitive as cooking if you know the basic recipe. You don’t need to follow business channels every day.

The basic concept of investing is actually quite straightforward, even boring. It involves buying ‘appropriate’ assets at a good price and then being patient for a very long time.

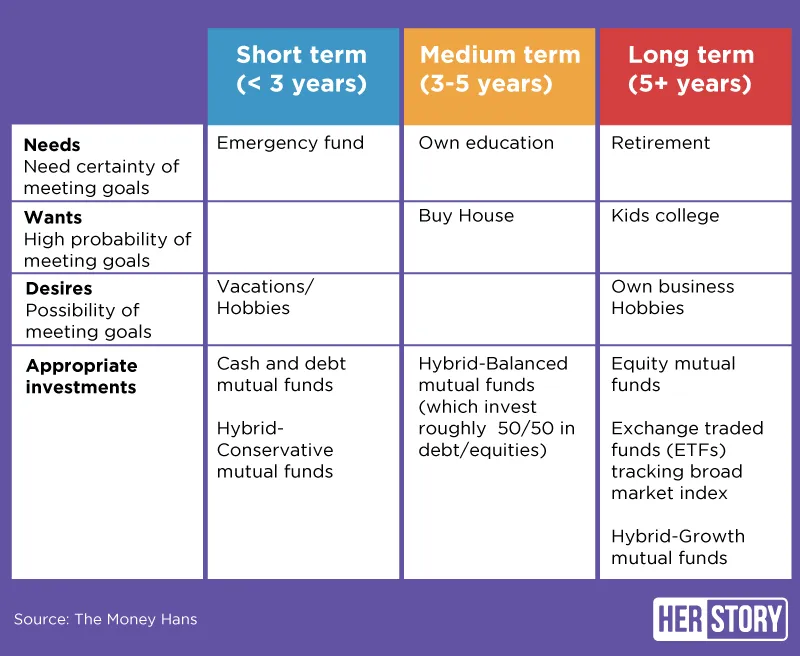

So you can make a list of your goals, and group them into ‘needs’, ‘wants’, and ‘desires’, or into short-term (less than three years), medium-term (3-5 years), and long-term goals. You can then invest in assets with similar risk characteristics and time horizons. Your financial plan could look something like this table:

Can’t investments lose money? Getting started is the hardest part

We all hear about people losing lots of money in the sharemarket, so we are absolutely justified in asking the question. Warren Buffett, the world’s richest investor, also hates losing money. So how does he manage to make so much money from the same sharemarket? He does his homework and then invests for the long term.

In the second video, I highlight that we rely on others because it’s convenient. But when pushed into a corner, we have to roll up our sleeves and jump in. We should definitely take all precautions to protect our downside. In investing it means we should ask a lot of questions, diversify our portfolio, and focus on ‘appropriate’ investments rather than what gets sold as ‘best investment’. But then we need to take that first step and get started.

I can’t list all the questions here, but I will soon start posting short videos answering ‘frequently asked questions’ that I can find on social media. Women are welcome to send in queries on social media (@themoneyhans), or even via direct messages on my Facebook page.

Support goals with good habits

In the third video, I compare investing to dieting fads. While goals can be good motivators, we rarely achieve them without good habits.

Just like we maintain our health with a good diet and hydration and daily exercise, we need good habits like always upgrading our skills and knowledge to stay relevant in the workforce. We also need to save and invest regularly. By investing small amounts on a regular basis, rather than one big lump sum at a particular time, we spread our risks over time.

We all know enough to do what I’ve listed here. I believe the only thing we lack sometimes is the confidence. Call it good luck or circumstances, I’ve studied for the best qualifications and worked for the biggest investment consulting firms in the world – just to realise that investing is common sense. But the proof is in the pudding, right? I quit corporate life before turning 40, and now I do what I love doing. I would love to see you do that too.

Be Money Confident.

Hansi Mehrotra is the Founder of The Money Hans, an investor education initiative.

(Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the views of YourStory.)