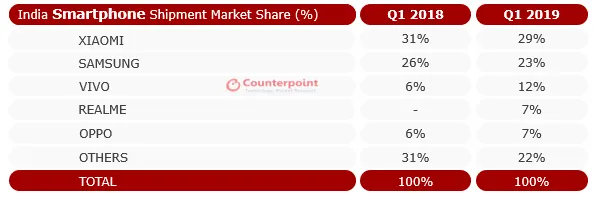

Chinese brands capture record 66 pc of Indian smartphone market: Research

The report says, the Chinese brands not only had the largest market share but also dominated the top five best-selling list.

The chances of you using a Chinese handset while reading this is quite high because the market share of Chinese brands in the Indian smartphone market has reached a record 66 percent during January to March (Q1 2019), according to a research report from Counterpoint’s Market Monitor service.

Chinese brands not only had the largest market share but also dominated the top-five best-selling list. Xiaomi Redmi 6A remained the top model following multiple price cuts, followed by Xiaomi Note 6 Pro, Redmi Y2, Samsung Galaxy M20, and Galaxy A50. The top 10 models contributed to 35 percent of overall smartphone shipments.

As a result, Indian brands reached their lowest ever share due to ongoing competition in the smartphone segment. Lack of refresh, strong competition, and slow growth of the entry-level segment where they had strong share were some of the reasons for their decline.

Commenting on the influx of Chinese brands, Tarun Pathak, Associate Director, Counterpoint Research said that data consumption is on the rise in India, and users are upgrading their phones faster as compared to other regions.

"This has led to users spending more on their purchase, which is driving up the overall average selling price (ASP) in the market. As a result of this, the premium specs are now diffusing faster into the mid-tier price brands. We estimate this trend to continue leading to a competitive mid-tier segment in coming quarters.”

In terms of volumes, the Chinese brands grew 20 percent year-on-year (YoY) mainly due to the growth of Vivo, Realme, and OPPO. While Vivo’s volume grew 119 percent YoY, OPPO grew 28 percent YoY.

Vivo’s expanding portfolio in the mid-tier (₹7,000 - ₹14,000 or roughly $100-$180) drove its growth along with aggressive IPL campaign around flagship V series, according to Counterpoint's Research. OPPO, on the other hand, focused on expanding its portfolio in the less crowded ₹15,000 - ₹25,000 (roughly $210-$350) segment, it added. Overall, India's smartphone shipments grew four percent YoY.

Anshika Jain, Research Analyst at Counterpoint Research, also pointed out that all the major brands expanded their footprint in offline channels to gain market share this year.

"Xiaomi has laid out big plans for offline expansion by increasing its number of retail stores (Mi Preferred Partners), Mi Homes, and Mi Stores specifically to target smaller towns. Realme, which started as an online-only brand, now gets majority of its sales from offline channels. OnePlus is also increasing its offline points of sale by launching exclusive stores across key cities,” she added.

Also Read: Mobile gone bust? Now get it fixed at home through Mobigarage