Uber’s upcoming IPO puts the spotlight on the ride-hailing startup’s bumpy ride to profitability

Ahead of the world’s largest ride-hailing company’s IPO, tempered investor expectations about the startup’s growth and profitability belie just how much Uber has cemented itself in our lives.

Uber, among the world’s most valuable startups, is set to go public on Friday, in what is expected to be one of the biggest U.S. IPOs since Chinese e-commerce company Alibaba debuted in 2014. Uber’s initial public offering (IPO) is also expected to be one of the largest technology IPOs of all time.

However, a lack of visibility around profitability and concerns over mounting competition and slowing growth, amidst growing discontent among its drivers, is taking the sheen off what promises to be one of the most highly-anticipated IPOs of all time.

“Over the last decade, as the needs and preferences of our customers have changed, we’ve changed too. Now, we’re becoming something different once again: a public company,” said Uber Chief Executive Dara Khosrowshahi in the regulatory filing.

Uber is expected to be valued anywhere between $80.5 billion and $91.5 billion when it debuts on the New York Stock Exchange under the symbol UBER on Friday. According to the company’s regulatory filing, Uber is offering 180 million shares priced between $44 and $50 per share.

Even at the top end of the range – where it is widely expected to price – the valuation is only a moderate jump from Uber’s latest valuation of $76 billion in August last year, suggesting more muted investor expectations about the startup’s growth prospects.

Also read: With Dara Khosrowshahi, Uber sees marked transformation after a year of bitterness

Dialing down expectations

Other details in the filing also echo similar tempered expectations.

The company warns that it may never achieve a profit, and growth in key metrics such as active users and revenue have already shown signs of slowing.

Uber’s monthly active users, which also includes Uber Eats, rose nearly 34 percent to 91 million in 2018 from a year earlier. However, this was a slowdown from the 51 percent growth it had recorded in 2017. The company recorded a 42 percent rise in revenue to $11.27 billion in 2018, but growth slowed from the 106 percent rise a year earlier.

Even so, Uber’s rapid growth to become the world’s leading ride-share provider cannot be denied. The market is dotted with fierce competition from rivals including Lyft in North America and Ola in India, as they each race to capture market share through discounts and promotions, which eats into profits.

Lyft, Uber’s largest rival in America, went public in March, and its performance is being closely tracked to understand how Uber may fare soon. However, in its first-ever report as a public company on Tuesday, Lyft forecast slowing revenue growth for the full year.

As of Tuesday, Lyft’s shares closed down nearly 17.5 percent compared to its IPO price of $72, highlighting concerns about the company, and by extension, Uber’s unpredictable ride to profitability.

Still, Uber is a more entrenched player, with a strong presence in more markets overseas and verticals such as food delivery and freight, which could raise even more concerns about how the company will continue to manage cash burn and operating expenses.

“What began as a ‘tap a button and get a ride’ has become something much more profound: ridesharing and carpooling; meal delivery and freight; electric bikes and scooters; and self-driving cars and urban aviation,” Dara Khosrowshahi said.

This, in turn, has meant fierce competition across its verticals, including in meal delivery and freight, and resulted in driver ire due to the company’s bets on self-driving cars and electric bikes and scooters.

Also read: Uber India’s first drivers' roundtable with Dara Khosrowshahi raises questions

Uber’s woes: rising competition, driver discontent

In India, Ola is the dominant player, with more than 50 percent of the market share, according to 2017 data from Statista. Ola currently operates in more than 110 cities in India, in comparison with Uber, which is present in 40 Indian cities. India’s Ola has also taken the fight with Uber international, expanding into markets like the UK, Australia, and New Zealand.

In India, the UK, and Australia, Uber competes with Ola

In its filing, Uber admits that many of its competitors are well-capitalised and offer discounted services, driver incentives, consumer discounts and promotions, innovative products and offerings, and alternative pricing models, which may be more attractive to consumers than those it offers.

Further, Uber believes its rivals in certain markets enjoy substantial competitive advantages such as greater brand recognition, longer operating histories, better localised knowledge, and more supportive regulatory regimes.

“In India, for example, our Uber Eats offering competes with Swiggy and Zomato, each of which has substantial market-specific knowledge and established relationships with local restaurants, affording them significant product advantages,” Uber said in its filing.

“As a result, such competitors may be able to respond more quickly and effectively than us in such markets to new or changing opportunities, technologies, consumer preferences, regulations, or standards, which may render our products or offerings less attractive,” it added.

Uber also acknowledged the effect that greater competition was having on its market share. Statista shows that in October 2018, Uber occupied 69 percent of the U.S. ride-hailing services market, down from 74 percent in September 2017.

Uber noted that its market leadership position declined significantly in the United States and Canada after “adverse publicity events” in 2017. This is an oblique reference to the various allegations that Uber fostered a negative and toxic work environment, which sparked the #DeleteUber campaign and culminated in the resignation of Travis Kalanick as CEO.

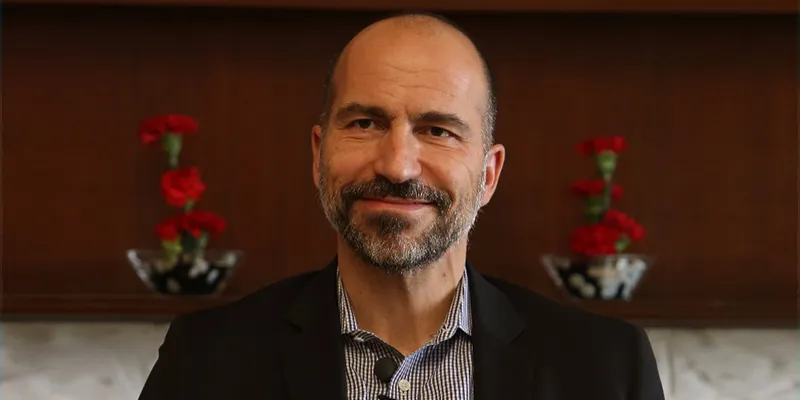

Uber Chief Executive Dara Khosrowshahi

“In getting from point A to point B, we didn’t get everything right. Some of the attributes that made Uber a wildly successful startup… led to missteps along the way," acknowledged Dara Khosrowshahi wrote in the filing. He added,

"When I joined Uber as CEO, many people asked me why I would leave the stability of my previous job for one that was anything but. My answer was simple: Uber is a once-in-a-generation company, and the opportunity ahead of it is enormous."

When YourStory founder Shradha Sharma met Khosrowshahi last year, she was struck by the difference between him and Kalanick. She wrote at the time,

“The first thing that struck me when Uber CEO Dara Khosrowshahi began his roundtable address in New Delhi was how different he sounded from his predecessor. Travis Kalanick, it seemed, had always enjoyed the media, being the centre of attention, being in the limelight. Dara could not be more different.”

Since assuming office as the CEO, Dara Khosrowshahi has made great strides in pushing the company towards maturity, including making necessary changes to ensure the ‘company culture rewards teamwork and encourages employees to commit for the long term.’

And yet, the company does not consider its three million drivers as employees, but as independent contractors. This has long been a bone of contention between Uber and its drivers, who complain about shrinking compensations and bonuses, which has in turn has attracted a lot of attention from regulators.

Dara Khosrowshahi has taken steps to address this, including paying $300 million to over 1.1 million qualifying drivers around the world and introducing Uber Pro, a rewards programme for drivers in the United States. But the company expects driver dissatisfaction to increase as it aims to reduce driver incentives to improve its financial performance.

“Driver dissatisfaction has in the past resulted in protests by drivers, most recently in India, the United Kingdom, and the United States. Such protests have resulted, and any future protests may result, in interruptions to our business,” the company said in its filing.

Also read: Khosrowshahi wants transparency to occupy driver's seat at Uber

The long road ahead

All this means, that Uber has a long road ahead, balancing investor expectations of profits with a vocal community of drivers and regulators pushing for change. This, especially as the company seeks to be more than an alternative to taxis.

“We are an alternative to taxis. But really what we want to be is an alternative to car ownership itself,” Dara Khosrowshahi has said.

Indeed, Uber’s dominance in its geographies has made it synonymous with the field it helped create, like Google and Xerox, and that kind of impact cannot be erased. For the near future, operating expenses and losses will continue to rise, but the excitement around the IPO proves that the company will be up to the challenge.

“There are developed markets that we are going to continue to invest in, they are going to be more profitable…But (at this time) we account for less than 1 percent of the overall transportation industry. This is a $5 trillion industry that we are competing in, and that is the ultimate size of the pie that we are aiming for.”

Also watch: How the #WomenofTech at Uber are making real impact