How COVID-19 changed everything for diagnostics services startup Redcliffe Labs

Incorporated in 2018 by Dheeraj Jain, Redcliffe Labs, a unit of US-based Redcliffe Lifetech Inc, strives to provide affordable diagnostic tests and quicker results.

On May 19, 2022, a drone carrying the blood sample of a patient in a 5 kg temperature-controlled payload travelled from Gyansu near Uttarkashi—a small, hilly town in Uttarakhand—to Vivek Vihar in Dehradun, the state’s capital. The first commercial drone flight completed the journey—which would have taken about six hours by road—in 88 minutes, with one battery swap for an aerial distance of 60 kilometres.

In Dehradun, at Redcliffe Lab’s diagnostics centre, the sample was tested and the company sent the result to the customer the same day. The project was a part of the Redcliffe Labs’ tie-up with Skye Air Mobility, a drone delivery tech startup. As part of the project, it will operate two flights daily from Uttarkashi to Dehradun.

The tie-up falls in line with the goals Dheeraj Jain, Founder of , set for the company of providing access to diagnostic healthcare services.

A serial entrepreneur, Dheeraj previously founded investment firm Redcliffe Capital, personal hygiene brand Peesafe, and Crysta, an end-to-end prenatal diagnostic services platform.

He incorporated Redcliffe Labs, a unit of US-based Redcliffe Lifetech, in 2018. The startup is headquartered in Noida, Uttar Pradesh.

The origin

The turning point in Dheeraj’s life came when he lost two relatives to cancer. This made him think about India’s healthcare system and why a large section of the population does not have access to diagnostic centres.

The Indian diagnostic industry is highly fragmented and under-penetrated despite the presence of over one lakh labs, according to a report by Edelweiss.

The industry remains largely unorganised with hospitals, standalone centres, and larger chains forming a part of the ecosystem. Further, organised diagnostic chains—including SRL Diagnostics, Metropolis Labs, and Dr Lal Path Labs—only have a 16 percent market share, as per the report.

A large chunk of revenue (about 55 percent) is decided by referrals from doctors and hospitals, which ends in driving up the prices. The market also remains unpenetrated as not many people take up tests.

Dheeraj’s initial approach to solving the problem was to offer super specialised tests in its labs. The first of them was genetic testing.

“These tests are based on research; they are very innovative and will be very relevant (to clinics),” the Founder of Redcliffe Labs tells YourStory.

In 2018, the company set up a lab in Delhi, a clinical team, and a portfolio of tests, including genetic testing and maternal health diagnostics.

By the end of the year, the startup went to the market, targeting Delhi-NCR, Hyderabad, and Pune. It worked with scientists and doctors, who started doing testing for their patients by sending samples to these labs, ensuring faster turnaround time and affordable pricing.

“We invested in scientists, scientific platforms, and clinical quality, which people don’t do even today,” he quips.

Gradually, the startup also started offering semi-routine tests—such as those for thyroid and vitamin—as well as routine tests including blood, urine, liver, and kidney tests.

The turning point

Up until now, the company was not conducting tests in large volumes. “We were still very small because we were more focused on sequencing,” Dheeraj says.

However, everything changed when the COVID-19 pandemic struck in 2020. There was a need for genome sequencing of the new virus and Redcliffe was ready to bank on its two-and-a-half-year experience.

The startup’s existing PCR (Polymerase Chain Reaction) infrastructure allowed Redcliffe to conduct COVID-19 testing.

“That was the start of a new era,” he quips.

The pandemic also led to a change in consumer behaviour.

“Consumers were now getting tested for the first time at home,” Dheeraj says. This made the company think about the larger testing portfolio, and how the market was adjusting to home collection services—which were earlier only availed by a handful of customers.

Sensing a huge opportunity, the team decided to adapt its operations to this business line. “In 2020, the company spent time and energy to build technology for home collection, developing the infrastructure for taking the sample from home to lab, and reporting the same day,” he explains.

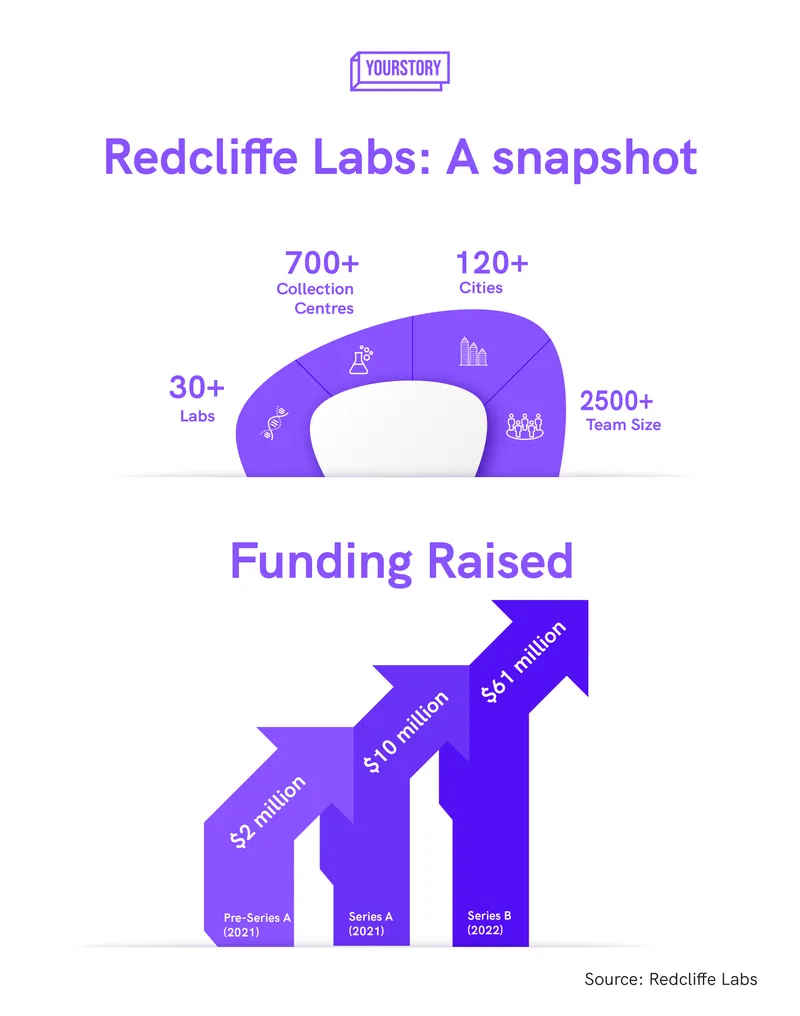

In March 2021, Redcliffe Lifetech raised about $2 million in a Pre-Series A funding round from Alkemi Venture Partners, Y Combinator, and LetsVenture, among others.

What does it offer?

Redcliffe Lifetech has five offerings—direct to consumer, direct to clinics and hospitals, specialised collection centres, radiology tests, and IVF.

Its home sample collection service is present in more than 120 cities, with 30+ labs and 700+ walk-in wellness and collection centres across India.

About 40 percent of Redcliffe Lifetech’s revenue comes from online test bookings. The company says its present annual revenue rate is about $55-60 million, and aims to grow it to $100 million by September 2022.

The latest available filings with the Registrar of Companies share income details from January 30, 2021 to March 31, 2021.

While many diagnostic labs provide home collection services, consumers still have to schedule testing, which is a task. Redcliffe Labs’ phlebotomists use an app which tells them the most effective way to collect samples, which is done by noon.

After collecting two samples, they pass them on to a rider, who takes them to the lab in temperature-controlled boxes which can be monitored in real-time.

The startup collects about 5,000 samples a day, with a 2,500-people team on the ground.

“When we are operating in cities where we don't have a lab, all the samples collected are shipped the same day, and the results come the next day in the morning,” he says.

Another problem is affordability. For example, it provides different packages for body check-ups, ranging from Rs 399 to Rs 850, while heart tests range from Rs 1,099 to Rs 1,599.

Dheeraj says Redcliffe Labs claims to keep prices low by not giving cuts to doctors. “We pass on the doctors, who have a massive reference price, and go straight to consumers. We don't pay doctors and pass on the benefit to consumers.”

It is betting on modern technology, self-owned lab setup, efficient machines, minimal human intervention, and the volume of samples tested to reduce the price.

The company competes with organised diagnostics chains as well as regional and local standalone test centres.

Funding and road ahead

In May 2022, the startup raised $61 million led by LeapFrog Investments. In 2021, it raised another $10 million, which Dheeraj says helped build the infrastructure.

So far, it has raised more than $73 million.

Now, the company plans to reach 500 million Indians in the next five years by targeting Tier-III and IV cities. It is also adding about 75 more labs in Chennai and Kolkata, among other cities.

“We already have 900 signed collection centres, which will be opened soon. We will increase this to 1,000 operating collection centres by September and 2,000 signed collection centres and 1500 operating by December, respectively,” Dheeraj says.

By December 2023, he aims to have 3,000 active collection centres performing 15,000 home collections every day.

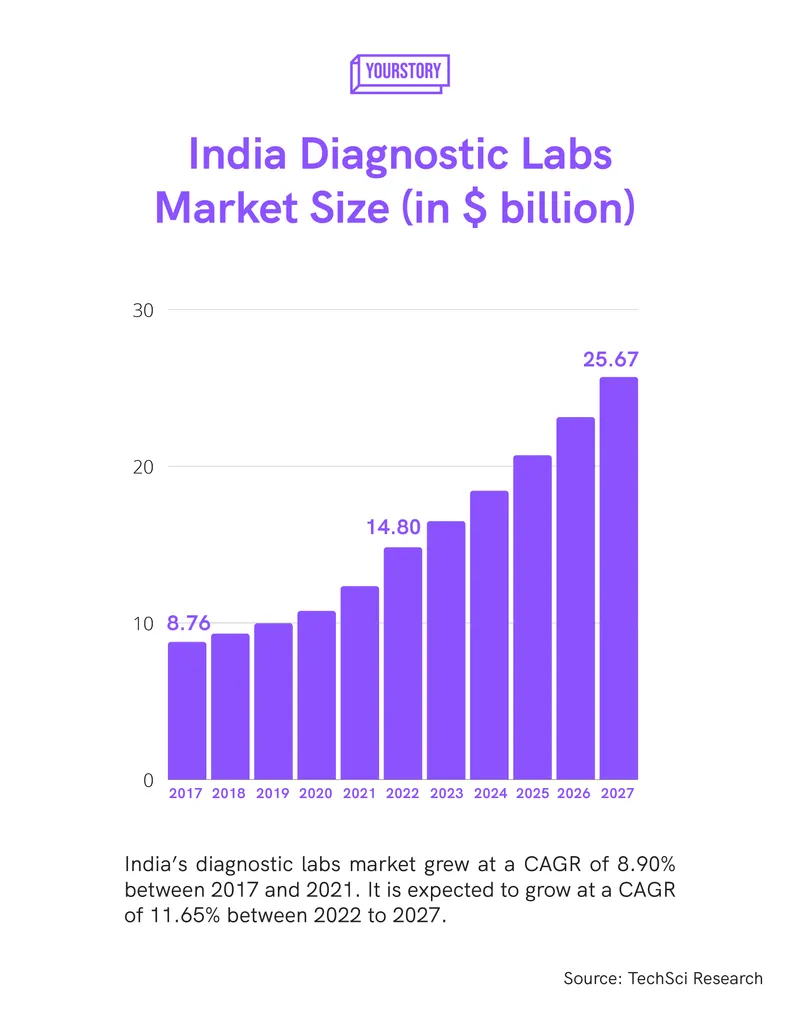

According to a report by Techsci Research, India’s diagnostic labs market is a $12.3 billion industry, growing at a CAGR (Compound Annual Growth Rate) of 11.65 percent. It is expected to grow to $25.7 billion by 2027.

(The story has been updated to reflect the correct team size in the infographic.)

Edited by Kanishk Singh