This SaaS startup is helping Shopify merchants with customer data

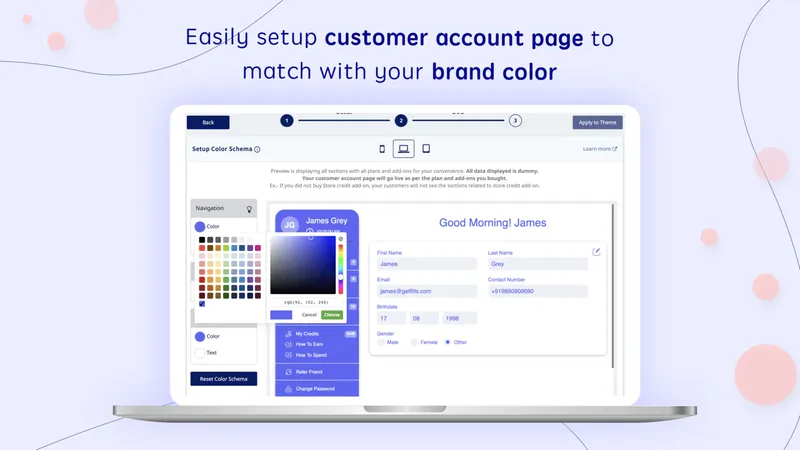

Ahmedabad-based Flits helps businesses and merchants using Shopify with solutions such as customer account page, reward program, social logins, and wishlists.

Ecommerce websites these days offer customers more than just a place to purchase products. They offer features that will make customers want to come back for more.

To enhance customers’ pre and post-purchase experience, Gunjankumar Patel and Milind Patel founded Software-as-a-Service (SaaS) platform in 2017. The Ahmedabad-based startup offers solutions such as customer account page, rewards program, social logins, wishlist, integrations, and customisation to businesses that use Shopify.

With the ecommerce industry booming, Flits provides customers with an account page where they can see all the data in an organised way like their profile, store credits, wishlist, order history, recently viewed products, delivery address, store credit, and other rewards program.

“We are improving customer returns for a long run value,” says Gunjan. “We are not like the direct marketing features, but indirectly we are keeping the customer base. We are adding value to customer data for merchants.”

At present, close to 5,000 Shopify stores are using the platform in over 100 countries. Some of them include MPL, The Man Company, and others.

Founding Team, Flits

How was it started?

“Players like Amazon, Flipkart, and many others provide these experiences in a very organised way, but Shopify did not have the same facility. Hence, we came up with this idea,” Gunjan tells YourStory.

This is not the first venture started by the school friends turned co-founders. They first started an online kite-selling platform called GMODI.com (Gunjan-Milind online distributor) during their college days.

“Milind and I wanted to start a business of our own. This led us to start the kite business. But after that, our families wanted us to find a job,” shares Gunjan.

Milind and Gunjan then joined Lucent Innovations. Later, they started a service-based company called eFANTOM, where they built customer applications based on the needs of their clients.

Using this experience and understanding of the market needs, the founding team started to work on Flits.

“After a lot of analysis and R&D, we came up with this idea and started working on it, and we launched the first phase in December 2017,” says Gunjan.

In the first month, the startup on-boarded three clients from the USA and India, earning Monthly Recurring Revenue (MRR) of $28 in the beginning.

With a 15-member team, the startup now has an MRR of $15,000, and recorded $700,000 in ARR for FY22.

The challenges

Speaking about challenges, Gunjan says, the biggest challenge the company faced was a lack of product awareness.

“Because we are the first customer account page related app in the ecosystem, we needed to highlight to the client about the key advantage point as it’s not a direct marketing feature, but it improves customer retention,” he says.

The problem that Flits chose to solve was a very minuscule part, which was always ignored. Solving something new meant more questions and more wariness among the customers.

Gunjans says they had to work a lot on building trust, but after they were able to gain some customers, the customer feedback helped the company reach the point where it is now.

The second challenge was finance. Flits is a bootstrapped startup and has not raised any funding. This allowed the company to be frugal with its expenses and it invested mostly in technology building, and depended on word of mouth for marketing.

Client stories

According to Gunjan, the company has helped its clients with an average of over 75% increase in revenue and customer retention.

For instance, in one of the case studies published by Flits, it said The Man Company increased its orders by 41% using store credits. The company had reached out to Flits when it was working to enhance its customer experience by categorising its customers based on their interaction with the brand, to gamify their rewards, and loyalty program. But at the same time, it wanted to bring all the customer data to a single dashboard.

The company was finding it difficult as it could not withdraw store credits after a cancellation. Flits helped the company solve this issue by setting up a tiered rewards program (a gold customer would get a 15% reward while a silver customer will receive a 10% and revoking of store credits in case of cancellation.) This led to a 91% increase in average order value with store credit.

Flits works on a subscription model with three plans—Basic, Business, and Enterprise. Its charges start from $5 per month. Currently, the startup gets its revenue from Shopify customers. It has plans to launch a similar software for ecommerce industry in the coming months.

The market and plans ahead

A 2016 report by Canada-based Bond Brand Loyalty, in collaboration with Visa, shows that 81% of customers are more likely to be loyal to a brand that offers a customer loyalty program.

“As per current ecommerce market, we can expand our software in many directions, which will add value to the customer,” says Gunjan. “We would like to add innovation, which adds value to customer experience as an end user for Tier II, Tier III, as well as rural areas.”

The startup is now planning to build software for the ecommerce industry and launch it by 2023. It has also integrated with a few PoS systems where business owners can manage their online and offline (retail) stores through Flits software. With this, the owner can have a single point of data storage instead of individual data.

“We are planning for a standalone product so that we can provide our software to other businesses apart from Shopify,” shares Gunjan.

Globally, the startup competes with Growave, Smile.io, and Yotpo to name a few.

Edited by Megha Reddy