PhysicsWallah’s marathon sprint: India’s youngest edtech unicorn hot on heels of BYJU’S, Eruditus

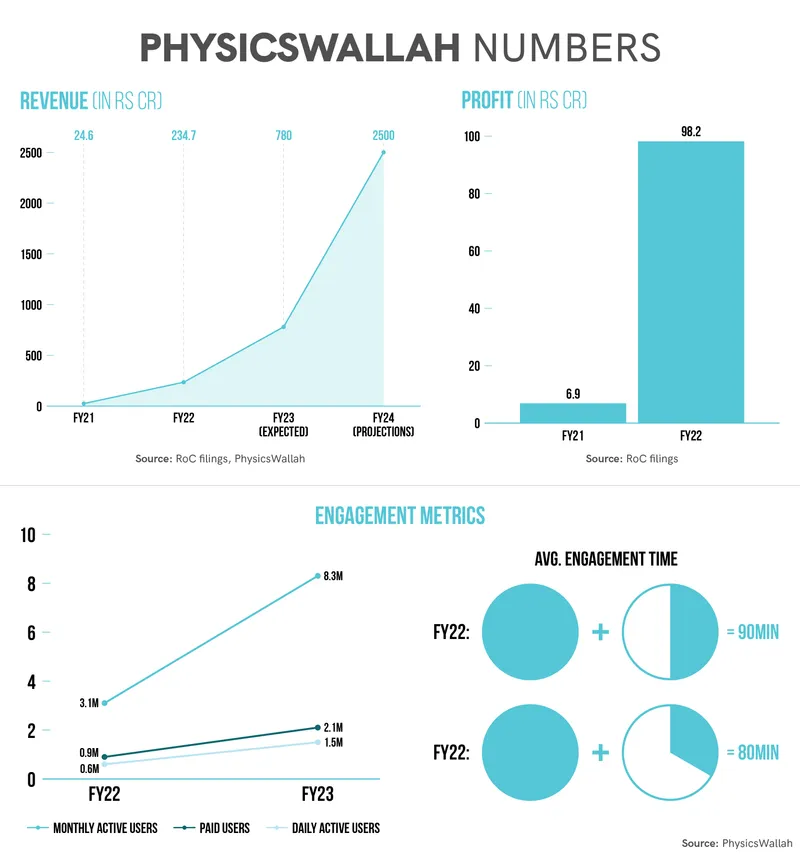

The three-year-old startup is growing at a faster clip than its more entrenched competitors, projecting a 3x revenue growth for FY 2022-23 and expecting to breach the Rs 2,000-crore milestone with a similar jump this year.

Key Takeaways

- PhysicsWallah expects to score a third consecutive year of profitability in FY 2022-23

- Sees revenue growing 3X to Rs 780 crore in FY2023, up from Rs 233 crore in the year prior

is eyeing a rather unique hat-trick despite the particularly tumultuous phase the rest of the edtech sector is going through: a third consecutive year of profitability.

PhysicsWallah, or PW, has been a rare profit-making edtech startup ever since its incorporation in 2020, registering a 14-fold jump in the fiscal year 2021-22. For the just-concluded FY2023, Co-founder Prateek Maheshwari said he expects the edtech unicorn to register a “sizable profit” riding a three-fold increase in revenue to about Rs 780 crore ($95 million).

That's not it. For the ongoing financial year (FY 2023-24), the company is targeting revenue of Rs 2,500 crore ($300 million) at the group level, Maheshwari told YourStory in an exclusive interaction. Of that, about Rs 1,900 crore revenue would flow from its core operations and the rest through acquired businesses, he said.

That target revenue leaps beyond a significant milestone in the broader sector, considering that and took about a decade to cross the Rs 2,000-crore mark.

“We are fundamentally a cash-generating company, so every year we generate cash and we invest in our growth,” Maheshwari said, adding that for FY 2023-24, PhysicsWallah is targeting 20% EBITDA margin, also at the group level. EBITDA, or earnings before interest, taxes, depreciation and amortisation, is a measure of core operational efficiency.

These assertions from India’s only profitable edtech unicorn come at a time when several startups in the space, including the unicorns with projected valuations of at least $1 billion, are struggling to cope with mounting losses, slowing their expansion plans, and seeking to reduce their expenses amid a funding winter.

Eruditus posted surprisingly optimistic numbers recently, emerging as the second-largest revenue-grossing edtech firm in India.

The startup, which offers executive-level courses from top universities, maintained its revenue momentum in FY2022, surpassing the cumulative revenue of Unacademy, upGrad, PW, and Vedantu. But its loss widened—to Rs 2,645 crore in FY2022 from Rs 2,174 crore in the year prior.

While BYJU’S crossed the Rs 2,000-crore revenue mark in FY2020, and Eruditus came close to the number in FY2022, PW expects to go beyond in the ongoing fiscal year—its fourth full year of operations. BYJU’S was incorporated in 2011, Eruditus in 2010, and PW in 2020.

registered a revenue of Rs 719 crore for FY2022, Rs 679 crore, and Rs 169 crore. BYJU’S, which is yet to file its financials for FY2022, reported Rs 2,280 crore in revenue for FY2021.

Infographic credit: Nihar Apte

A key reason for PW’s strong growth, according to Rahul Maheshwari, Partner at -backed V3 Ventures, is its low customer acquisition cost, whereas, for several other players, that’s been a bottleneck. While V3 Ventures is not directly linked to an edtech firm, Verlinvest has backed BYJU’S.

PW, which traces its origins as a YouTube channel from 2016, continues to host more than three dozen channels with free content, garnering more than 22 million subscribers and over 500 million monthly views.

This allows PW to acquire paying users at minimal cost for its core business category, including preparation for competitive exams to professional courses, as well as for categories such as skilling and tests for government jobs.

PW is also one of the most affordable edtech platforms in India. According to the company, its fees for online courses are about one-tenth that of the competition’s, and about half for offline courses.

Fundraising and expansion

PhysicsWallah, which remained bootstrapped till its maiden fundraising in June last year, is sufficiently capitalised and does not plan to raise more money this year, said Prateek Maheshwari.

The startup, however, has been receiving interest from new as well as existing investors willing to partner for both equity and debt funding.

“Debt makes a lot of sense for PW as our equity is appreciating at a phenomenally high rate,” Maheshwari said, adding that the company would decide on whether to opt for a mix of debt and equity at an appropriate time.

While a fundraise could help bankroll a potentially transformational acquisition for PhysicsWallah, the edtech firm isn’t planning any significant purchase for at least the next six months, said Maheshwari, who as co-founder oversees products, technology and business affairs at PW.

In June last year, PW raised $100 million in its first round of funding from and at a valuation of $1.1 billion. After joining the unicorn club, PW has been on a buying spree.

It's utilised about 40% of the funds raised for mergers and acquisitions, Maheshwari said. Some of the acquisitions, such as of and were targeted at strengthening PW’s NEET, GATE and similar categories. Other deals were directed at expansions.

While NEET, or the National Eligibility cum Entrance Test, is an entrance test for admissions to undergraduate medical courses, JEE, or the Joint Entrance Examination, is for admissions to undergraduate engineering schools. GATE, or the Graduate Aptitude Test in Engineering, is for post-graduate courses.

In March, PW acquired UAE-based startup , marking its first international acquisition. Knowledge Planet has 10 centres in the UAE. PW is also planning on expanding to Oman, Qatar, Bahrain and Saudi Arabia, as well as to parts of North Africa.

A number of edtech companies, including BYJU’S and Eriditus, have also explored international markets through acquisitions and partnerships, although that approach hasn’t always worked out well in some instances because of problems related to scalability and oversaturation.

Maheshwari said PW has a “simple playbook”, where the company initially tests a market through its online channel. If it seems like a market has a need for offline or hybrid learning models, it then decides to venture through those channels.

He added that PW was following the same playbook in the Gulf Cooperation Council (GCC) region.

Infographic credit: Nihar Apte

PhysicsWallah is also firming plans to grow its footprint across India. The Delhi-based company is largely present in North Indian cities including Kota, Patna, Noida, Lucknow, and Chandigarh, with some offline centres located in the East and West as well.

Now, PW is working on growing in the southern parts of the country, and has “found a good partner in South India”, according to Maheshwari. Edtech companies like BYJU’S have a stronger presence in the southern states.

Maheshwari said PW plans to announce a partnership for the southern markets in a few weeks, adding that the firm will start with one partner and understand the market before expanding further. In the first year, it will offer its test preparation products for competitive exams such as JEE and NEET.

From schools to skilling

PW is also adding a lot more exam categories and working on a business model around schools. It currently enables schools to offer JEE and NEET preparation courses at the school level in 40 cities across India. These are mostly in Tier III and IV cities where “finding a good local coaching centre” is a challenge, Maheshwari said.

“We did a proof of concept last year. Now we are scaling and will be doubling down again on that model next year,” he added.

Although there’s demand for offline classes now, at PW, 95% of the students learnt through the “online mode” last year, with the number expected to drop slightly to 90% this year, according to Maheshwari.

In terms of revenue, about 65% came from online channels and 35% from offline in FY2023, which Maheshwari expects could change to 60:40 this year.

Skilling is also an important business focus.

PW has partnered with artificial intelligence and data sciences-focused edtech platform iNeuron to strengthen its skilling unit, a platform being used by college students as well as professionals for upskilling, per Maheshwari.

In February, PhysicsWallah formed a joint venture with e-learning platform to provide academic training and courses in various categories. Utkarsh will assist PW in strengthening its offline operations and building a robust hybrid learning model.

PW ventured into the offline space as well last year. In addition to PW Vidyapeeths, offline learning centres with smartboards, the company has Pathshala Centres, which bring face-to-face and online learning together.

The edtech firm said it has 60 company-owned and 12 franchised offline centres, and plans to double down on the number of centres in the next academic year.

While PhysicsWallah seems to be storming ahead with multiple experiments, it might need to tread with some caution given the current state of India’s once-exuberant edtech sector. Given that it’s relatively young, though, these experiments, including the multiple acquisitions, may be a necessity to power growth.

PW is new, so it can afford to make some mistakes and take bolder bets without being highly scrutinised as firms like BYJU’S and Unacademy are, said Siddharth Shah, who is a part of the investment team at , which has backed .

“We have not yet read about PW facing issues, which may mean slightly less scrutiny, slightly more headway, and slightly more patient investors, because their investments may be 12-15 months old," Shah said. "So the clock is not ticking yet.”

(Cover image by Chetan Singh; infographics by Nihar Apte)

(The story has been updated to correct a typo in the infographic)

Edited by Feroze Jamal