Flush with funds, ALLEN’s eager to ramp up its digital game

After more than three decades in offline coaching, ALLEN Career Institute is now looking to make an impact in the online space, as it takes on edtech giants and attempts to shake up the status quo in the sector.

Over 35 years ago, set up shop in the industrial town of Kota, which is today considered the coaching hub for competitive exams. Its first coaching centre, established in 1988, had just eight students.

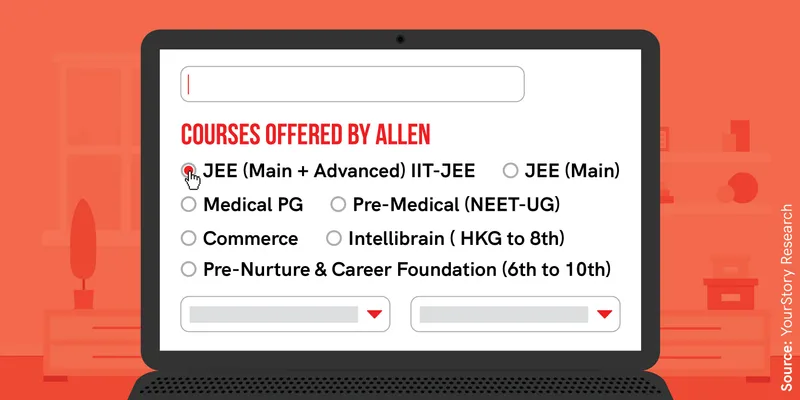

Since then, ALLEN has consolidated its position as a major coaching institute in the country—particularly for entrance exams in medicine (National Eligibility cum Entrance Test) and engineering (Joint Entrance Exam)—with over 50 centres across India, coaching over 2.8 million students till date.

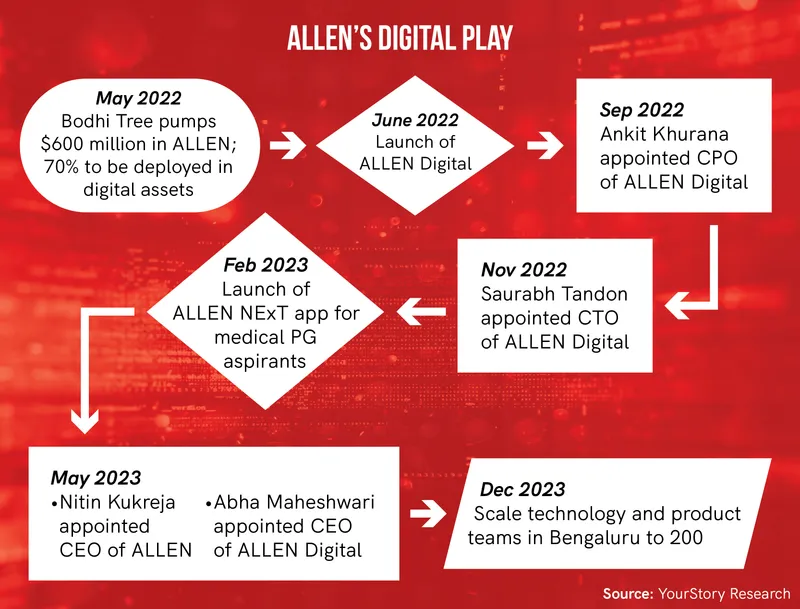

However, for long, it was missing from all the action in the online space, preferring to stick to the traditional format of coaching. That is, until last year. In June 2022, recognising the growing importance of the online education market, it entered the digital arena, after bagging funding of $600 million from Bodhi Tree Systems.

Armed with a deep understanding of the offline industry and bolstered by over half a billion dollars of funding and a growing student base, the company is now keen to make its mark in the online space.

Under its digital arm ALLEN Digital, the firm has launched interactive learning websites and mobile apps, catering to various undergraduate and postgraduate courses. It has also made several key hires at the C-suite level in the last six months to ensure it has the requisite leadership at the top to spearhead its digital business.

Last month, it launched the ALLEN NExT App—a platform for PG medical students to expand their knowledge through daily quizzes, conceptual videos, and practical videos to strengthen understanding of clinical topics. It also offers the latest news and updates, exam information, and a video bank that covers concepts tested in NEET-PG, INI-CET, FMGE, and NexT.

This strategic shift towards online coaching indicates ALLEN’s newfound intent to adapt to the changing landscape and establish itself as a formidable force in online education, by taking on some of the biggest names in the edtech sector.

Since the pandemic, there has been a notable shift towards the online medium, Aman Maheshwari, Managing Director of ALLEN Global Studies, tells YourStory. He says a chunk of the funds raised from Bodhi Tree—about 70%—is earmarked for expanding digital assets and digital coverage across India.

“ALLEN is a known offline brand for test prep. However, it was lacking an online presence. Considering other players, especially Aakash, which is leveraging BYJU’S online expertise, it was necessary for ALLEN to also get into online content delivery,” observes Anil Joshi, Managing Partner, Unicorn India Ventures.

He adds, “The raise from Bodhi gave ALLEN necessary resource allocation for online play and to avoid missing out compared to its aggressive competitors.”

The edtech company provides a comprehensive array of programmes catering to diverse student requirements at various levels. Its offerings encompass classroom coaching, distance learning, online tests, study materials, and now digital tools.

Infographic credit: Nihar Apte

ALLEN is venturing into the online space at a time when the market is saturated with companies of varying sizes. Is there enough space for another player with ambitious aspirations?

“The only disadvantage for ALLEN is that it’s a late entrant,” says Joshi. But online play shouldn’t be difficult for the company as it has its own content and money to spend to build a digital library of content, he adds.

Operational efficiency

The company has set an ambitious target of reaching 25 million students by 2028, which will be largely determined by the success of its digital journey in the next five years.

As the company scales up its digital play, it can take heart from the fact that its revenue has crossed the Rs 2,000-crore mark, on the back of an increase in student base.

According to Maheshwari, the student base has nearly doubled over the last year, and the company is on track to reach 3.5 lakh to 4 lakh students this year, through both the offline and online channels.

In FY2023, the firm clocked a revenue of Rs 2,600 crore, compared to Rs 1,900 crore in the previous year, as per Maheshwari.

In comparison, BYJU’S-owned Aakash Educational Services, a direct competitor to ALLEN—which also has a legacy of over three decades—expects a revenue of Rs 3,000 crore in FY23. PhysicsWallah is targeting a revenue of Rs 2,500 crore at the group level for the ongoing financial year (FY 2023-24).

ALLEN registered an EBITDA of Rs 600 crore in FY2023, up from Rs 450 crore in FY22, indicating the company’s focus on core operational efficiency.

The numbers are significant considering many edtech companies are struggling to carry out their operations profitably. Numerous startups in the industry, including unicorns, are grappling with mounting losses, slowing expansion plans, and actively cutting expenses in response to the current funding climate.

In FY21, BYJU’S registered a loss of Rs 4,564 crore; its EBITDA margin was -170.63%. upGrad’s revenue rose to Rs 692 crore in FY22, but losses widened nearly three times to Rs 627 crore. Vedantu and Eruditus too faced widening losses. PhysicsWallah recorded a profit of Rs 98.2 crore in FY22, while EBITDA stood at Rs 134.45 crore.

In edtech, it is crucial to find sustainable ways to maintain profitability, says Maheshwari.

In contrast to many edtech giants that allocate significant resources to advertising and marketing efforts, ALLEN has achieved significant growth without heavy expenditure in this domain, he says.

A digital approach will allow ALLEN to transcend the limitations of physical infrastructure and tap into a larger market, thus maximising revenue potential, he adds.

For 2023-24, the fee for IIT-JEE coaching (for class XII passed students) is Rs 99,999 for online coaching and Rs 1,59,000 for offline coaching.

For 2023-24, the fee for pre-medical NEET (UG) coaching (for class XII passed students) is Rs 95,999 and Rs 1,36,000 for offline coaching.

The average revenue per user (ARPU) from the online offering is less than that from the offline model. Having said that, if ARPU this year is similar to last year, the company could clock a much more significant top-line number, Maheshwari notes.

Digital gameplan

To facilitate its progression in the digital world in a structured manner, the company has strengthened its leadership by recruiting several people in C-suite positions.

Recently, Abha Maheshwari, who worked with Meta, joined as ALLEN Digital’s chief executive officer to lead its digital and technology teams in Bengaluru. Earlier this month, Nitin Kukreja, from Marigold Park, was appointed the chief executive officer to lead ALLEN’s transformation going forward.

In addition, the company has roped in Ankit Khurana as the chief product officer and Saurabh Tandon as the chief technology officer of ALLEN Digital. It also plans to hire a chief marketing officer soon.

Apart from top hires, ALLEN is also looking to scale its technology and product teams in Bengaluru to 200 by the end of the year.

Unlike its competitors, ALLEN has not spent significantly on marketing and promotions. But now, the company has started exploring marketing avenues to reach out to potential students and spread awareness about its digital offerings.

ALLEN has given a substantial boost to its social media presence across platforms. It is actively sharing videos on social media and organising live sessions on YouTube. The company is also showcasing its students’ achievements online through Twitter, LinkedIn, Facebook and Instagram.

At a time when several online edtech firms are ramping up their offline presence, is ALLEN’s strategy to up the ante on the digital front the right move?

Joshi thinks a presence in the online space will bolster ALLEN’s image as a holistic player. He believes it will help ALLEN capture the students it had lost out on earlier due to the absence of an online offering and expand its student base.

“Online presence will help in substantiating their offline delivery as well as their ability to reach out to a wider student base, who are not able to attend physical classes due to various reasons like distance, location or even non-availability close to their home,” he notes.

Infographic credit: Nihar Apte

Funding and growth

ALLEN says it is sufficiently capitalised and does not plan to raise more money immediately, says Maheshwari. The company is expected to receive over Rs 1,500 crore (~$181 million) in another tranche this year, as part of the $600-million infusion from Bodhi.

Unlike certain competitors in the edtech industry who have made acquisitions after securing funding, ALLEN has not yet pursued this path yet.

Apart from Aakash, BYJU'S has made other acquisitions, such as TutorVista and Great Learning, to strengthen its foothold in international markets and diversify its product portfolio. PhysicsWallah, with a dedicated allocation of $100 million for acquisitions, has acquired five companies within the last year. Its acquisitions include PrepOnline and Altis Vortex in the test preparation category, iNeuron in upskilling, and the international startup Knowledge Planet.

Going forward, ALLEN intends to foster growth through both organic and inorganic means. Given that it has substantial funds at its disposal, it is exploring M&A opportunities in new and proven technologies and assets.

The company has in fact allocated 20% of its funds towards mergers and acquisitions—Maheshwari says some of these acquisitions may happen by the end of this year or next.

“Given our extensive student base and the expertise of our faculty members, we are confident that there are a few companies out there that would be valuable acquisitions for us.”

Another significant goal for ALLEN is to go public within the next few years. The company is open to the possibility of raising additional funding, if necessary, prior to the public offering. Interestingly, BYJU’S is also preparing to list Aakash Educational Services.

Synergy between online and offline

The investment valuation of ALLEN was Rs 12,500 crore (~$1.5 billion) when the Bodhi funding happened last year. Currently, the company is valued at Rs 15,000 crore (~$1.8 billion), according to Maheshwari. Its objective is to attain a valuation of Rs 1 lakh crore (~$12 billion) by 2028.

“Accomplishing this ambitious target requires a concerted effort and a harmonious synergy between our online and offline components. By integrating both systems effectively, we aim to realise our goal,” says Maheshwari.

Even as the company prioritises online expansion, it hasn’t abandoned its offline business and is developing strategies, in tandem, to reinforce its offline presence.

Currently, the company has over 200 classroom centres in 53 cities in India, including Tier I and II cities. It plans to open centres in Hyderabad and the Delhi-NCR region this year. ALLEN is also looking to open offline centres for ALLEN NExT in Bengaluru, Delhi, Chennai and Hyderabad.

While the online space is no doubt new and exciting, ALLEN prefers to do certain things the old-fashioned way and even borrow best practices from its offline business model. The company aims to replicate its successful offline strategies to attract individuals to its online offerings.

Maheshwari elaborates that ALLEN will continue to emphasise the importance of instilling discipline among students who join its online platform and encourage students to adhere to the curriculum and maintain a consistent class routine.

Furthermore, the company intends to incentivise students for their commitment to discipline. It will provide online students the opportunity to access its offline centres, where they can personally interact with teachers to clarify their doubts and queries.

Competitors, Maheshwari says, prioritise marketing strategies over producing concrete outcomes, while ALLEN focuses on delivering tangible results and helping students crack exams such as NEET, and JEE. This, he says, has organically attracted students to its platform.

According to information on the websites of ALLEN and Aakash, 34 students from ALLEN were within the top 100 all-India ranks at JEE Main 2023, while Aakash had 11 students. A total of 22,007 Allen students were eligible for JEE Advanced 2023, whereas 12,918 students from Aakash were eligible for the same examination.

Going forward, ALLEN’s efforts will be focused on drawing students to the digital platform.

“If we want, we can always go to 20 cities and just open centres there. But we know that we need to tackle the digitalisation journey,” says Maheshwari.

“The focus this year is towards building a better product for students, getting feedback, initiating the feedback into our act, and then getting even better results and better products out there for students.”

Analysts believe the success of edtech players in the online space hinges on creating a pipeline of good content, increasing demand, and enrolling students well in time for them to reap the benefits of online learning.

ALLEN will be on a steep learning curve as it navigates its way through the hitherto unfamiliar digital landscape.

Edited by Swetha Kannan