SaaS—Elevation Capital’s newfound interest—seems to be paying off

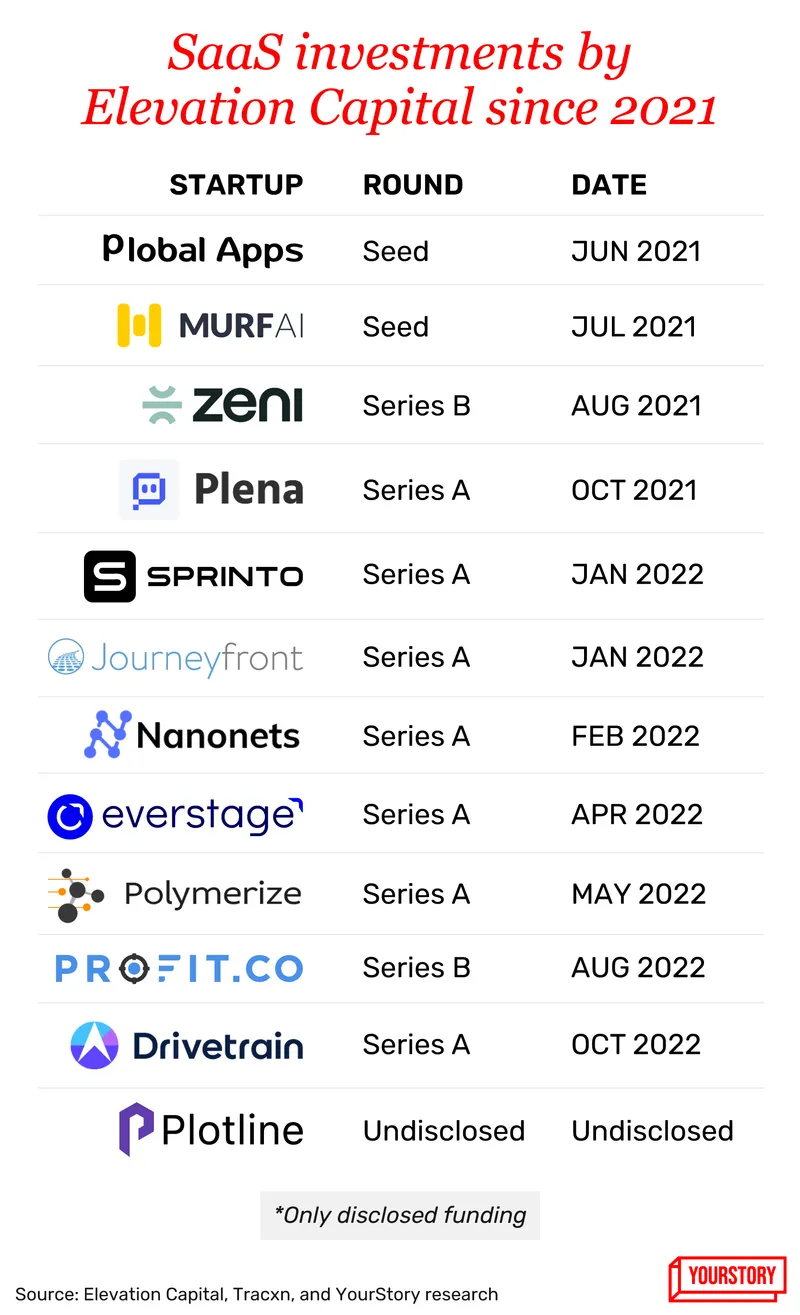

The fund, which has traditionally invested in consumer internet and fintech startups, is now betting big on software-as-a-service and has backed 15 SaaS firms in the last three years.

Known for its winning bets in the consumer internet and fintech segments, venture capital and growth equity firm is now saddled up for some success in the software-as-a-service (SaaS) space—an interest it has been nurturing for the last three years.

The Gurugram-based VC firm expects its investments in the SaaS sector to break out in terms of revenue in the next two to three years.

The optimism stems from the fact that five of the 15-plus SaaS companies it has backed since 2020 have crossed the $5-million annual recurring revenue mark.

“I am feeling better about the portfolio right now than last year when the companies would raise at 50-100X revenue, but the burn would also go up, versus now, when people are building the right way,” Mukul Arora, Co-managing Partner at Elevation Capital, tells YourStory.

Arora is referring to the fact that founders of SaaS startups have now pulled up their socks to drive efficiencies in fixed costs and marketing spends—something that was necessitated by a correction in valuation, after the buoyancy of 2021.

He isn’t deterred by the current slowdown in closing sales leads and the slashing of marketing budgets and believes that SaaS companies with “better products” will stand out and gain as well. In particular, SaaS startups in generative AI, devtools, and cybersecurity and vertical-specific SaaS will do well going forward, he adds.

The market buzz around generative AI has certainly benefitted some of Elevation’s portfolio companies, including , an AI-enabled voice-over startup, which the fund had backed in a seed round in July 2021. In September last year, the startup raised $10 million in a Series A round.

Murf has managed to grow nearly 5X over the last year, shares Arora.

, an AI-based document workflow automation company, which raised $10 million in a round led by Elevation Capital in February 2022, has also seen a revenue uptick.

To tap into the potential that SaaS startups offer, an eight-member team is actively building portfolio services and an advisory network for SaaS companies.

Elevation is not tied down to companies of any particular stage or life cycle and prefers to cast its net far and wide.

“Our investments over the last three years in SaaS have been spread across stages and life cycles of companies,” says Akarsh Srivastava, Principal at Elevation Capital.

These include companies in seed stage; those with super-early products such as Superops, Murf, and a couple of unannounced deals; Series A startups showing early signs of product adoption, such as Everstage, Nanonets, Profit.co, and Sprinto; and Series B firms as well.

On Elevation’s watchlist—at the seed stage—are SaaS startups with proven go-to-market (GTM) strategies and strong product muscle and customer-centric companies with evidence of quick product iterations.

For Series A and beyond—from a diligence standpoint—the VC firm is tuned to the voice of customers. Customer retention rate and churn metrics are the key parameters here, says Srivastava.

“We also spend a lot of time understanding acquisition channels and implications on lifetime value and customer acquisition cost paybacks.”

Bets on growth-stage companies

The venture capital firm is deploying capital from its fifth India-focused fund with a corpus of $670 million, and growth-stage startups continue to interest the firm.

Elevation Capital Fund VIII had earlier backed growth-stage companies, including Mintifi, which provides working capital for retailers, in February last year, and direct-to-consumer milk brand , in November 2020.

Arora says, going forward, the fund is likely to invest 25% to 40% of its corpus in leading growth-stage deals.

India funds of Elevation Capital

“Since we raised a larger fund, the core belief was to invest in scaled-up companies raising Series B and C rounds who want a partner who brings value beyond capital,” says Arora.

“We want to do more such investments, leading $20 million to $30 million rounds in companies where there is a strong meeting of minds and we can add more value.”

He clarifies that, unlike some of the other funds, Elevation is not planning to raise a separate growth fund vehicle—this is to ensure a single team works with startups across stages.

Consumer tech firms and consumer brands

SaaS may be the firm’s current area of focus, but Elevation is also an early backer of fintech and consumer internet companies.

In the last seven years, the firm has made 28 investments in consumer technology firms—including food technology platform , value commerce platform , Indian language social app , home services marketplace , proptech platform , and used car marketplace .

The firm is also an investor in consumer brands such as , wellness platform , and apparel brands and , writing cheques ranging from $2 million to $5 million at the seed stage and up to $25 million at the Series C stage.

“We have always admired and understood the business model and potential for consumer brands and were early investors in and Urban Ladder. The pace of investments has gone up in the recent past,” says Chirag Chadha, Vice President at Elevation Capital.

“This is driven by high quality founders building in the space. Digital-first GTM (strategies) have made it possible to build consumer trust and establish reach for new-age consumer brands much faster than a decade ago,” adds Chadha.

He adds that the firm has a portfolio of consumer brands that have grown past the Rs 1,000-crore revenue mark, such as Country Delight.

Elevation will continue to back consumer internet companies and consumer brands depending on the opportunity.

Of course, the lines between consumer tech companies and consumer brands are blurring, points out Arora, and adds that these companies have the potential to grow along with the rising per capita income.

Exit route and road ahead

What kind of exit strategy does the growth equity firm have in the current market scenario?

As growth companies stay away from the public markets for now, exits through secondaries have been on the rise for funds nearing the end of their lifecycle.

Elevation too has clocked multiple secondary sales recently, including those in listed fintech company and logistics unicorn .

The VC firm believes profitability is the key to ensuring sustainability in a tough market.

Most of Elevation's portfolio companies are focused on EBITDA breakeven, says Arora. Among its portfolio companies valued at over a billion, he expects at least 50% of them to turn profitable over the next 12 months.

While the firm is keenly looking at profitability from its investments, it is also willing to play the long game before making an exit.

“Even though capital markets are not in a great place, profitable consumer technology or financial service companies will have a lot of demand. As a fund, we are happy to remain invested for longer than 10 years. For example, we exited MakeMyTrip after 13 years and we have partnered with Paytm for over 15 years,” says Arora.

(Cover image and infographics by Winona Laisram)

The copy was updated to correct a quote.

Edited by Swetha Kannan