India's SaaS sector to reach revenue of $26B by 2026: Report

A report by Chiratae Ventures and Zinnov estimates that the Indian SaaS industry was set to grow to $26 billion in terms of revenue by 2026. It also expects Enterprise Value-to-Revenue ratios to recover to pre-pandemic levels over the next 12 months.

The Indian SaaS industry is set to reach $26 billion in terms of revenue by 2026, according to a report by venture capital fund and strategy consulting firm .

The report titled 'India SaaSonomics: Navigating Growth and Efficiency' offers a cautiously optimistic outlook for the Indian SaaS sector, which turned out to be more resilient, showing less decline than the US and EU when it comes to Enterprise Value-to-Revenue (EV/R) multiples. The commonly-used valuation metric compares a company’s enterprise value to its revenue.

“Before the pandemic, EV/R of SaaS companies was at 9-9.5X on average. The year 2021 was an aberration and in the high liquidity market, EV/R reached 15X globally. At present it is back at 5X and we expect it to reach the pre-pandemic levels over the next 12 months,” Venkatesh Peddi, Managing Director at Chiratae Ventures, told YourStory.

The report highlighted that 80% of the business-to-business (B2B) SaaS unicorns were created in the last three years. Though the sector has been facing headwinds due to restrained funding activity, the number of deals and funding value for seed and early-stage startups continued to grow in 2022.

Snapshot of Indian SaaS unicorns

In keeping with the global trends, the drop in the valuation of SaaS companies in the public markets has had a major impact on private market companies. Funding value fell by nearly 80% in Q1 2023 compared to Q1 2022, driven by a significant decline in late-stage funding valuations.

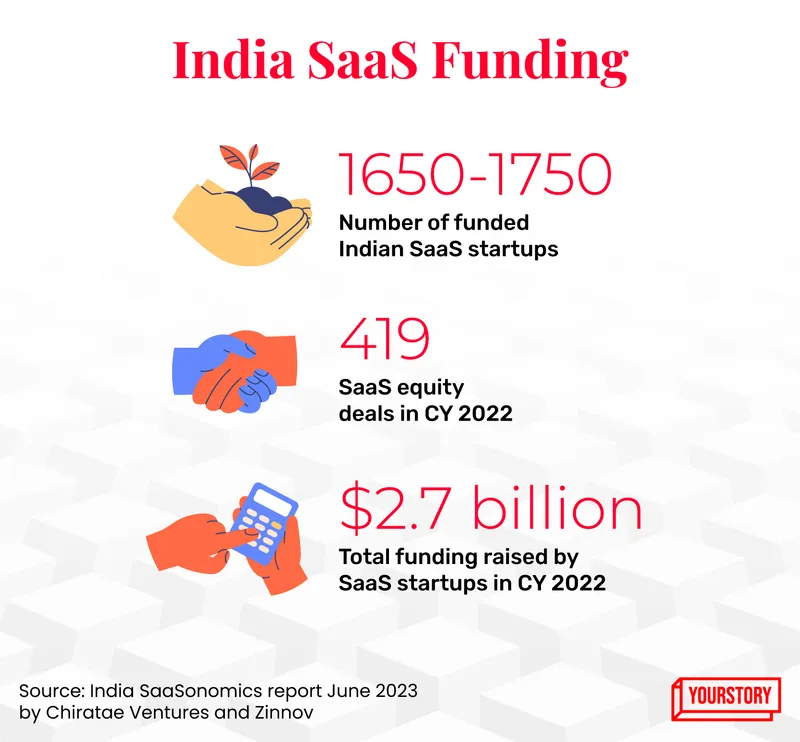

Overall, the number of deals in the SaaS sector has increased by 30% in CY 2022 from CY 2021, while equity investments in the sector have grown steadily at a CAGR of nearly 47% from CY 2019 to CY 2022.

“The top-quartile of technology stocks are back at pre-pandemic levels in terms of valuations. Recovery will happen in cohorts,” added Atik Danak, Partner and Head at Zinnov CoNXT.

Equity investments in Indian SaaS startups

As part of the report, Zinnov surveyed over 130 SaaS founders and investors in March 2023 and found that nearly 93% of them expect their revenues to increase over the next 12 months, driven by new customer acquisition and geographical expansion.

The report mentioned DevOps, cybersecurity, vertical SaaS, Generative AI and Web3 as key opportunity areas driving innovation.

(Infographics by Winona Laisram)

Edited by Kanishk Singh