PhonePe turns adjusted PAT positive in FY23-24

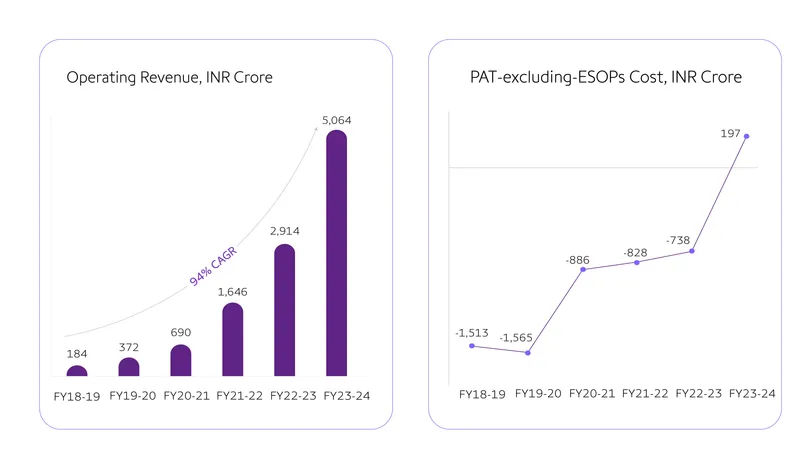

PhonePe also reported that its revenue surged 74% year-on-year to Rs 5,064 crore from Rs 2,914 crore in the previous fiscal year.

Digital payments giant said that it has turned adjusted profit after tax (PAT) positive, reporting a profit of Rs 197 crore excluding ESOP-related costs in FY23-24, marking a recovery from a loss of Rs 738 crore in FY22-23.

The UPI app maker also reported a revenue growth of 74% year-on-year to Rs 5,064 crore, from Rs 2,914 crore in the previous fiscal year.

Source: PhonePe

The standalone payments business contributed significantly, achieving an adjusted PAT of Rs 710 crore, compared to a loss of Rs 194 crore in the prior year, it said.

PhonePe attributed its growth and profitability to its market leadership, platform reliability, and its strategic focus on cross-selling a diverse product portfolio.

“Our financial strategy is anchored on three key pillars: predictable and sustainable growth in revenue, diversification of revenue streams, and continuing improvements to the bottom line. These pillars have guided our strategic decisions, enabling us to scale rapidly, while maintaining a focus on profitability and our healthy financial position.” Adarsh Nahata, CFO of PhonePe, said in a statement.

PhonePe is the topmost player in the Indian UPI landscape, processing over 10 lakh crore worth payments from 6,983.97 million customer initiated transactions till date, according to NPCI UPI ecosystem data.

Last week, it launched launched Credit Line on UPI on its platform to enable consumers availing credit lines from their banks to seamlessly link them to UPI on PhonePe for merchant payments.

Edited by Jyoti Narayan