Income tax rates for Entrepreneurs

As a startup, it would be crucial for you to understand your income tax liability. This article explains the income tax rates applicable for the Financial Year 2016-17 on you being the promoter.

The Government of India prescribes applicable tax rates and slab rates every year in its annual finance budget. As a promoter of your company, it is usual for you to earn income from the venture, which can typically be in the form of salaries. Hence, it may become crucial for you to understand the manner in which your income is assessed to income tax in India.

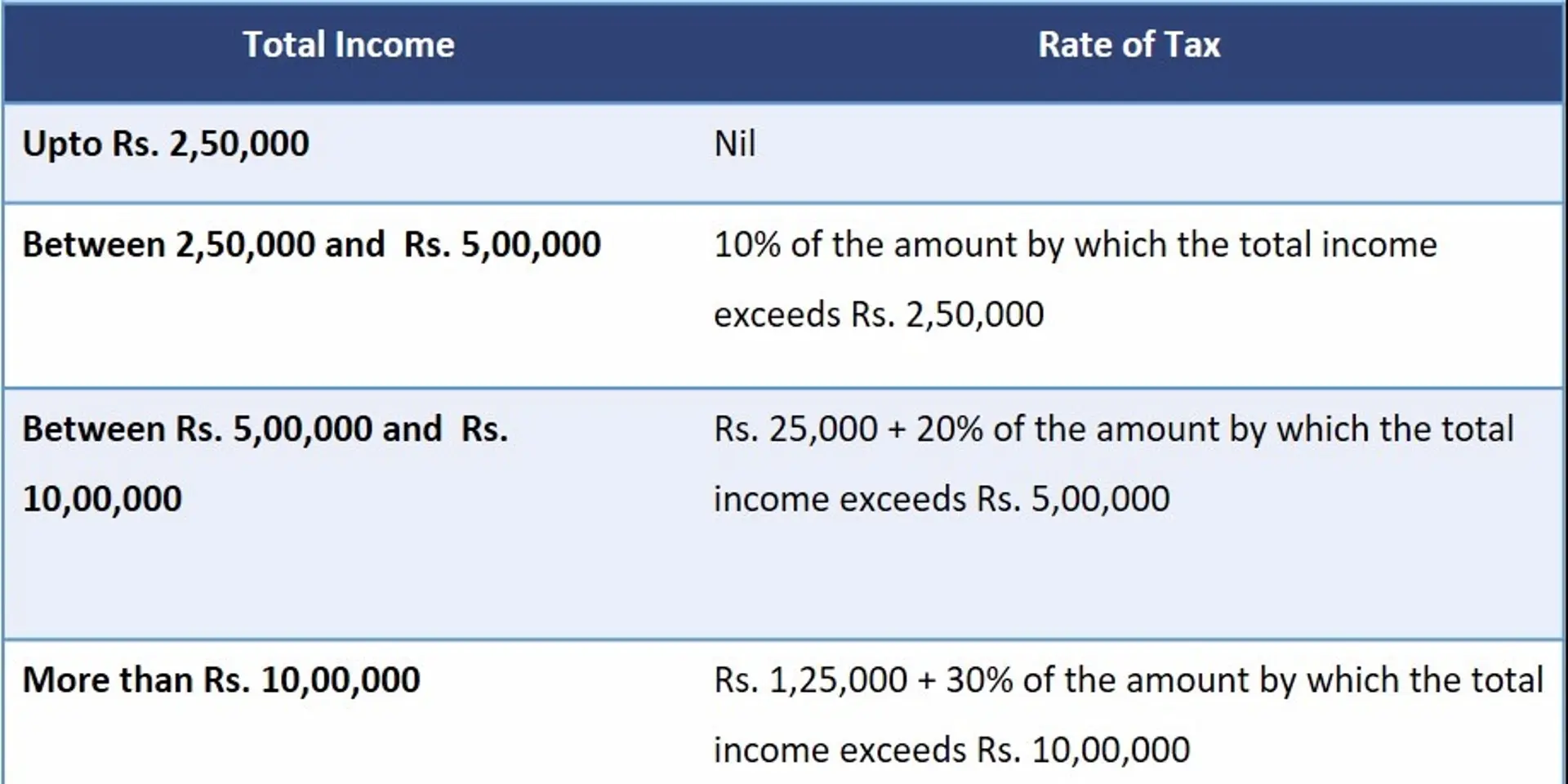

Income tax rates applicable for Financial Year 2016-17 for Individuals (resident or non- resident, Men or Women) below the age of 60 years:

Income tax rates for FY 2016-17

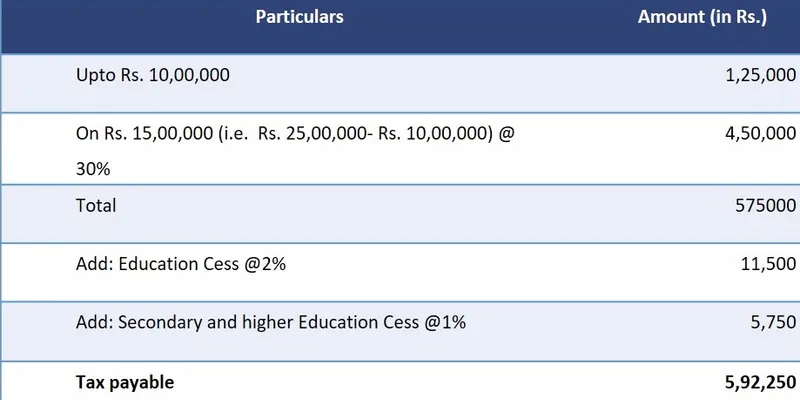

Now let us understand this with an example. Assuming you are the promoter of your company and your income from salary is Rs 25,00,000 from salary.

Your tax will be calculated as under:

Special tax rates: In case of any other source of income (other than salary), tax rate may be different based on the nature of income. Some examples include:

- 15% tax rate on short term capital gains on sale of listed shares and securities

- 0% tax rate on long term capital gains on sale of listed shares and securities

- 20% tax rate on long term capital gains for sale of capital asses (such as shares, debentures of company etc)

- 0% tax rate on dividend income from companies (the company would deduct dividend distribution tax at source)

Where the total income of an individual exceeds Rs. 1 crore, additional surcharge at the rate of 12% would be levied on the amount of income tax (excluding education cess).

In the end, income tax is all about planning efficiently and if you are able to plan your taxes on time, you can achieve best possible results.