Looking for angel investment for your startup? Here's all you need to know

“Obstacles are those frightful things you see when you take your eyes off your goals.” — Henry Ford

You would have laid the foundation for your dream startup by raising funds from your savings, family members or friends. Now, it’s time for you to push your dream further beyond the odds. To kickstart a new business into the accelerated growth mode brings money problems for any founder.

To be specific, capital issues or a cash flow crunch can hit you hard with respect to the production, recruitment or business expansion. The chances of getting bank finance without adequate collateral security are hardly zero.

Even if the chances are good, taking too much debt at the earlier stage of your business will burden your growth.

Then how do you source capital for your expansion?.

Fortunately, there are a specific set of investors called angel investors who are looking for opportunities to fund new businesses. Unlike a loan, you don't have any monthly repayment commitments in angel funding. You don’t even have any obligation to repay the invested capital in the event of business failure.

But, it comes with a drawback of loss in control over the business since you have partial ownership of your business.

Most small businesses don’t have awareness about angel investors or are clueless about finding an angel investor.

So in this post, we will look at what are the things angel investors look in a business and how to approach them. We compiled a list of top angel investors in India along with their contact details.

Who is an angel investor?

An angel investor is a high net-worth individual who provides financial support to small businesses or startups in exchange for ownership equity. Angel investors focus on helping startups to grow rather than concentrating on profits the company make. This is the main fundamental difference between angel investors and venture capitalists.

What is the role of angel investors?

Angel investors can be anyone from any professional background. They may be a doctor, lawyer, business associates and even other entrepreneurs. They are not motivated by profits and concentrate on startup’s success instead.

Since they are passionate about the business, they assist the business in every step and take up the mentorship role. Most angel investors are experienced executives who have worked in top companies.

Hence their mentorship is very useful for your company’s growth. Considering their guidance and mentorship, angel financing is crucial for the startup ecosystem.

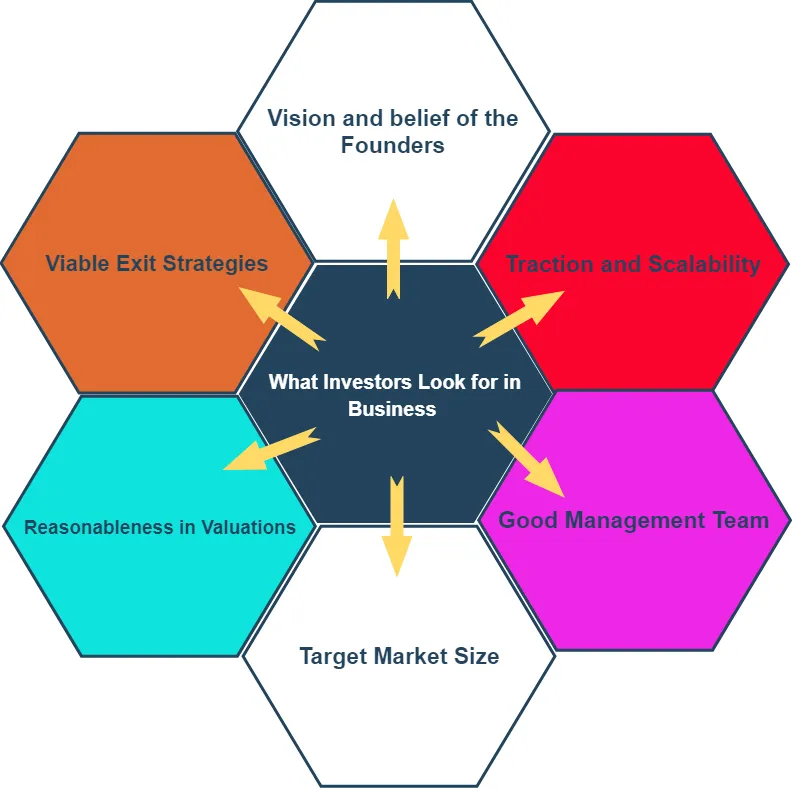

What does an angel investor look for in a business?

An angel investor will always look for the following in the business before investing.

1. Genuine belief and commitments of the founders

The vision of the founders and their commitment to their customers is the strong motivating force for any business.

Rajan Anandan, one of the top investors in India emphasises that he would bet on the founding team or the founders. Whom he believes solving a real problem and has tenacity, vision, can build up a team and raise funding.

2. Traction and scalability of your business

Business traction is nothing but a having the momentum or signs of growing business such as having a measurable customer base, growth in sales, etc. So, higher the traction, the more investors are attracted to the organisation.

Scalable business means when a business has the potential to multiply revenue with a minimal incremental cost. The best example would be software services. It costs huge capital to make the first copy of the software but any number of additional copies can be cloned with a small incremental cost.

3. Have a good management team

If your team is not efficient, there is no point of having a great startup idea. Angel investors generally like to interact with the founder’s team and management team to access their quality.

4. Size of target market

Revenue generation purely depends upon the target market. If your product or service is appealing to a large population, investors would be interested in investing in your idea.

5. Reasonableness in evaluating your business plan

Be genuine while estimating your financial numbers on your business plan. Don’t do overvaluation as well as undervaluation. Do proper research to get a reasonable estimation in the valuations.

6. Viable Exit Strategies

Angel investors are patient and willing to invest in the long-term. Though profit is not their main motive, they expect some sort of return on their investment. Therefore it is obvious for them to look for an exit strategy to reap their benefits.

The most common exit strategy is sale of shares to the company’s principal founders. Other common think is selling the business to strategic buyers. Some startups even try to convince their angels for an IPO.

How to approach an angel investor in India?

Step 1: Prepare your pitch deck

You need to explain your idea, team, business model, target market, and competitors to your potential investors. It is very important to prepare a PowerPoint presentation on this - called a pitch deck.

And it should be your first task before approaching any angel investor.

The pitch deck must be simple yet persuasive to cover all the key elements of your business. You must consider all the challenges of your business and be ready for the tough question.

Step 2: Have your product/service prototype

You need to create a practical demonstration of your product/service idea to the investors so that you can show the investors that your business plans are achievable and not just numbers.

So, having a prototype of your product helps you to convince your angels and get your angel funding easily.

Step 3: Find an angel investor

There are many affluent investors in India. You can easily find them online on Twitter or LinkedIn. Search your angel based on your industry/niche. Then send them a direct message with your brief yet powerful pitch on LinkedIn.

We have sorted out the list of top active angel investors in India along with their portfolio, industry and contact information for your easy reference.

You won’t get your pitch right in your first approach so you need to follow your angel and network with others by joining investors' groups, attending business meets and joining the Indian angel network.

Some reliable angel networks are Angel.co, Investment Network, Let’s Venture, Your Nest, etc.

This way of networking will lead you to get someone who is in common with the angel investor to give a warm introduction about. And from there, it is a matter of your persuasive presentation skill.

Step 4: Present confidently

After your successful pitch, you need to present your ideas, business plan and your product prototype to your business investor confidently. Don't worry about the result just show them how passionate you are for your idea, how will your market and scale your revenue.

ALSO READ

List of top active angel investors in India

Delhi

Rajan Anandan

Rajan Anandan is an active angel investor for startups related to technology industry such as mobile, internet and software. He mostly prefers to invest in early-stage tech startups.

He is a business executive and the former MD of Google India and South East Asian region. Now, he is a part of Silicon Valley-based Venture Capitalist Sequoia Capital.

Startup portfolio: Unacademy, Travel Khana, EasyGov, Instamojo, Webengage, Blue Ocean Ventures (Sri Lanka), Mobilewalla

Industry/niche: Startups dealing in mobile, internet and SaaS.

You can find him on Twitter and LinkedIn.

Dr. Ritesh Malik

Ritesh Malik is a young successful doctor-turned-entrepreneur and a business investor in India. His investments are mainly focussed on healthcare and robotics. He is listed on Forbes 30 Under 30 in the Finance and Venture list (Asia) 2016.

Ritesh is also the founder of Innov8 Coworking, which is a coworking space service provider in Delhi and Project Guerrilla, a funding venture.

Startup portfolio: Technolabs, Asimov Robotics, Fin Robotics, RHLvision, Addodoc, Flip motion.

Industry/niche: Startups working in robotics, hardware, healthcare.

You can find him on Twitter and LinkedIn.

Sharad Sharma

Sharad Sharma is one of the top investors in India with about two dozen investments. He is a passionate evangelist of the software product ecosystem in India. He is also the co-founder and Governing Council member of iSPIRT.

He has held a number of senior executive positions with leading technology companies. He was the CEO of Yahoo India - R&D. At present, he is the CEO of Brand Sigma Inc.

Startup portfolio: Mobilewalla, IntensAquatica, Vayavya Labs, Durva Software

Industry/niche: Software, mobile and internet.

You can find him on Twitter and LinkedIn.

Kunal Bahl

Kunal Bahl is the CEO of Snapdeal.com which is one of the leading online marketplaces in India. He mainly prefers to invest in online transportation network, ecommerce, and related sectors.

He has ranked 25 on Fortune 40 under 40 Most Influential Business Leader list 2014.

Startup portfolio: Olacabs, Rapido, Unicommerce, Gigstart, UrbanClap, Jugnoo, Leena AI, Bewakoof.com

Industry/niche: Ecommerce, online-based transportation network, artificial intelligence, and chatbots.

You can find him on Twitter and LinkedIn.

ALSO READ

Mumbai

Anupam Mittal

Anupam Mittal is an early-stage active investor and the Founder and CEO of People Group, which owns many of his portfolio companies. He has invested in more than 20 startups - mainly focussed on real estate.

He has over 12 years of management and business development experience in communication, media, and technology.

Startup portfolio: Ola, Shaadi.com, Makaan.com, Mauj Mobile, Durva Software, Kae Capital, FabHotels.com

Industry/miche: Real Estate, SaaS, internet-based consumer sites.

You can find him on Twitter and LinkedIn.

Samir Bangara

Samir Bangara is the CEO and Co-founder of Qyuki.com, which helps to create content and connect with other people and to monetise their content.

He prefers to invest in social games and app development platforms.

Startup portfolio: Pokkt, Playblazer, Thrill, ZAPR, tushky.com

Industry/niche: Social games, app development platforms and media

You can find him on Twitter and LinkedIn.

Zishaan Hayath

Zishaan Hayath is running an angel investment club called Powai Lake Ventures. He is also the co-founder of Toppr.com, which is an Indian online learning and test preparation application for engineering and medical entrance exam.

Startup portfolio: Olacabs, Housing.com, Powai Lake Ventures, SquadRun

Industry/niche: Education, travel, real-estate

You can find him on Twitter and LinkedIn.

Ajeet Khurana

Ajeet Khurana is an active angel investor and known for overcoming financial and operational challenges of running an education business.

He is the CEO of IIT Bombay’s SINE and has invested in more than 20 startups in India.

Startup portfolio: Rolocule Games, PickMe eSolutions, Karmic Life Sciences, Maximojo, Carveniche Technologies, Hacker Noon, Medd, Snackexperts.com

Industry/niche: Education, enterprise software

You can find him on Twitter and LinkedIn.

Bangalore

Kris Gopalakrishnan

Senapathy Gopalakrishnan, popularly known as Kris Gopalakrishnan was awarded the Padma Bhushan award by Government of India.

He is the Chairman of Axilor Ventures, a venture capitalist firm for young entrepreneurs.

He is also the co-founder of Infosys and its former executive Vice Chairman.

Startup portfolio: FirstCry, GoCoop, Ampere, MagicX, LookUp, BuyHatke, FreshWorld, Acko General Insurance, Verloop, HungerBox

Industry/niche: IT Services, B2B tech firms

You can find him on Twitter and LinkedIn.

Sachin Bansal

Sachin Bansal, the illustrious co-founder of Flipkart, earlier worked as a software developer in Amazon. Today, he is helping young entrepreneurs through angel investments, personally and through his latest venture BACQ.

Startup portfolio: NewsInShorts, Madrat Games, Spoonjoy.

Industry/niche: Technology and ecommerce

You can find him on Twitter and LinkedIn.

Ganesh Krishnan

Ganesh Krishnan is a serial entrepreneur and angel investor based in Bangalore. He is the co-founder of PorteaMedical and the founder of TutorVista

His startup portfolio is mostly focussed on consumer internet and tech companies.

Startup portfolio: Verloop, Hungerbox, HomeLane.com, fresh menu, Bigbasket, Bluestone, Qtrove, PorteaMedical, Growfit, TutorVista, HouseJoy

Industry/niche: Consumer internet, tech companies, healthcare, and education.

You can find him on Twitter and LinkedIn.

Pallav Nadhani

Pallav Nadhani is an active angel investor who has invested in more than 25 tech companies in India and the US. He is mostly interested in B2B startups and SaaS companies.

He is a young entrepreneur who started his company at the age of 16. He is the co-founder and CEO of Fusion Charts and RazorFlow.

Startup portfolio: Shield Square, HealthifyMe, Betaout, Minjar, Skillenza, Eduora Technologies, Cropex

Industry/niche: SaaS companies, cloud computing.

You can find him on Twitter and LinkedIn.

The right time to approach an angel investor is when you need money for your expansion. Preparing a solid business plan with reasonable valuations, having a good management team, and understanding your target market are the best ways to attract your angel investor.

Once you have done these, you can easily follow the steps mentioned above to approach and pitch for your angel fund. Remember, not all startups are investment-ready and not all the investment-ready startups get investment.

Being an entrepreneur is a long term commitment and you need to be persistent. So, try approaching different investors of your industry until you succeed.

ALSO READ

![[Funding Alert] Ather Energy raises $51M led by Sachin Bansal](https://images.yourstory.com/cs/2/a9efa9c0-2dd9-11e9-adc5-2d913c55075e/L-R_-_Mr1559040259488._Sachin_Bansal,_Tarun_Mehta,_CEO_and_Co-Founder,_and_Mr?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)