Union Budget 2023: Startup India's expectations and wishlists

Ahead of Union Budget 2023, India Inc is hoping for investments in the tech industry to propel the country into the next phase of development.

All eyes are on the red ledger as Union Finance Minister Nirmala Sitharaman gears up to present Budget 2023 on Wednesday.

Last Thursday, the 'halwa' ceremony, an annual ritual that heralds the Union Budget, returned after a year's break with Sitharaman stirring a 'kadhai' to mark the traditional event. The ceremony, which was curtailed last year in view of the COVID-19 pandemic, coincided with Republic Day.

In what is touted to be the first budget after a relatively pandemic-free year by various stakeholders of the Indian startup ecosystem, the demand for stable and progressive policies has been top of the list.

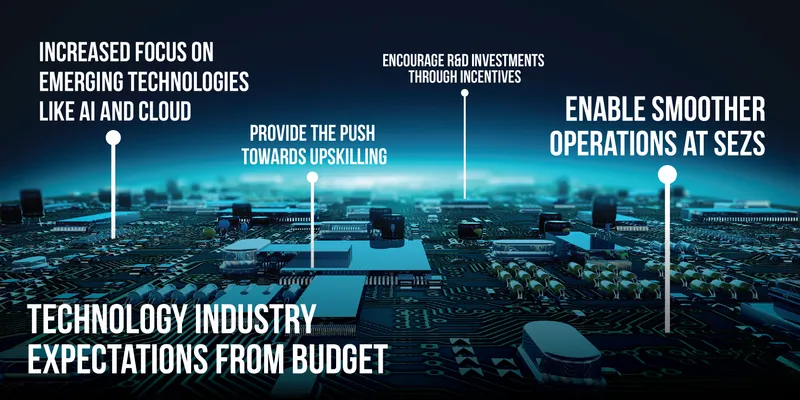

With India heading towards a ‘techade’ as described by Sitharaman herself, tech-led innovations will play a key role in deciding India’s digital dreams and stakeholders in the technology sector expect announcements to turbocharge the segment. The renewed interest in artificial intelligence (AI) with ChatGPT has also brought back focus on upskilling the workforce.

If last year was all about the government looking to jumpstart investments and technology advancements after the pandemic-induced break, expectations from Budget 2023 range from easing taxation and licensing norms to continuing the momentum of growth to achieve the vision of a $5 trillion economy by 2024-25.

Calling for bold moves, Padma Shri Awardee TV Mohandas Pai wrote, “The economy is in good shape with buoyant tax collections and signs of capital expenditure rising. These have to be leveraged to spur growth and consumption in the Indian economy.”

Here’s all you need to know before February 1.

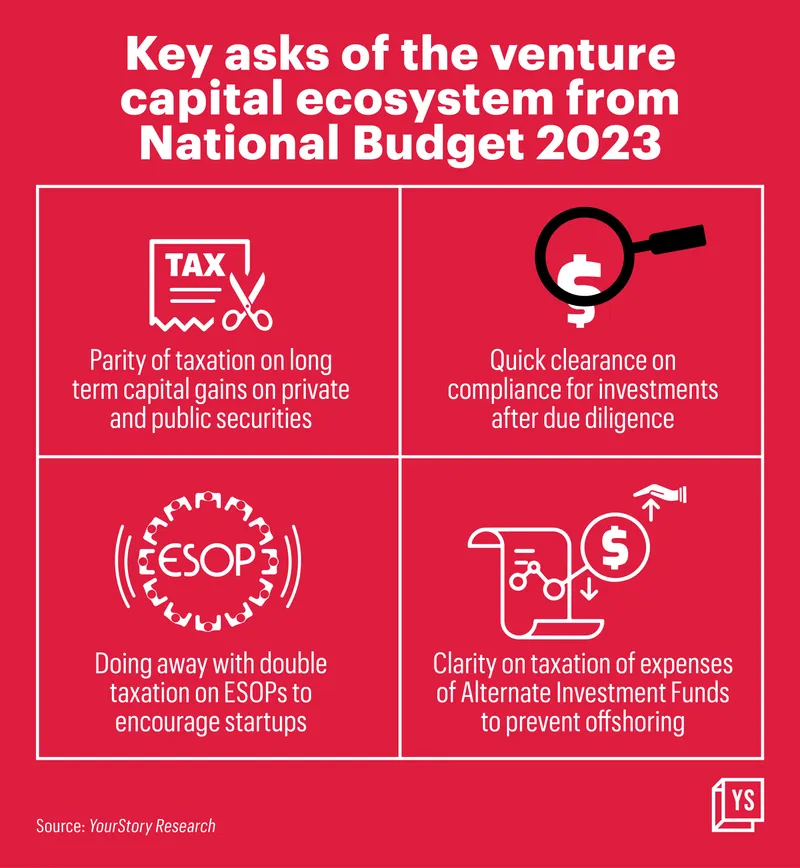

The VCs’ wishlist: Tax reforms for startups, funds

The Indian Venture and Alternate Capital Association (IVCA), an industry body representing venture capital and private equity players in India, has asked for parity in tax treatment for various security classes in a presentation made to Finance Minister Nirmala Sitharaman ahead of the Budget.

Currently, the Long Term Capital Gain (LTCG) on investment in private shares is taxed at 20%, while the taxation on publicly listed shares is at 10%.

“Investors take a higher risk by investing in private companies. We are not asking for a preferential rate of return for investments in unlisted entities, but we would like it to be on par with the listed entities,” Padmaja Ruparel, Co-founder at Indian Angel Network and Founding Partner at Indian Angel Network Fund, told YourStory.

US venture capital firms investing in India are expecting the Budget to support the growth and development of the startup ecosystem in the country, according to Arun Kumar, Managing Partner at Celesta Capital.

Budget asks from the VC ecosystem

Tech sector hopes for an accelerated Digital India push

Both AI and cloud computing found their place in Budget 2022 as Union Finance Minister Nirmala Sitharaman spoke about AI and its potential to assist sustainable development at scale besides providing employment opportunities for youth.

“We hope the upcoming Union Budget 2023 will be a beacon of hope for creating National R&D Ideas Incubators, which will nurture critical cross-disciplinary research, new ideas, and technologies through the early phase. Encouraging joint collaborations and ownership by industry and academia, along with centres of expertise will also be a welcome experience,” said Jagdish Mitra, Chief Strategy Officer, Tech Mahindra.

Technology companies often collaborate with academic institutions to develop new solutions. The industry hopes that Budget 2023 lays out an outline for such projects, especially in terms of providing grants and facilitating an easier flow of capital into such projects.

Jatin Kanabar, Partner with Deloitte Haskins and Sells LLP, and Anant Gangwal, Manager with Deloitte Haskins and Sells LLP, wrote, “Easy availability of capital is essential for entrepreneurs in a startup’s early stages of growth, and hence, Budget 2023 should try to make these investments attractive to investors.”

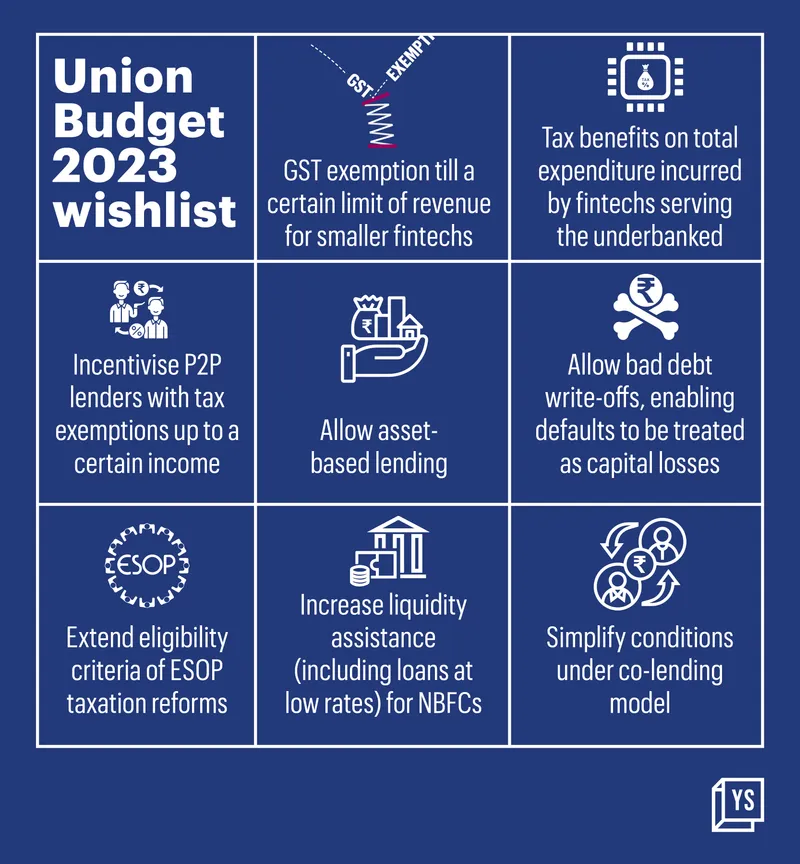

Fintechs hope for easier taxes, better co-lending policies

The fintech sector too is ready for the challenge, with new regulations in place on lending. Companies are hoping Budget 2023 would give them a shot in the arm to add more muscle to their businesses, with lower tax burdens and better lending arrangements with regulated entities, including banks and non-banking financial companies.

Startups in the sector, especially in the lending space, want the government to simplify the co-lending model and better lending arrangements with regulated entities including banks and NBFCs.

Companies in the financial inclusion space have been looking for tax sops to ease the burden. The companies in the space would also like the regulators to allow asset-based lending to further the sector.

Small fintechs have sought exemption in the Goods and Services Tax (GST) till a certain limit of the revenue. “This will eventually reduce the tax burden and challenges that startups face at the nascent stage,” Kumar Shekhar, Deputy Country Manager at Tide India, told YourStory. Tide India helps SMEs open business accounts.

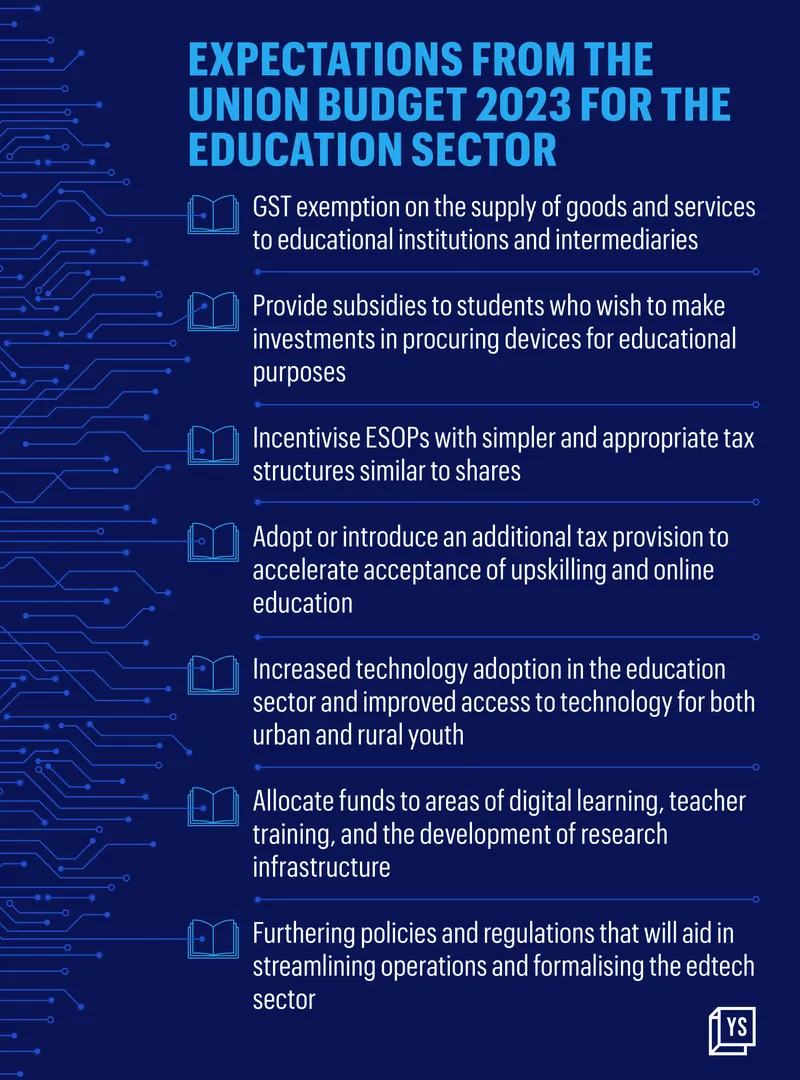

Edtechs seek tax exemptions, subsidies for students

India’s edtech sector has been caught in a maelstrom for a while now. The pandemic provided tailwinds for massive growth, but the reopening of offline classes and a funding winter dealt startups a double blow. Edtech players across India are hoping that Budget 2023 will remedy this with measures such as tax exemptions, lower GST, subsidies for students, better digital infrastructure, and more allocation for the sector to turbocharge growth.

Industry players are looking for the government’s push towards building a stronger digital education ecosystem that enables learning and a robust way to accelerate the implementation of the New Education Policy (NEP) 2020.

Vamsi Krishna, Co-founder and CEO of , told YourStory, “We expect the government to frame a policy structure that could encourage schools to expand online learning efforts by enabling them with more education technology.”

Infographic credit: Chetan Singh

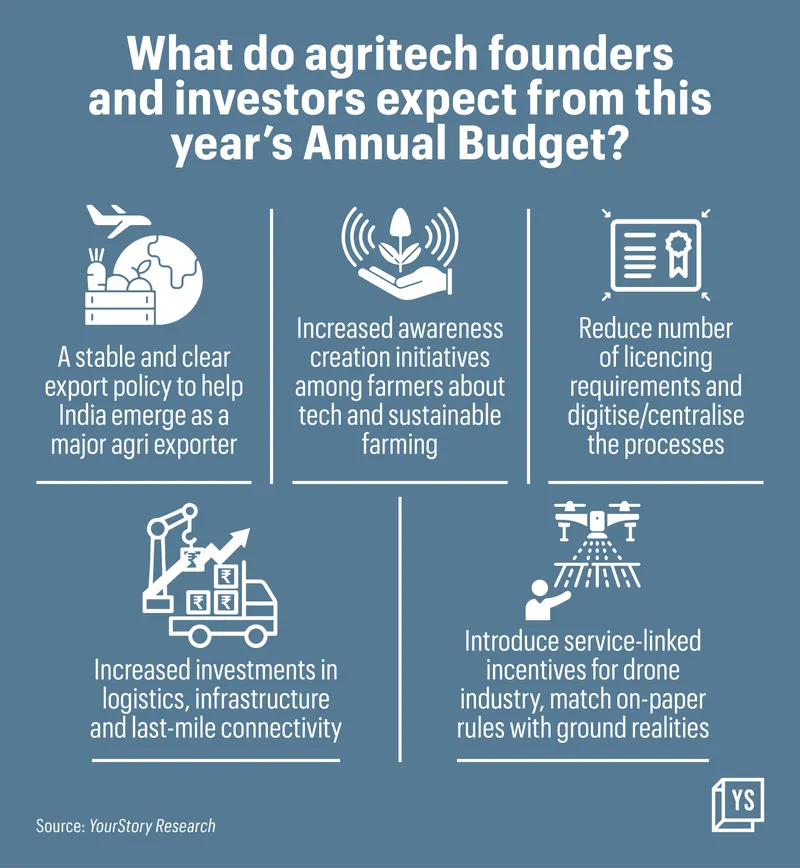

Agritech startups seek stable export policy, increased digitisation

In 2022, agritech found a mention in the budget speech for the first time, highlighting the role technology-led companies played in the sector’s growth story. Agritech, which crossed the $50 billion milestone in exports in FY22 according to the Union Ministry of Commerce, wants a clear agriculture export policy and investment in infrastructure to scale.

“This idea that you constantly stop exports whenever prices start to go up prevents India from becoming a dominant agricultural exporter,” Mark Kahn, Managing Partner at agri-focused venture capital fund Omnivore told YourStory.

This becomes key as Indian agritech is expected to grow at a CAGR of nearly 50% over the next five years, presenting a $34 billion market opportunity by 2027, according to a report by Avendus Capital. Stable policy measures are likely to add to the sector’s growth.

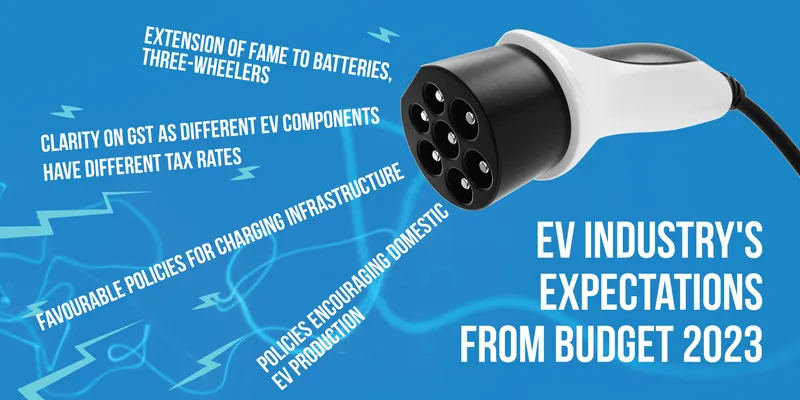

For EV industry, clarifications on FAME, GST relief top list

For Budget 2023, EV industry stakeholders hope for an extension of FAME and lower GST (goods and service tax) rates as well as policies encouraging domestic EV production.

Saying that 2023 will see EVs becoming mainstream, Altigreen founder Amitabh Saran said, “It is noteworthy that GoI’s subsidy schemes like FAME supported this development. Electric three-wheelers, which are the backbone of mass public transportation across India, are leading this transformation. We want GoI to take cognisance and expect an extension of the FAME-II scheme similar to the one given to two-wheelers.”

Players also expect more equal distribution of central and state subsidies by the government pertaining to charging infrastructure. Companies hope that enabling OEM-agnostic charging and swapping technology platforms can help end users directly claim the full subsidy benefits provided by the government.

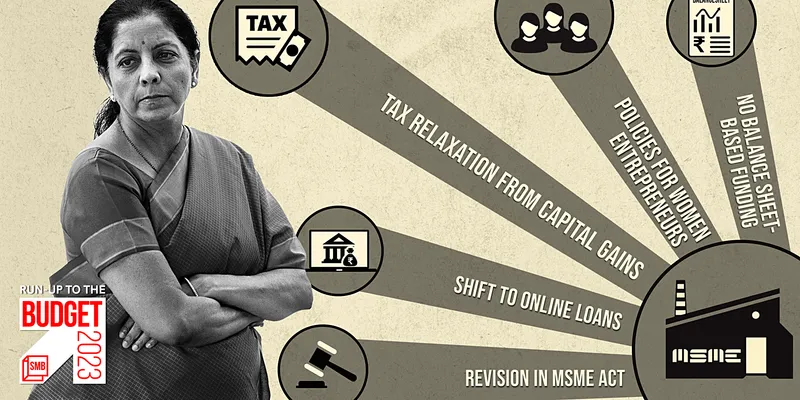

Revisions in MSME Act 2006, tax relaxations, and more

Credit is a key play for agritech and MSMEs. The MSME sector, which plays a key role in India’s exports and employment generation, has sought easier access to loans and better terms, digital loan applications, and the growth of cash-flow-based funding to ensure that the sector can continue to meet its working capital needs.

Mukesh Mohan Gupta, President of the Chamber of Indian Micro Small and Medium Enterprises, told SMBStory the organisation has submitted 75 suggestions to the Prime Minister and Finance Minister, of which one is “bank finance that is of the utmost importance”.

“All MSMEs complain that banks don't give them loans. So, we have recommended that offline loan applications are closed and there should be only online loan application systems. The purpose is to ensure a complete track record,” Mukesh added.

Other expectations include revisions in the MSME Act 2006, expansion of women entrepreneurship policy, and more.

Web3 startups call for more progressive regulation to compete globally

In particular, some industry leaders are calling for the classification of VDAs as a regulated asset class, the repeal of the 1% TDS rule, and the ability to set off or carry forward losses in VDAs.

Rajagopal Menon, Vice President of the Indian cryptocurrency exchange , believes that VDAs should be classified as a separate asset class with tax slabs and set-off benefits similar to those applied to securities.

On the other hand, , an NFT marketplace and ecosystem, is calling for the government to establish a clear legal framework for boosting the use cases of blockchain in the country.

"The Indian government should create a framework for the secure and efficient use of blockchain technology, which can be used in various industries such as finance, healthcare, and supply chain management," said Abhay Aggarwal, CEO and Founder, Colexion.

In addition to this, other industry leaders in the NFT segment have highlighted the need for clear policies for different types of crypto assets under the wider gamut of VDAs.

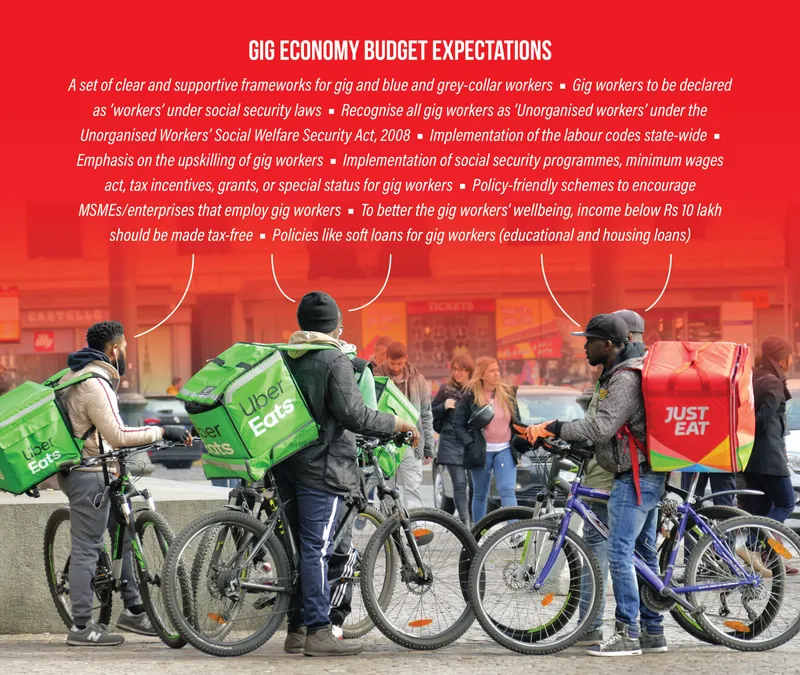

Gig economy looks for social security, minimum wages, and tax relief

As the gig economy expands, the concerns of its rapidly growing workforce must be addressed. Stakeholders expect the upcoming Union Budget to deliver on four major aspects—social security, minimum wage, tax relief, and upskilling, to help formalise this large but informal workforce.

“A set of clear and supportive frameworks for gig and blue and grey-collar workers is imperative to help formalise this informal workforce as they play a vital role in the success of our economy,” says Ajay Kumar Singh, Chief Business Officer, Billion Careers, a Quess subsidiary and a job portal for gig and blue-grey collar jobs.

The budget must address these issues, say industry observers. It should focus on schemes that encourage MSMEs and enterprises that employ gig workers and implement social security programmes that provide access to healthcare and retirement benefits.

Women business leaders seek skilling, micro-loans, concessions

Women entrepreneurs have great expectations from the government regarding credit support and COVID incentive for women-led businesses. There is a need to relook at investments for healthy leadership to be inclusive, diverse, and reasonable.

In the upcoming Budget, the women workforce, especially entrepreneurs, expect the government to give extra incentives, including tax relaxation, interest-free loans, and offer funds dedicated to women entrepreneurs.

The Budget should also have measures for skill development for women and parity in salaries for the female workforce, keeping in mind that the scope has now shifted to technology-based jobs.

Edited by Teja Lele