[Weekly funding roundup Feb 6-10] Sharp rise in VC inflow with EV startups in focus

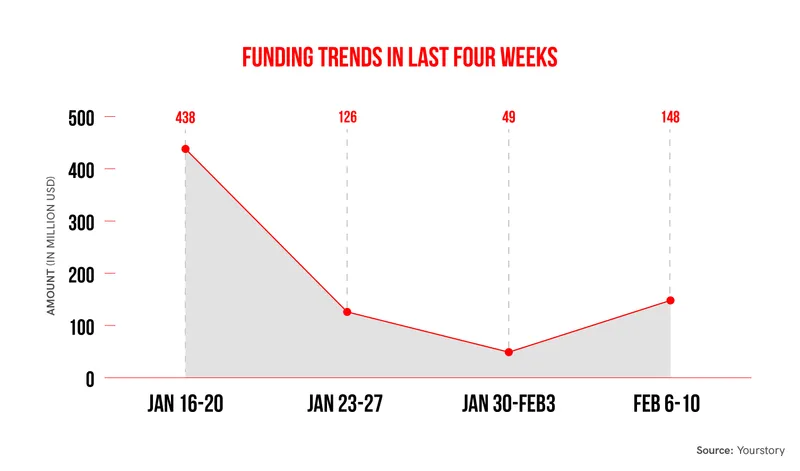

The second week of February saw VC funding touching $148 million with the boost provided by EV-focused startups.

The Indian startup ecosystem saw a sharp rise in venture funding in the second week of February. Startups manufacturing electric vehicles (EVs) or focused on e-mobility gained the maximum traction.

In a relief to the startup ecosystem, the week saw $148 million in venture funding as compared to $49 million in the comparable previous week.

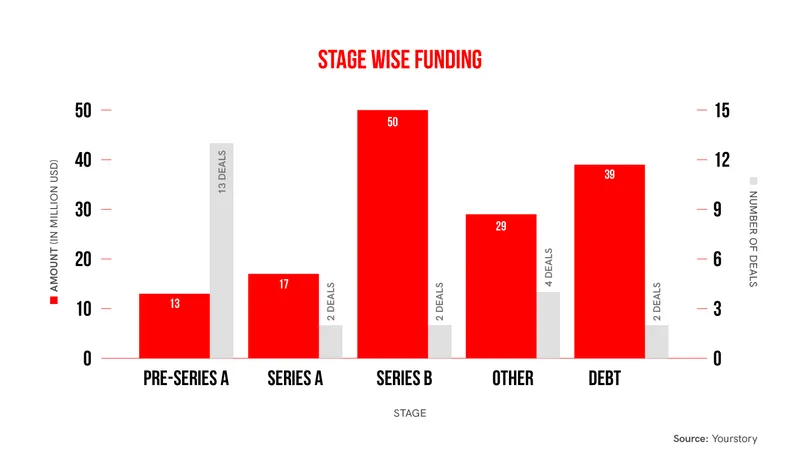

The week saw EV startups like , , and raising reasonable capital given the funding winter drying capital inflow. The period also saw the return of debt financing, which was almost negligible in the last two weeks.

This week also saw many startups including , , and posting healthy earnings from the previous quarter, sending a sense of optimism across the ecosystem.

On the other hand, the fintech industry also suffered a setback when the Union IT Ministry banned the operations of financial lending apps. However, the ministry later reversed the order, with impacted companies including , PayU-backed , , Indiabulls Home Loans, and Faircent allowed to continue their operations.

Key transactions

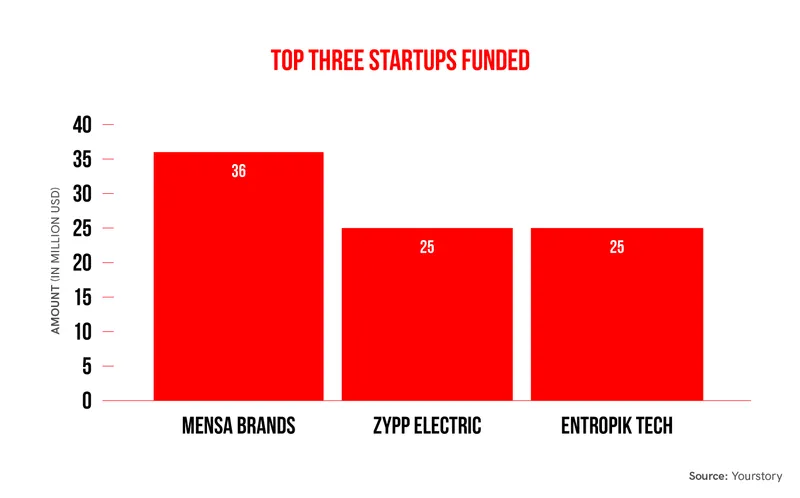

Bengaluru-based Mensa Brands has raised Rs 300 crore (approx $36.3 million) in debt from , a Mumbai-based alternative debt platform.

EV startup Zypp raised $25 million from Gogoro, Goodyear Ventures, 9Unicorns, WFC, Venture Catalysts, LetsVenture, IAN, IVY Growth, Grip, and other angels.

Tech startup Entropik secured $25 million from Bessemer Venture Partners, SIG Venture Capital, Trifecta Capital, Alteria Capital, and Bharat Innovation Fund.

EV startup Simple Energy raised over $20 million from a group of angel investors, Lambda Test, Purple Moon Ventures, and Vasavi Green Tech.

Turno, a EV segment focused startup, raised $13.8 million from B Capital, Quona Capital, Stellaris Venture Partners, Avaana Capital, Alteria Capital, and InnoVen Capital.

FireCompass, a tech startup, raised $7 million from Cervin, Athera Venture Partners, and Bharat Innovation Fund.

Edited by Kanishk Singh

![[Weekly funding roundup Feb 6-10] Sharp rise in VC inflow with EV startups in focus](https://images.yourstory.com/cs/2/220356402d6d11e9aa979329348d4c3e/funding-roundup-LEAD-1667575602969.png?mode=crop&crop=faces&ar=2%3A1&format=auto&w=1920&q=75)