Form AOC-4: All about Filing the form and its requirement

What is AOC-4 Form filling?

Every year the financial statements of a company need to be registered with the Ministry of Corporate Affairs(MCA). For filling the financial statements with MCA form is AOC-4. In the Company's annual general meeting the form AOC-4 is submitted with the MCA for every Financial Year within 30 days.

Adjacent with AOC-4 form, the documents like :

- Auditors’ report

- Board’s report

- Details of CSR policy

- Statement of subsidiaries in Form AOC-1

And many more are filed. AOC-4 needs to be approved by a practising Company Secretary or Chartered Accountant (CA).

What is the Requirement for AOC -4 Filing?

AOC-4 has to be filled by all company in 30 days. From the discussion conclusion of the Annual General Meeting with MCA. It has to be uploaded with the Auditor’s report, Board's Report and additional necessary documents.The uploads are as per activities of a company.

The certification from company secretary or the practising CA of a company is a mandatory part for AOC-4.

The due date of company annual return filling /AOC-4

The financial statements of the company need to be filled with the Registrar of the Company every year. If a company declines to file these financial statements within the specified period.

Further, it will be responsible for an additional fee or penalty.

For filling a company annual return and annual account follow up with the procedure given below:

- For passing assured resolutions conduct an Annual General Meeting. The shareholders are the one whose approval is final and accepted for the financial statements.

- For the preparation of the financial statement keep a board meeting to authorize the auditors. Moreover, in refrence to company act to authorize the CS or directors has to make an annual return or board report.

- For the approval of financial statements draft, another board meeting is held by the directors.

Who has to file AOC 4?

The following companies are asked to file AOC 4 form XBRL:

- The companies who have capital more than 5 crores or above than that.

- All the companies which have 100 crores of turnover and more than that are eligible for form AOC-4.

- Companies that are dated under the Companies Rules 2011

- Any company listed with the stock exchange in India plus their Indian subsidiaries.

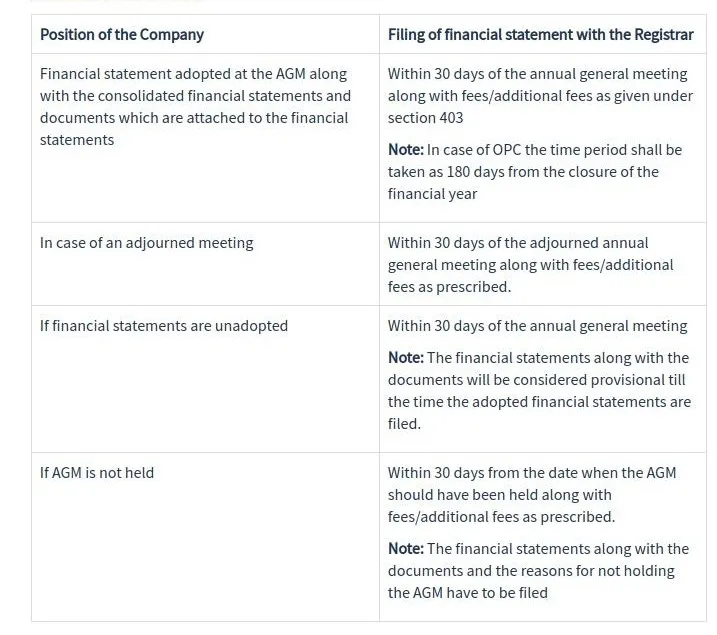

- The provisions which are relevant for filing financial statements with ROC are mentioned below in the image.

Who has to file AOC 4

Fees for filing AOC 4

The nominal share capital and fees applicable is mentioned below :

- Less than 1,00,000- Rs 200 per document

- 1,00,000 to 4,99,999-Rs 300 per document

- 5,00,000 to 24,99,999- Rs 400 per document

- 25,00,000 to 99,99,999-Rs 500 per document

- 1,00,00,000 or more -Rs 600 per document

Penalty for Late Filing and non-filing AOC 4

Penalty for Late Filing

The penality is charged when a company fails to file AOC-4 form. Adjacent with a copy of the financial statements before the due date. The company will be condemned with a fine of Rs.1,000 for each day. During which the failure extends up to the highest amount of Rs.10 lakhs.

Moreover, the Managing Director, Directors and the Chief Financial Officer of the company could be sentenced with imprisonment.For a term which may extend to 6 months or with fine which will not be less than 1-5 lakhs.

The Government fee for filing AOC-4 would also be extended as follows:

- Around 30 Days- 2 times of normal filing fees

- Higher 30 days and Up to 60 Days-4 times of normal filing fees

- Higher than 60 days and Up to 90 Days-6 times of normal filing fees

- Higher than 90 days and Up to 120 Days-8 times of normal filing fees

- Higher than 120 days and Up to 180 Days-10 times of normal filing fees

- Higher than 180 days and Up to 270 Days-4 times of normal filing fees

Penalty for non-filing

The penalties defaulters along with the number of penalties imposed are mentioned below :

- Company -Rs.1000 for every day of default subject to Maximum 10 Lakhs

- Managing Director or Chief Financial Officer- Rs1 Lakh+Rs. 100 for each day of default subject to Maximum of Rs. 5 Lakhs.

Documents required for filing in AOC-4 form

The company financial statements comprise of:

- Cash Flow statement

- Balance sheet

- Profit and loss account,

-Explanatory notes annexed to the financial statements and statement of change in equity.

Board report along the financial statements needs to be filed for all companies. The types of comapnies such as Private Limited Company, One Person Company, Limited Company etc. They should be presented to goverment, stakeholders, shareholders etc. during the fiscal year.

A complete list of documents that must be filed with AOC-4:

- CAG of India details of comments

- SAR (Secretarial Audit Report)

- Remaining CSR activities details

- Statement of subsidiaries in Form AOC-1

- CSR policy of Company

- Other entity details

- Statements in the AGM (annual general meeting)

- Approval letter of extension of fiscal year

- Under Section 143test audit report or Supplementary

- Optional attachment, if any.

Points to retain while filing AOC 4

- Start and end date of the fiscal year is to be recorded.

- The CIN (Corporate Identity Number) of the company requires to be mentioned. The same can be seen here either by using the company name or company’s registration.

- Particulars of the auditor such as:

- Name

- Address

- Auditor’s firm’s registration number

- Membership number of the auditor

Requires to be filled in.

- Date of the Board of Directors’ meeting in which the financial statements and Boards’ report are allowed to be registered.

- If AGM is held the date requires to be mentioned.

Approving and Certifying of Form AOC 4

A statement has to be given by the Manager, Director, Secretary, CFO or CEO. Verify all data presented in the form is valid and accurate and is assent with the law. The form has to be digitally signed by

- DIN of the director

- PAN of the Manager

- CFO

- CEO

A full time practising CA or CS has to give a statement saying he/she has checked all the documents attached. Hence, he/she confirms all the details to be accurate, right and flawless.

The membership number must be stated .Along with the status that is associated or fellow by the practising professional. The practising professional has to also state the membership number and the status i.e. fellow or associate.

This article is written by Shrishti Jain, who is a content writer at LegalRaasta.India' one of the best portal LegalRaasta is a platform that offers legal services at a valuable cost like Private limited company registration, LLP Registration, Partnership Registration, Sole Proprietorship Registration, One Person Company Registration and many more.