Meet the Mavericks: Rejected by 100 banks, Razorpay Co-founder Harshil Mathur’s story is one of perseverance and speed

Keep on keeping on. YourStory’s video series Mavericks gives you insider access into the lives of some of the country’s most successful entrepreneurs. In our fifth episode, we bring to you the incredible rise of B2B payment solutions company Razorpay.

A maverick is a person of incredible vision, someone who challenges the norm and forces people to think beyond the ordinary. YourStory is going behind the scenes to uncover the inspirations and secrets of the ultimate maverick in the business world: the entrepreneur.

This week, YourStory’s latest Maverick is Harshil Mathur, CEO and Co-founder of Razorpay:

“If technology is a second step, if technologies are second thought after cash and traditional modes, then it can never overtake cash. That’s what clicked for us,” says Harshil Mathur, CEO and Co-founder, Razorpay.

For Harshil, a nine-to-six corporate job is the ultimate Achilles heel. For him, everyday is a new challenge. It might sound like the usual entrepreneur’s trope, but the need to be challenged, to be on his toes solving a new problem every single day is what keeps him motivated. It is also the reason that pushed him to start up on his own in the first place.

An IIT-Roorkee graduate, Harshil launched Razorpay in 2014, along with fellow Roorkee alumni Shashank Kumar. Almost five years since its inception, the Bengaluru-based startup is now a full-stack converged payments solution company that aims to revolutionise online payments by providing clean, developer-friendly APIs, and hassle-free integration.

The startup offers businesses comprehensive and innovative solutions built on robust technology to address the entire length and breadth of their payment journey.

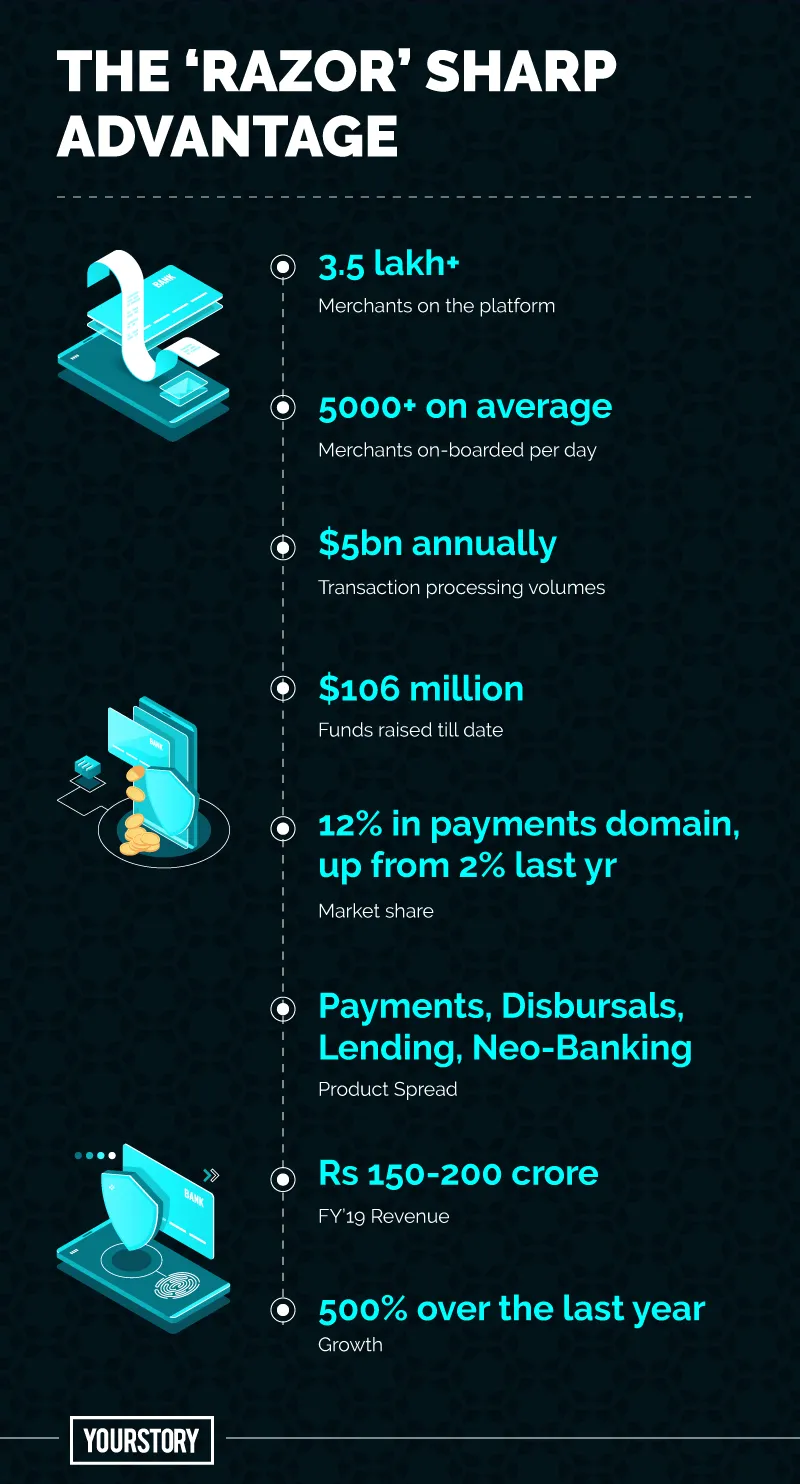

At the moment, Razorpay caters to more than 350,000 merchants, on its platform including the likes of startup unicorns such as OYO, Zomato, and Swiggy, and large enterprises like Airtel and the state-run IRCTC. It processes transactions to the tune of $5 billion annually, on-boarding around 5,000 merchants on their platform every day.

In terms of market share, the company commands more than 12 percent of the Indian payments domain at present, up from the two percent market share a year ago. It’s further scaling up from here, Harshil says.

“We are here to power the financial ecosystem for disruptors - from payments and disbursements to banking and lending,” he adds.

To power startups and disruptors

An IIT-Roorkee graduate, Harshil Mathur launched Razorpay in 2014, along with fellow Roorkee alumni Shashank Kumar.

At the heart of Harshil’s venture, the idea was to power startups and disruptors who were reinventing or revolutionising their business domains. He was forging a symbiotic relationship of sorts, ensuring that as the merchants on the platform grew (in terms of business), Razorpay also evolved and grew.

Since Harshil’s very approach to the industry was different, the challenges he faced along the way were different as well. “The question was not, 'how many players are there?'” he says. “The question is, 'are they solving the need in the market?'”

Around 2012-2013, Harshil realised that payments was an enterprise-dominated space in the fintech sector. This means that payments solutions were being offered to only the large enterprises – hotel chains and airlines, and there wasn’t much on offer for startups.

So with a tech-first approach, Harshil, along with Co-founder Shashank, decided to make startups their #1 priority, servicing the many payment needs of this fast-emerging sector in India.

Today, their tech-enabled product suite includes a vast array of features and functionalities, including their core offering, a B2B payment gateway, their SME lending arm Razorpay Capital, and a neo-banking platform called Razorpay X. Together, with these various offerings, the mission is to fine-tune Razorpay business banking services for its merchant partners.

The Formula (One) behind growth

“I believe the need for speed has been part of my growth story.”

Harshil isn’t referring to the “you-know-which-movie”. He literally means Formula One racing and karting. Having grown up watching race cars speed against one another on the tracks, the engineer-turned-entrepreneur feels strongly about “speed”. It is also a parallel he frequently draws between the tracks and the business world.

A fan of Formula One, Harshil frequently draws parallels between the tracks and the business world

Having high speed and traction is one requirement to come out at the top, he says. A philosophy that’s reflected in Harshil’s own entrepreneurial endeavour as well.

In the payments domain, when others were merely tinkering with payment gateway, Razorpay took to innovation using technology to come up with a new product or offering.

For instance, they were the first to introduce a completely digital on-boarding process for businesses around a time when time-consuming, paper-based KYC was still the norm. An early bird with Unified Payments Interface (UPI), Razorpay claims it was the first to launch support for UPI as a payment gateway, first to launch support for Bharath QR, and also the first to introduce recurring payments for businesses through Razorpay Route.

Of rejections and perseverance

If speed has helped him stay on top of his game, perseverance has kept the brain behind the company steady, even in the face of challenges and multiple rejections.

Before starting Razorpay, Harshil and Shashank (both freshers) were treading the corporate life. While the former was working with US-based oilfield services company Schlumberger, Shashank was placed with Microsoft.

Armed with reasearch and a zeal to build a platform dedicated to startups and their payments needs, Harshil and Shashank embarked on the Razorpay journey.

Their job was everything that a fresher would dream of – it was well-paying with perks, promotions, etc. However, there was an underlying sense of dissatisfaction.

“We were really bored,” Harshil says. “As I said, I love challenges, and I got really bored of doing the same nine to six job.”

What followed next is something most entreprenerus would relate to. Tired of the routine corporate life, Harshil started tinkering with projects and part-time work, and as one thing led to another, he found himself working on a crowdfunding platform for India.

“It was a social crowdfunding platform, kind of like a Go Fund Me,” he quips. Basically, a platform where people, in case of a medical emergency, could post a public campaign and raise funds.

However, challenges emerged when they started accepting payments. Digital payments still being enterprise-dominated at the time, it was difficult for startups to transact. Most transactions were done in cash, he adds.

“This was very counter intuitive to us,” he says, rhetorically questioning how technology could still be second to cash or traditional modes of payment.

Armed with reasearch and a zeal to build a platform dedicated to startups and their payments needs, Harshil and Shashank embarked on the Razorpay journey. According to them, the biggest obstacle in their path was getting the required licence and certification.

“Payments is not a simple domain. You can’t just build an app and launch,” our Maverick quips.

If the domain presented the duo with challenges, banks and financial institutions served them with multiple rejections. Of the hundred banks the two went to, and the 20 to 30 banks the two submitted their proposal to, almost everyone turned them down. That is until a senior banker from a leading private bank took notice of their potential.

This banker was from a private sector bank was fairly young, a graduate from XLRI, and someone who understood what the journey of a startup was like, Harshil recalls. He chose to “take a bet on us” and the rest, as they say, is history.

Perseverance worked well for us and is very critical, says Harshil.

“There’ll be ups and downs, but you need to stick to what you believe and you need to keep pushing,” adds the techie-turned-entrepreneur.

The Y (Combinator) factor and a ‘Master’ stroke

Another milestone along the way was getting into the prestigious Y Combinator programme in 2015. A seed accelerator based out of the US, Y Combinator is deemed as the original startup accelerator having nurtured globally successful companies like Airbnb, Reddit, Quora, etc.

For Harshil and Shashank, this was a huge step, becoming the second India-focussed company to have made it to this coveted programme after Cleartax, the online tax and investing platform. Not only did it mean a “validation” for the founding duo that they were on the right track, but also a global recognition and help with fundraising.

“From the day we launched, we had 300 businesses sign up with us,” Harshil says. “This was without any marketing or advertising spends.” It was because, as he says, “the problem we were solving was so deep”.

Razorpay growth metrics

But one hurdle still remained. Given Harshil and Shashank’s non-finance background, banks weren’t really ready to trust them.

However, this changed when they managed to secure backing from Mastercard, the leading global company in payment solutions.

“Banks really trust the Mastercard brand,” says Harshil. “So, getting funded by Mastercard helped us quickly navigate a lot of bank innovation and tie-ups.”

ALSO READ

Cash is not the king

It’s been almost five years since Razorpay was launched, but still Harshil maintains they are not a payments company. He categorises Razorpay as “the most innovative” tech company, which is into payments, and not the other way round.

And it’s not hard to understand why. The success of Razorpay can largely be attributed to its constant innovations, a phenomenon that even led to the rebranding of its solutions as 'Razorpay 2.0' in September 2017.

The revamped version includes plug-in-plug-out features for digital money movement such as scheduled payments, collections, and disbursals.

“The idea is that our biggest competition is not other players. It’s cash. So we constantly look for areas where cash is still dominant and try to disrupt that,” says Harshil.

Over the years, Razorpay has also brought into its fray educational institutions and NGOs that are not known to be technically nimble, with its easy set up of customisable pages and sharebale links to accept payments.

And thankfully for the startup, the tech-first approach and knack for innovation has helped it record a growth of more than 500 percent last year. In June, 2019, the company even raised a Series C round to the tune of $75 million, which Harshil said would be utilised to scale up their banking and lending verticals – Razorpay X and Razorpay Capital.

The swift story

That Razorpay is scaling new heights in the payments domain – and that too with a certain agility – is hardly a surprise. Harshil, after all, is a self-confessed fanatic when it comes to speed. Even his penthouse in Bengaluru, a haven for bachelors with a poker table in one corner and a wall dotted with inspirational quotes by tech entrepreneurs, is a testament to his work hard, party harder regime.

Our Maverick Harshil Mathur firmly believes in the 'work hard, party harder' mantra.

But there’s a certain caution in the way Harshil sums it all up, driving home a poignant realisation – that things can go extremely wrong if one keeps on speeding without a thought.

“Sometimes you need to strap back and think,” he says, borrowing (at least the essence of it) from John Carreyrou’ latest book (and his current favourite), Bad Blood: Secrets and Lies in a Silicon Valley Startup.

Concept & Direction: Shivani Muthanna

Cinematographer: Parmesh C.M & Chidanand H.K

Video Editor: Shlok Bhatt

Writer: Sutrishna Ghosh

Content Editor: Megha Reddy

![[Funding alert] Online payments provider Razorpay raises $75M in Series C round led by Ribbit C...](https://images.yourstory.com/cs/wordpress/2017/08/Harshil-Mathur-Shashank-Kumar-Razorpay-Founders.jpg?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)

1559412493019.png?fm=png&auto=format&h=100&w=100&crop=entropy&fit=crop)