Festive orders, faster delivery: Ecommerce, logistics players double down on hiring to manage surge

Ecommerce giants, quick commerce players and their logistic affiliates are gearing up infrastructure and undertaking contracted seasonal hiring to manage festive surge in orders.

The festive season is here and so are flashy sales and deep discounts. Behind the scenes, ecommerce giants and logistics platforms are mobilising an army of gig workers—on the ground and in warehouses—to manage operations.

This time around, quick commerce companies are also ramping up efforts to attract customers.

And, the stakes are high as online shoppers are expected to spend about Rs 1 lakh crore throughout the festive season in 2024, with an 8% share for quick commerce according to a report by Datum Intelligence.

“Buoyed by easing inflation in July, firms are optimistic about the festive season, albeit with a bit of caution,” says Balasubramanian A, Senior VP and Business Head at General Staffing, TeamLease Services. In India, the festive season typically starts in December and runs until November.

Flipkart's The Big Billion Days Sale and Amazon's Great Indian Festival sale both begin on September 27. Amazon is also expected to launch another sale ahead of Diwali. Additionally, Myntra, Nykaa and Meesho are preparing for seasonal sales.

Stepping up delivery

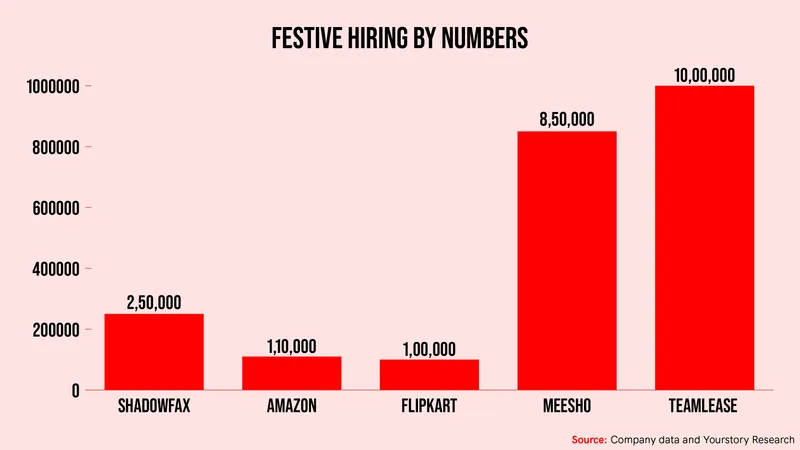

Logistics player Shadowfax, which also provides last mile fleet to quick commerce players, says it plans to onboard about two lakh delivery partners and facility staff for the season.

While nearly 12% of the additional force will be allocated across fulfillment centres, warehouses, and last-mile hubs, the remaining will serve as last-mile delivery partners, noted Praharsh Chandra, Co-founder and Chief Business Officer, Shadowfax.

Xpressbees, another 3PL firm, expects to ramp up its workforce by 20-25%. The company is looking to increase hiring throughout September and October, as it anticipates a peak in mid-October. It currently has about 30,000 contracted workers in its ecommerce ecosystems.

According to Balasubramanian, nearly 7-8 lakh workers were hired for the festive season in 2023 across ecommerce and quick commerce sectors.

The number is higher this year.

Flipkart has prepared for its Big Billion Days by onboarding one lakh new workers across various supply chain verticals. It has also launched 11 new fulfillment centers across nine cities.

Ecommerce marketplace Meesho says it plans to add 8.5 lakh seasonal job opportunities within its seller and logistics network, a 70% rise from its seasonal hiring in the previous year.

Amazon expects this festive season to be its biggest-ever shopping event in India, after closing its Prime Day which saw record-breaking Prime member engagement. The company will hire over 1.10 lakh seasonal workers across major Indian cities like Mumbai, Delhi, Pune, Bengaluru, Hyderabad, Kolkata, Lucknow, and Chennai.

Quick commerce vs ecommerce

From pooja essentials to Diwali decorations, quick commerce companies are trying to attract consumers with festive hampers and bundles as they try to expand their user base.

Shadowfax sees nearly 50% of its total festive hiring to be dedicated to quick commerce and hyperlocal verticals.

While for ecommerce, the festive sales season will likely wane after Diwali, quick commerce platforms expect demand to persist until the year's end.

Ecommerce peak day orders during the festive season are expected to be 15-20% higher than the peak from last year, says Chandra.

In contrast, peak day orders for quick commerce players—such as Blinkit and Zepto—are anticipated to increase by nearly 50%-60% during the festive season compared to last year.

Money Money

For gig workers, the festive season means higher pay.

Delivery partners typically earn around Rs 24,000 to Rs 28,000 per week on regular days, especially in metro cities where quick commerce has gained traction, as per data shared by Shadowfax.

“Payouts have remained relatively stable across quick commerce and ecommerce, with earnings during the sale season seeing a 20-30% increase on average,” notes Chandra.

Delivery partners also have the opportunity for additional earnings and incentives ranging from 30% to 60%, says Harshal Bhoi, Chief Business Officer, Xpressbees.

The incentives include attendance bonuses, referral incentives, and bonuses on the first attempt delivery strike rate— which refers to successful delivery closures on the first attempt. Along with that, after a certain threshold, delivery partners get incentives per delivery made. Therefore, the more they deliver the more they are paid.

Along with these, companies are also awarding overtime pay to increase efficiency, Emiza, a 3PL, noted that it had increased incentives by more than 10% this year as compared to the previous year.

"There haven't been any significant changes in payouts compared to last year," noted Bhoi.

Executives at logistics companies also highlighted a noticeable shift towards hiring workers with tech-savvy skills to manage growing investments in digital tools such as AI-driven route optimisation and real-time tracking which are becoming a key focus for ecommerce operations.

These contract-based workers are mostly sought for positions of warehouse operators and delivery personnel. To manage increased workload, customer support. And inventory management also sees high traction.

“The mass hiring by major marketplaces is leading to a shortage of available manpower and driving up labour costs, with these industry giants offering a 25-35% salary increase—rates that 3PLs cannot match,” notes Ajay Rao, CEO & Founder, Emiza.

Even with similar payouts, quick commerce and ecommerce platforms come with their own set of benefits and challenges. Quick commerce offers more structured routes but lower flexibility, with demand rising during specific hours of the day, usually in 2–3-hour slots. Since, the typical order size usually involves grocery and food delivery, delivery personnel complete anywhere between 20-30 orders in a day.

Ecommerce involves handling heavier parcels but allows for route optimisation and more flexibility.

Tier II towns to shine

As expected, high traction is expected from top metro cities, including Hyderabad. Mumbai, Delhi, Kolkata and Bengaluru.

However, smaller cities are seeing traction. According to a joint report by Myntra and Bain Company, two out of three online shoppers are from smaller cities while one in two shoppers belongs to low or low-mid income segment.

“We are also focusing on expanding our presence in Tier II and III cities, such as Jaipur, Indore, and Coimbatore, to cater to the growing customer base in these regions,” says Zaiba Sarang, Co-founder of iThink Logistics, a 3PL firm.

Quick commerce unicorn Zepto also outlined its plans to expand its operations in cities like Jaipur, Ahmedabad, and Chandigarh apart from ramping up its efforts in top cities. Its peers Blinkit, which is focusing on adding more stores in the top eight cities, and Swiggy’s Instamart already have considerable strength in Tier II markets.

Meesho said it sees 60% of seasonal hiring opportunities be created in the Tier III and beyond regions.

So, what happens to contract workers when the festive rush ends?

“Typically, these workers are hired on a short-term contract ranging from three to six months, depending on the demand surge,” Sarang says. Post this, they go on to find work in other sectors, extend their contracts, or get hired permanently by the company.

Edited by Affirunisa Kankudti